XRP’s journey this December has been a mix of volatility and innovation, and the aftermath is being seen in the current market. With a market cap of over $149B, XRP’s price is consolidating above the $2.3 support level, while Ripple is pushing the boundaries with tokenization, DeFi, and stablecoins.

XRP is looking to retest $2.9 or even break $3, but it’s all about liquidity, sentiment and how the new developments like RLUSD stablecoin play out. Will these be the catalysts for XRP to go up or will changing liquidity be the sign that the rally is on pause?

XRP’s Crucial $2.3 Support

After a stunning 280% move in November and 30% this early December, XRP price peaked at $2.9. Its momentum has since then cooled, and is consolidating above the short-term $2.3 support.

Technical indicators are neutral. The Relative Strength Index (RSI) is close to the 50-mean on the 4-hour chart, showing strong demand but no real bullish confirmation. Chaikin Money Flow (CMF) is showing neutral money inflows, meaning the buyers are still participating, but the market has no momentum.

On higher timeframes, XRP’s market structure is still bullish. Weekly charts are showing good price momentum and buyers in control, as supported by Directional Movement Index (DMI). However, a break below $2.3 may bring lower supports into play, with the golden ratio at $1.5 being the next key floor.

Ripple’s Big Plans: RLUSD and DeFi

Larger ambitions for the XRP Ledger from Ripple far exceed simple speculation over price. The rollout of the RLUSD stablecoin was a slow introduction to the regulated stablecoin market. As of early December, RLUSD issuance had reached 52.2 million tokens split between Ethereum and XRPL chains. The initial supply was only for internal testing but has since become more public as interest in the Ripple stablecoin project grows.

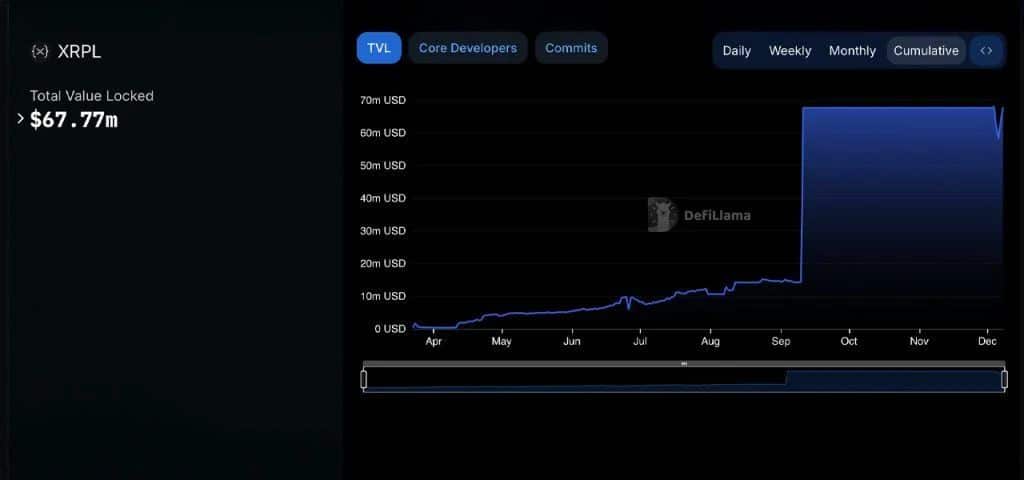

Ripple is also using the XRPL network for tokenization and DeFi. Over 200 tokens are listed on the platform, including popular ones like Sologenic (SOLO). It tokenizes assets with a market cap of $220M. Despite all that, DeFi activity of XRPL is still small. TVL stands at $67.77 million and is practically fully contributed by the XRPL DEX.

Liquidity and XRP Price Predictions

Market liquidity is very important for XRP price action. From the Coinglass liquidation heatmaps, there are clusters of liquidity on both sides, providing leeway for market makers to move the price in either direction.

On the upside, leveraged short positions are concentrated above $2.6 and may act as resistance. On the other hand, market makers could target liquidity at $2.45 and $2.38 before XRP goes north. This could imply that XRP will likely fall to the lower liquidity levels before bouncing back to $2.9 or higher.

The $2.3 support is a double-edged sword. Where it holds, it opens up the path to retest the 2021 high at $3.3. Where it breaks, it will turn short term sentiment bearish for a retest of lower levels.

XRP’s Further Outlook

XRP’s next few weeks will depend on how well the $2.3 support holds up with the changing liquidity landscape. While focusing on regulated stablecoins, DeFi expansion and asset tokenization will put the XRPL network at the top of the crypto world. These initiatives also highlight the scaling challenges of liquidity and infrastructure.

Traders will have to watch liquidity sweeps, capital inflows and regulatory developments to make predictions on XRP’s next moves. As Ripple innovates, the role of the XRP Ledger in DeFi and the real world and asset tokenization will be the key to its long-term value.

Conclusion

XRP price consolidation at $2.3 is a balance between bulls and market uncertainty. Ripple’s recent moves into stablecoins and DeFi add an extra layer to its ecosystem, but how the market reacts to it will be key.

Whether XRP goes above $3 or drops to retest lower levels of support, its path forward will be determined by liquidity, retail appetite and the overall crypto market. For now, XRP’s community and roadmap is a strong story in a crowded space.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.