The XRP price continued its downward slide on June 5, 2025, falling 2.45% in the last 24 hours to trade at $2.19. This decline comes amid mounting selling pressure that has overwhelmed recent support levels, sparking concerns of deeper losses ahead. The sharp drop was preceded by a notable volume spike of 1.2 million units, a sign of traders fleeing their positions in response to worsening market sentiment.

The XRP price has now formed a descending channel on the daily chart, a bearish technical pattern that suggests a prolonged struggle to regain upward momentum.

XRP’s market capitalization declined by approximately $6 billion in the session, reinforcing the scale of the downturn. Weekly losses have now reached 9.11%, placing the token among the hardest hit in a market increasingly impacted by global macroeconomic uncertainty and geopolitical instability.

Ripple Strategy and Institutional Expansion

Ripple’s broader strategy continues to evolve even as the XRP price falters. The company has reaffirmed its commitment to integrating with traditional finance institutions rather than displacing them outright. In addition, Ripple’s acquisition of Hidden Road, a financial infrastructure provider, is designed to strengthen the token’s role in global remittance and liquidity services.

While the XRP price has yet to reflect these developments positively, long-term investors view them as foundational shifts that could improve adoption over time. The company’s regulatory engagement has also ramped up, particularly in the Middle East. Ripple is currently working with regulators in the UAE to explore tokenized real estate initiatives.

This enforces Ripple’s belief that expanding utility through tangible, real-world use cases will eventually stabilize the XRP price.

Another boost to institutional interest came from China-based Webus, which disclosed in an SEC filing plans to raise $300 million, part of which is earmarked for building an XRP strategic reserve. While short-term price action remains bearish, such moves could influence sentiment over a longer time horizon, especially if market conditions stabilize.

Technical Breakdown: XRP Price Faces Persistent Resistance

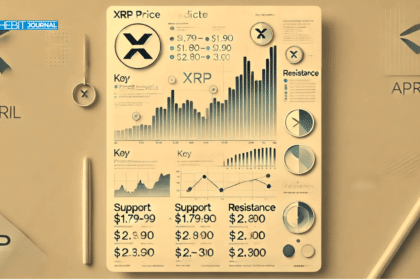

From a technical standpoint, the XRP price is under considerable pressure. Analysts at CoinDesk Research report multiple failed breakout attempts around the $2.265 to $2.270 resistance zone, confirming strong selling interest. The above-average trading volume accompanied each rejection, further validating the bearish tone. The XRP price now trades firmly below these levels, with momentum continuing to favor the bears.

On the support side, a fragile floor has formed between $2.10 and $2.15. However, traders warn that this zone remains vulnerable as downward momentum builds. Early on June 5, the XRP price briefly broke below $2.204, accompanied by an uptick in sell volume exceeding 399,000 units.

Although the price later rebounded to $2.208, technical signals indicate that buying interest may be insufficient to fuel a sustained recovery without a shift in broader sentiment.

Despite these challenges, some analysts are pointing to a potential double-bottom pattern. This formation, highlighted by the price bouncing twice off a similar level, may indicate short-term accumulation. Supporting this theory is a surge in open interest, which recently climbed above $4 billion.

While this metric signals growing liquidity and trader engagement, a true reversal in the XRP price will require a confirmed breakout above $2.270.

Ripple’s Vision vs. Bearish Momentum

The divergence between Ripple’s long-term ambitions and the current XRP price action is stark. While the company builds partnerships, expands regulatory clarity, and launches new products, the market remains locked in a bearish phase. Technical analysts highlight an inverted V-shape pattern on the daily chart, a formation that typically signals a loss of bullish momentum.

This shift from aggressive buying to persistent selling has frustrated traders looking for upward continuation. Short-term gains have been swiftly erased, and attempts to reclaim higher ground have been met with strong resistance. XRP price remains confined to a bearish structure unless buyers can reclaim critical levels.

Sentiment remains mixed as traders weigh Ripple’s developments against market realities. Volatility, low-risk appetite, and macro headwinds continue to weigh heavily. Until catalysts emerge that fundamentally shift market perception, the XRP price is likely to remain under pressure.

Conclusion: Outlook for XRP Price Remains Cautious

The XRP price faces a confluence of bearish technical signals and broader market uncertainty. Despite Ripple’s strategic initiatives and institutional alignment, the token struggles to maintain support levels. The descending channel, resistance near $2.270, and high-volume breakdowns all contribute to a cautious near-term outlook.

Still, rising open interest, potential bottoming patterns, and Ripple’s continued push into regulated financial spaces offer a glimmer of optimism. If macro conditions improve and buying momentum resurfaces, the XRP price could stage a recovery. Until then, traders must remain vigilant, watching for key breakouts or further downside confirmation.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Why is the XRP Price Dropping?

The XRP price is falling due to strong selling pressure, technical breakdowns, and broader market volatility.

What are Ripple’s Plans Despite the XRP Price Fall?

Ripple is focusing on integration with traditional finance, including launching the RLUSD stablecoin and acquiring Hidden Road to boost infrastructure.

Is There Hope for a Short-term XRP Price Recovery?

A potential double-bottom pattern and increased open interest may hint at short-term accumulation, but confirmation is needed for a reversal.

What Levels are Critical for the XRP Price to Regain Momentum?

Key resistance lies at $2.270, while support near $2.10 must hold to avoid deeper losses.

Glossary

XRP Price: The current market value of the XRP token, influenced by trading activity and broader sentiment.

Descending Channel: A bearish chart pattern marked by lower highs and lower lows, signaling downward momentum.

Open Interest: The total number of outstanding derivative contracts, used to gauge market activity and potential volatility.

Double Bottom: A chart pattern suggesting a potential price reversal after two failed attempts to break a support level.

Volume Spike: A sudden increase in trading volume, often signaling significant buying or selling pressure.