The U.S. Securities and Exchange Commission (SEC) unveiled a significant policy shift, mandating that its attorneys obtain approval from politically appointed leaders before initiating formal investigations. This change, reported by Reuters, marks a departure from the SEC’s previous approach and is anticipated to decelerate the pace of crypto-related probes. The policy adjustment comes as part of a broader transformation under the new administration, which has signaled a more crypto-friendly stance.

A New Era of Crypto Regulation

The SEC’s latest directive reflects a broader shift in the regulatory landscape for cryptocurrencies. Acting SEC Chairman Mark Uyeda announced the formation of a crypto task force dedicated to developing a comprehensive and clear regulatory framework for digital assets. Commissioner Hester Peirce, known for her pro-crypto views, will lead this initiative. The task force aims to provide clarity and foster innovation within the crypto industry, moving away from the previous enforcement-centric approach.

XRP’s Meteoric Rise

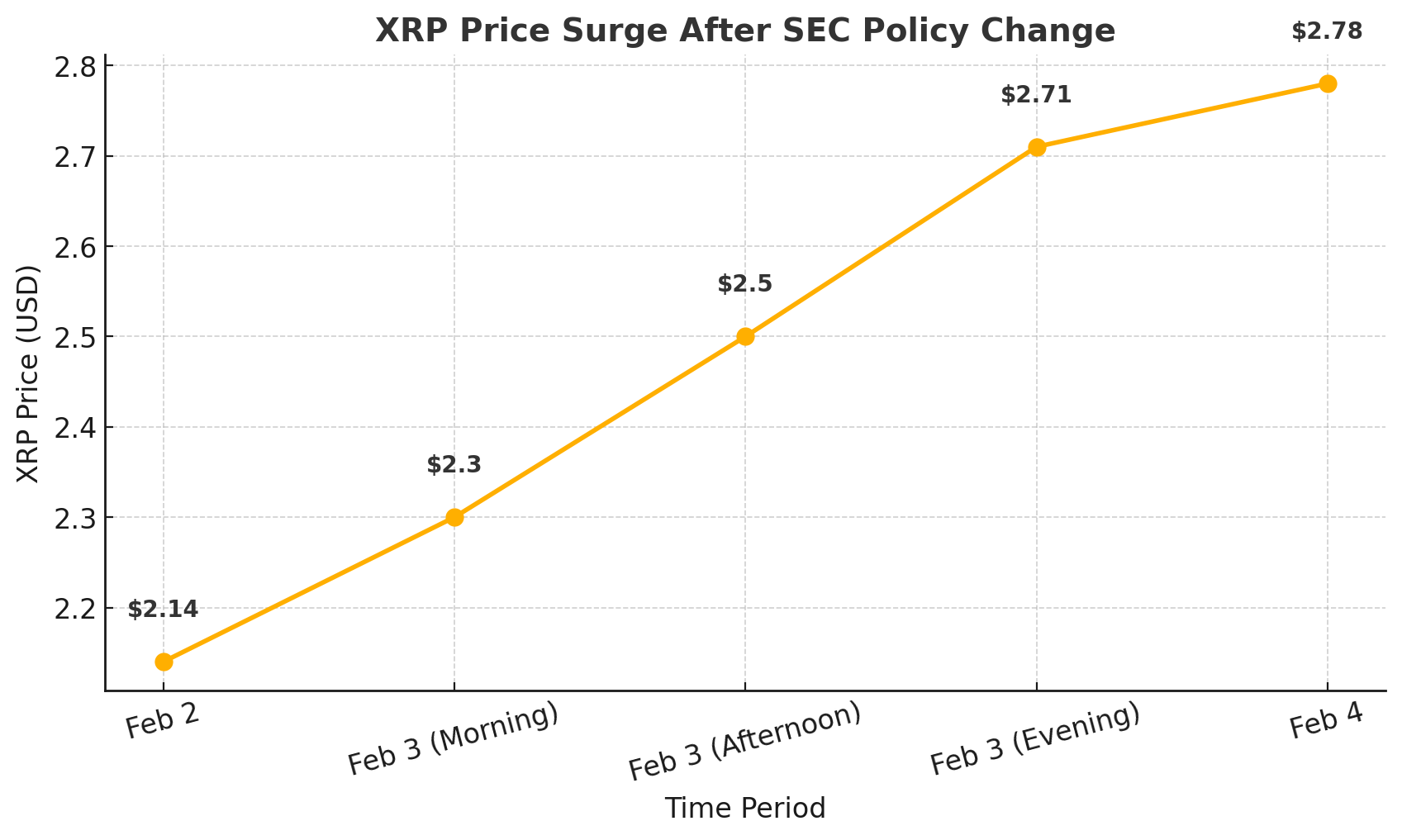

In the wake of the SEC’s announcement, XRP, the digital asset associated with Ripple Labs, experienced a remarkable surge. The cryptocurrency’s price soared by approximately 19.90%, reaching a high of $2.78 before settling around $2.58. This rally reflects growing investor confidence amid expectations of a more lenient regulatory environment.

Market analysts have noted that XRP’s recent performance indicates the broader optimism permeating the crypto sector. The anticipation of clearer regulations and the potential for increased institutional adoption have contributed to this bullish sentiment. As one analyst remarked,

“The SEC’s new direction is a game-changer for cryptocurrencies like XRP. Investors are now more confident in the market’s future.”

Industry Reactions

The crypto community has largely welcomed the SEC’s policy shift. Many industry leaders have long advocated for regulatory clarity, arguing that ambiguous guidelines have hindered innovation and growth. The establishment of the crypto task force is seen as a positive step toward achieving this clarity.

Former SEC lawyer Marc Fagel commented on the development, stating,

“I was heavily involved in the policy allowing formal order authority to be delegated to the staff, enacted in the wake of the Madoff debacle. So for those whose response to Madoff was ‘the SEC should move more slowly,’ this is great news.”

Looking Ahead

The crypto industry is poised for significant changes as the SEC embarks on this new regulatory path. The move toward a more structured and transparent framework is expected to attract greater institutional investment and foster innovation. However, the true impact of these regulatory shifts will unfold over time.

For XRP and other digital assets, the future appears promising. With increased regulatory clarity, these cryptocurrencies are well-positioned to capitalize on new opportunities and navigate the evolving landscape of digital finance.

In conclusion, the SEC’s recent policy changes represent a pivotal moment for the cryptocurrency industry. As the regulatory environment becomes more defined, digital assets like XRP will likely experience continued growth and adoption, heralding a new era in the crypto world.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs:

Why did the SEC change its policy on crypto investigations?

The SEC now requires attorneys to get approval from politically appointed leadership before initiating probes. This is part of a broader regulatory shift under the new administration.

Why did XRP’s price surge after the SEC policy change?

Investors see the new SEC stance as a positive shift, reducing regulatory pressure on crypto assets like XRP. This boosted confidence, leading to a sharp price increase.

How does this policy change impact the overall crypto market?

It could slow down aggressive enforcement actions, allowing the industry to operate with more clarity and less fear of sudden crackdowns. This may attract more institutional investment.

Will the SEC’s new approach benefit other cryptocurrencies besides XRP?

Yes. A more structured and transparent regulatory environment is expected to benefit the entire crypto industry by fostering innovation and mainstream adoption.

Glossary:

SEC (Securities and Exchange Commission): The U.S. regulatory agency responsible for overseeing financial markets, including cryptocurrencies.

XRP: A cryptocurrency associated with Ripple Labs, known for its fast transactions and use in cross-border payments.

Regulatory Clarity: Clear and transparent rules that help businesses and investors understand how to operate within legal frameworks.

Bullish Sentiment: A market attitude where investors expect prices to rise, leading to increased buying activity.

Institutional Investment: Large-scale investments made by financial institutions like banks, hedge funds, and pension funds.

Enforcement Action: Legal measures taken by regulators against companies or individuals for violating financial laws.

Formal Investigation: A structured probe by the SEC into a company or asset to determine if any laws have been violated.

Politically Appointed Leadership: Officials chosen by the President or government bodies to oversee regulatory agencies.

Crypto Task Force: A group formed to create guidelines and policies for the cryptocurrency industry.

Market Surge: A rapid increase in the price of an asset due to high demand or positive news.