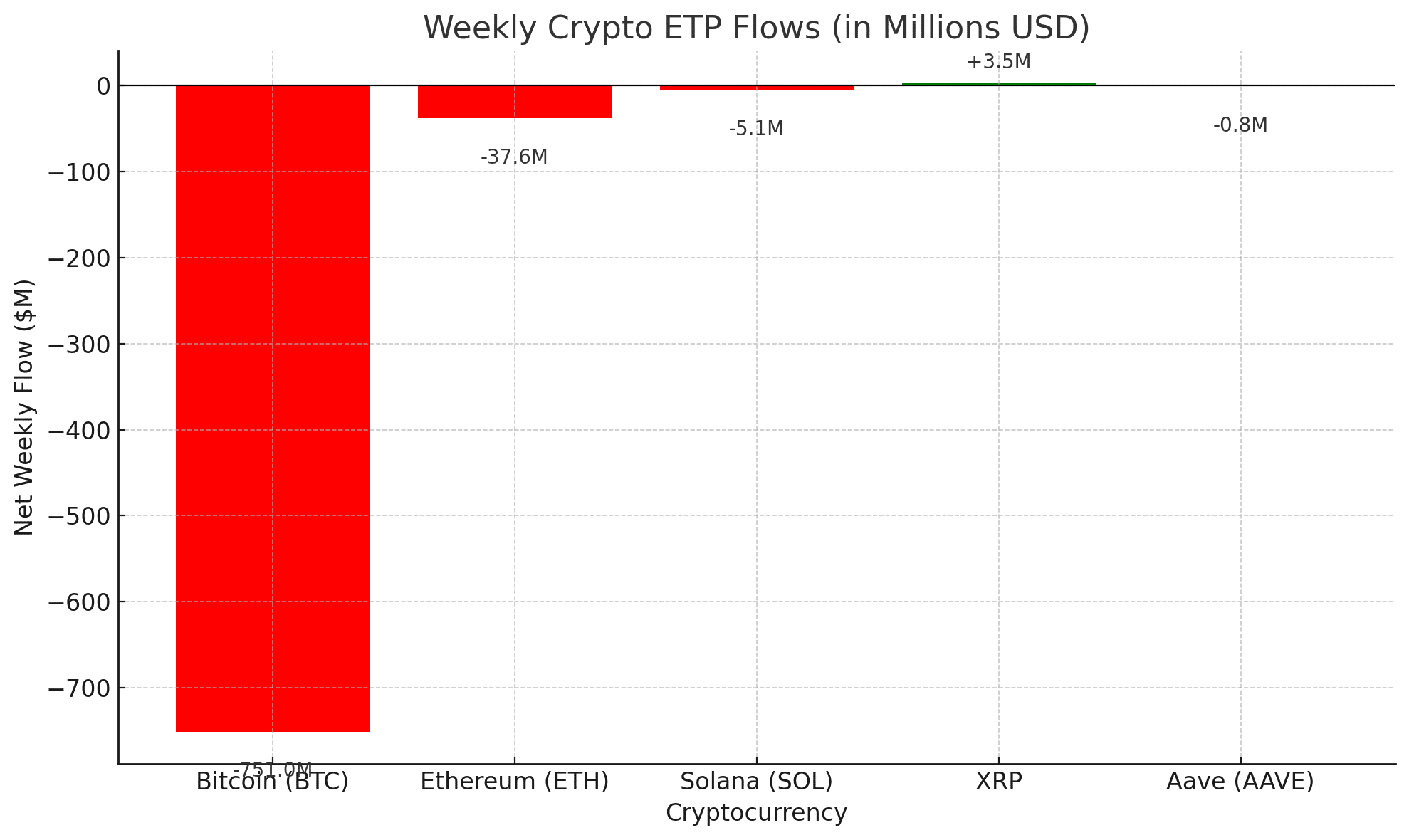

A fresh wave of unease has swept across global digital asset markets as cryptocurrency exchange-traded products (ETPs) faced heavy outflows totaling $795 million in the past week alone. However, amid the bearish pressure, XRP continues to buck the trend, standing firm with a steady stream of inflows — signaling a strategic pivot among investors.

Bitcoin and Ethereum Lead Market Outflows

According to data from CoinShares, this marks the third consecutive week of net negative flows from crypto ETPs. With geopolitical stress rising — especially due to tariff tensions between the U.S. and China — institutional and retail investors appear to be seeking safety.

Bitcoin (BTC) bore the brunt of the retreat, experiencing $751 million in outflows, though it still holds a year-to-date net inflow of $545 million. Ethereum followed suit with $37.6 million in weekly outflows. Meanwhile, altcoins like Solana, Aave, and Sui saw relatively modest capital exits.

| Cryptocurrency | Current Price (USD) | Weekly Flow | Year-to-Date Flow |

|---|---|---|---|

| Bitcoin (BTC) | $85,210 | –$751M | +$545M |

| Ethereum (ETH) | $3,605 | –$37.6M | +$98M |

| Solana (SOL) | $172.44 | –$5.1M | +$27M |

| XRP | $0.678 | +$3.5M | +$176M |

| Aave (AAVE) | $109.11 | –$0.78M | +$6M |

XRP Stands Tall with Consistent Inflows

In a week that saw most major assets hemorrhaging capital, XRP brought in $3.5 million in fresh inflows, boosting its total net inflows to $176 million for 2025. This resilience is gaining attention.

Teucrium, a notable name in the crypto investment space, recently launched the first U.S.-based XRP ETF, named the Teucrium 2x Long Daily XRP ETF (XXRP). The ETF seeks to deliver twice the daily return of XRP, and its launch day saw over 215,000 shares traded, reflecting a keen interest from short-term and leveraged traders.

“XRP is positioning itself as the contrarian bet in an increasingly nervous market,” said Teucrium CEO Sal Gilbertie. “The fund is designed for traders seeking high exposure in volatile conditions — and clearly, the demand is there.”

Tariff Tensions Shake Investor Confidence

The market’s current unease is partially rooted in macroeconomic tremors. U.S.-China tariff disputes have resurfaced, stoking inflation concerns and denting risk appetite. Although President Donald Trump has issued a temporary 90-day pause on broader tariff policies, the global investment climate remains jittery.

CoinShares’ head of research, James Butterfill, noted that investor behavior reflects “a growing wave of negative sentiment that began in February and has only intensified due to geopolitical risks.”

This risk-averse mood is directly impacting Bitcoin and Ethereum — once viewed as the “blue-chip” assets of the crypto space.

Are Investors Rotating into Strategic Altcoins?

While overall outflows suggest declining confidence, selective rotation is underway. XRP’s popularity may stem from its regulatory clarity, especially after a partial win against the U.S. SEC in 2023. Analysts also believe speculation around a spot XRP ETF approval in 2025 is keeping inflows strong.

Ethereum Layer-2s and AI-related tokens have also managed to stay afloat despite broader outflows. Some analysts suggest this could signal the early stages of another sector-specific altcoin season, where only high-utility tokens attract capital.

Conclusion: Strategic Moves in a Cautious Market

The $795 million pulled from crypto ETPs last week is a loud signal: the market is rattled. But XRP’s resilience suggests not all hope is lost. Investors may be pruning their portfolios—not abandoning crypto but zeroing in on selective, high-potential assets.

“In times of uncertainty, capital doesn’t vanish — it migrates,” said blockchain strategist Lena Park. “XRP is proving itself to be a magnet right now.”

As macroeconomic risks unfold and regulatory frameworks shift, investors would do well to monitor XRP’s trajectory. Its ability to defy the trend may offer a roadmap for navigating crypto’s current storm.

Frequently Asked Questions (FAQs)

What caused the $795 million in outflows from crypto ETPs?

Geopolitical tensions, especially U.S.-China tariff conflicts, have heightened investor caution and led to widespread outflows from crypto investment products.

Why is XRP receiving inflows while others are not?

XRP’s recent ETF launch, regulatory clarity, and strong investor sentiment have made it a standout asset amid market turbulence.

What is the Teucrium XRP ETF?

It’s a leveraged U.S.-based exchange-traded fund that seeks to provide 2x daily returns on XRP. Its strong debut signals high trader interest.

Will Bitcoin recover from these outflows?

Despite the outflows, Bitcoin still holds positive year-to-date inflows. Its long-term trajectory depends on broader market sentiment and macroeconomic stability.

Glossary of Key Terms

Crypto ETP: A financial product traded on exchanges that tracks the performance of one or more cryptocurrencies.

Inflows/Outflows: Capital entering (inflows) or leaving (outflows) investment vehicles, used to measure investor sentiment.

XRP ETF: A fund that tracks the price of XRP, offering exposure without direct ownership of the asset.

Tariffs: Taxes imposed on imports/exports. In crypto, rising tariffs may reduce investor appetite for risk.

Leveraged ETF: An investment fund that aims to amplify returns through derivatives, often used for short-term strategies.