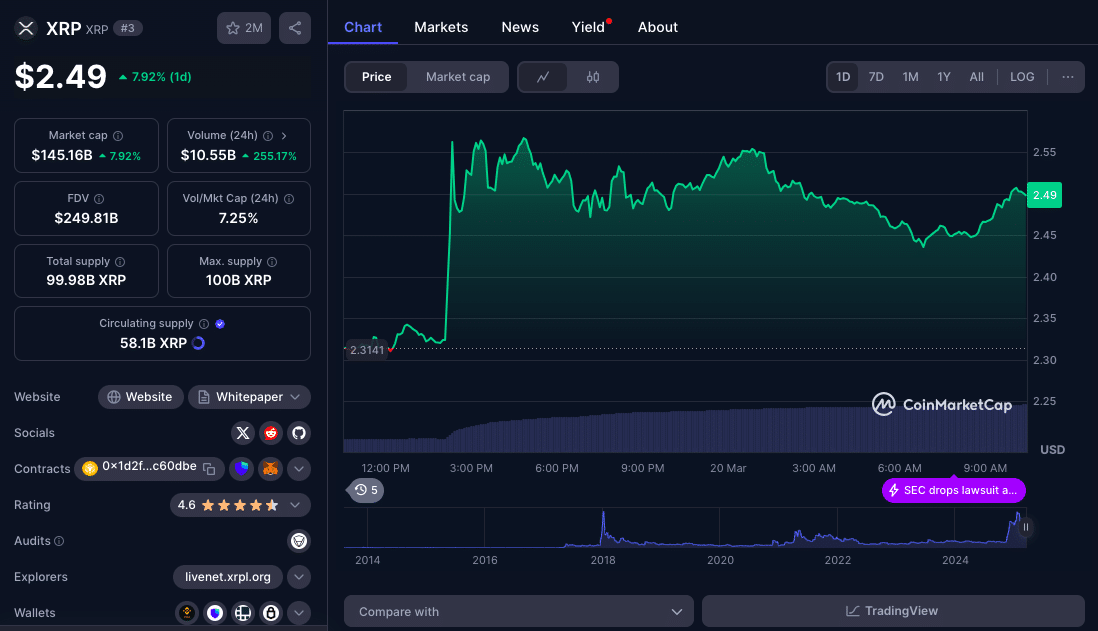

Based on reports from Ripple CEO Brad Garlinghouse, after nearly four years of legal battles, the U.S. Securities and Exchange Commission (SEC) has reportedly dropped its case against Ripple, marking a big win for the crypto industry. In response to the news, XRP jumped 11% in 6 hours, to a high of ‘$2.56 before settling at $2.52. The ruling removed a major overhang for Ripple and XRP. At the Digital Assets Summit in New York, Ripple CEO Brad Garlinghouse had previously expressed his frustrations:

“It’s been almost four years and about three months since the SEC originally sued us—certainly a painful journey in lots of ways. I really deeply believed we were going to be on the right side of the law and on the right side of history.”

Analysts now say, this big decision will open up more XRP adoption in cross-border payments, XRP ETFs, and better regulatory clarity for the crypto space.

Market Reaction: XRP and Crypto Rally as Sentiment Improves

XRP moved up 11% in 6 hours to $2.56 before settling at $2.52, right after the announcement. XRP’s 11% surge wasn’t an isolated move as the whole market responded.

Key Market Movements

| Asset | Price Change | Price After Surge |

|---|---|---|

| XRP | +11% | $2.56 |

| Bitcoin (BTC) | +3.2% | $85,972 |

| Ethereum (ETH) | +4% | $2,019 |

| Total Crypto Market Cap | +3% | $2.81 Trillion |

Institutional Interest in XRP Heating Up

After the SEC’s decision, institutional investors are looking at XRP again, especially for cross-border payments.

Ryan Lee, Chief Analyst at Bitget Research, said:

“Ripple’s latest win against the SEC clarifies XRP’s regulatory status, potentially makes it a commodity and institutional friendly. This could lead to XRP ETFs, $142 billion market cap and weaken the SEC’s stance, creating a more crypto friendly environment for the broader altcoin market.”

Ripple’s Lawsuit with the SEC: A Timeline

Based on available data’, the ‘SEC filed a lawsuit against Ripple in December 2020, alleging Ripple sold $1.3 billion worth of unregistered ‘securities through the sale of XRP. This became one ‘of the most watched legal battles in crypto history as the outcome was expected to have far reaching implications for the classification of digital assets.

| Date | Event |

|---|---|

| December 2020 | SEC files lawsuit against Ripple, alleging XRP sales violated securities laws. |

| July 2023 | Judge Analisa Torres rules that XRP is not a security when sold to retail investors but is a security when sold to institutions. |

| October 2023 | Ripple secures a partial victory, providing regulatory clarity for retail XRP sales. |

| March 2025 | SEC drops its lawsuit, ending the legal battle. |

Ripple’s legal team won the argument that XRP is more like a commodity than a security, setting a model for other digital assets under scrutiny.

What’s Next for XRP? Will It Hit $3?

With regulatory clarity, analysts think XRP is ready to go higher.

1. Will XRP ETFs Be Approved?

With Bitcoin and Ethereum ETFs out, XRP ETFs could be next.

Crypto analyst Christopher Perkins said:

“The SEC dropping the lawsuit removes a major roadblock. We could see big institutional flows into XRP, especially if ETF issuers like BlackRock or Grayscale move forward with filings.”

2. Institutional Adoption and Financial Partnerships

Ripple reportedly has hundreds of financial institutions as partners, but many held back due to regulatory concerns. Now with the coast cleared, banks and remittance companies might just start integrating XRP into their systems.

3. Price Targets: Will XRP Hit $3?

XRP has gained 20% this year and could test $3 soon.

– Resistance: $2.80, $3.00

– Support: $2.40, $2.20

If XRP breaks $3, some think it could go to $5 by 2025 with institutional inflows and broader crypto growth.

Macroeconomic Factors Supporting XRP’s Growth

1. Federal Reserve Policy and Inflation Outlook: Crypto investor sentiment has been boosted by recent Fed comments.

Although the Fed kept rates steady but signaled two rate cuts this year, experts believe it is good for risk assets like crypto.

Federal Reserve Chair Jerome Powell said:

“We expect inflation to ease. The effects of recent tariff changes will be transitory.”

2. A Crypto Friendly US Administration: Since Trump took office, the administration has softened its stance on crypto regulations, dropped lawsuits against Coinbase, Uniswap and Robinhood and reorganized the SEC’s crypto enforcement team.

These changes are boosting crypto sentiment, and XRP is one of the biggest winners.

Conclusion: XRP’s Future Has Never Looked Better

With the lawsuit behind it, Ripple has achieved regulatory clarity that could open new opportunities for XRP. Institutional investors are back in, and an XRP ETF is on the horizon.

As Ripple CEO Brad Garlinghouse said:

“It’s time to make the United States the crypto capital of the world.”

XRP’s short-term is still volatile but the long-term is looking up with analysts expecting stronger price action to $3+ in the coming months.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did the SEC drop the lawsuit against Ripple?

The SEC likely ‘dropped the case because of Ripple’s strong legal position, shifting priorities and new administration’s softer stance on crypto.

2. Will XRP hit $3 soon?

Many think XRP will break $3 if the bull run continues, driven by institutional interest and ETF approvals.

3. What about other cryptos?

Ripple’s win sets a yardstick for other cryptos under SEC scrutiny, so more clarity across the industry.

4. Will an XRP ETF be approved?

With uncertainty removed, analysts say XRP ETFs are now more likely after Bitcoin and Ethereum ETFs.

5. Who will use XRP now?

With regulatory status cleared, banks, remittance companies, and financial institutions can now use XRP for cross-border payments and financial services.

Glossary

SEC (Securities and Exchange Commission): U.S. securities regulator.

Ripple Labs: The company behind XRP focused on blockchain financial solutions.

XRP ETF: Potential exchange-traded fund that tracks XRP’s price.

Cross-Border Payments: Transactions between countries where XRP offers fast and cheap solutions.

Institutional Investors: Big financial firms like hedge funds and banks that invest in crypto.