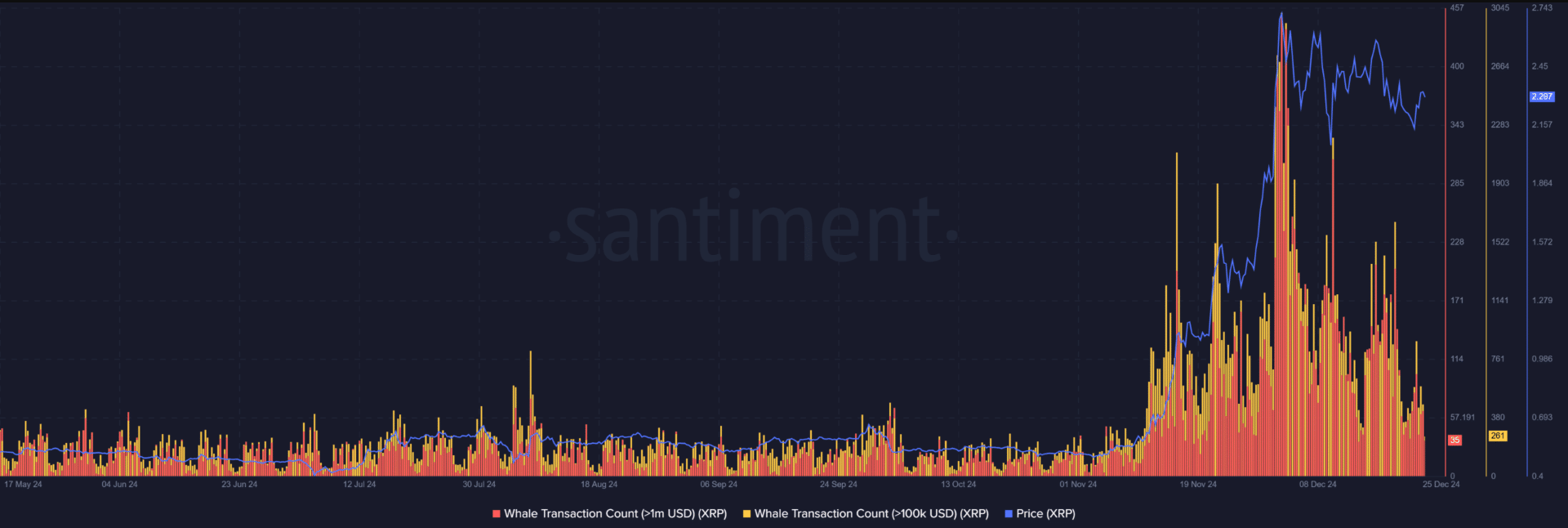

In recent weeks, XRP has seen a notable surge of activity among major holders of the digital asset, commonly called “whales”. Analysis of transactions on the blockchain shows that addresses containing between 1 and 10 million XRP have aggregated roughly 150 million additional tokens, representing an outlay of about $327 million at current market values.

The bursting accumulation by the heavyweight investors implies they are tactically arranging themselves for an approaching momentous change in price. “The proliferating whale purchases mirrors a resolute confidence in XRP’s coming potential,” commented digital currency analyst Virginia Bramlett. Some longer addresses are hoovering up large sums, while others snap up smaller amounts in fits and starts. The diverse approach of collectors signals anticipation of significant fluctuation sometime soon. According to Bramlett, the appetite of deep-pocketed backers foreshadows a duration of heightened activity to come.

XRP Price Movements and Market Dynamics

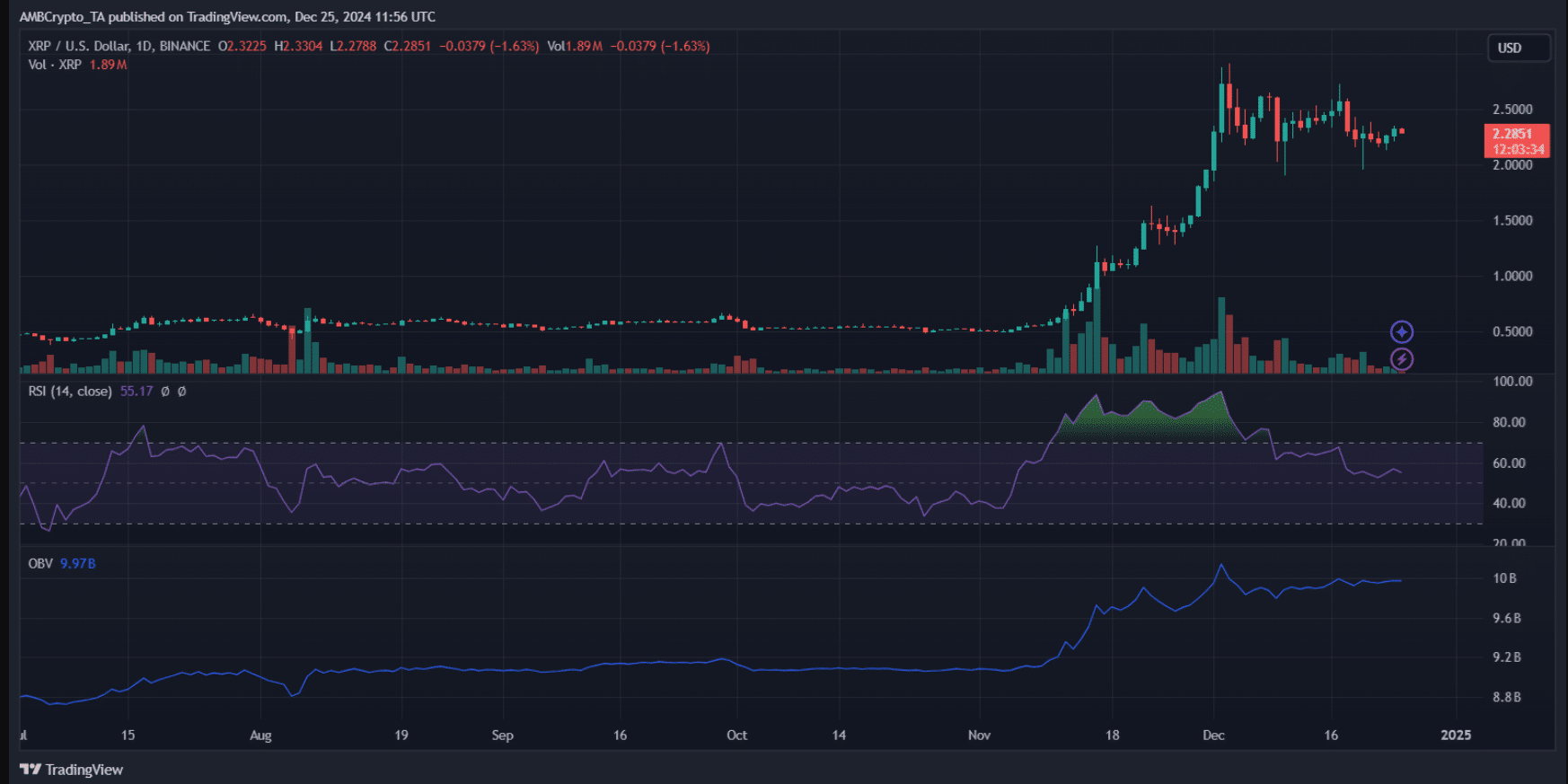

As of late December, XRP’s value had risen to approximately $2.20, marking a substantial increase from earlier in the year. The cryptocurrency peaked at a six-year high of $2.49 on December 4th, propelled upward by accumulation from crypto behemoths and optimism surrounding imminent regulatory approvals.

However, XRP’s climbing exchange rate has been volatile, with recent dips attributed to broader digital currency market reactions to shifting economic signs. For example, the Federal Reserve’s mid-December policy meeting adopted a more hawkish tone, indicating monetary tightening would likely persist into the following year.

This unexpected development startled investors, resulting in precipitous declines across XRP and other digital assets. While the cryptocurrency’s value has surged in the short term, its trajectory remains firmly coupled to developments in traditional markets and regulatory sentiment, ensuring future price swings remain a certainty.

Analysts Perspectives on Future Price Action

Market speculators have varied perspectives on XRP’s future cost behaviour. Some, like Arthur Azizov himself, CEO of B2BinPay, stay confident, proposing that “XRP could arrive at a scope of $5 to $7 in the principal half of 2025,” citing the crypto’s solid post-decision energy and Ripple’s developments in the crypto space.

Then again, others recommend prudence. Alex Kuptsikevich of FxPro expects that XRP may carry out inadequately contrasted with the market in 2025 as financial specialists move towards more current digital forms of money, proposing that XRP’s notoriety could be diminishing. The coin’s confused future stays ambiguous, with experts partaking in both viewpoints without an accord on its trajectory throughout the following quite a long while. All things considered, XRP will keep on being a questioned resource with potential for critical increases or decreases relying upon key advancements from its issuer and reception levels crosswise over installment forms.

Impact of Regulatory Developments

Regulatory deliberations remain consequential in shaping XRP’s commercial performance. The New York Department of Financial Services recently allowed Ripple Labs’ dollar-pegged digital coin RLUSD. Ripple’s Chief Executive Brad Garlinghouse declared this administrative triumph, suggesting that exchange and partner listings for RLUSD would spring up soon.

Additionally, the appointment of crypto-friendly figures in the incoming administration has fueled optimism. President-elect Donald Trump’s choice to lead the SEC, Paul Atkins, is seen as favourable towards cryptocurrencies, potentially mitigating past lawful pressures on Ripple, which had previously been accused by the SEC of offering unregistered securities.

Summing Up

The deepened accumulation of XRP by giant investors underscores a developing assurance in the digital currency’s potential. While the latest cost motions mirror both hope and caution, the interplay of market elements, administrative progressions, and institutional interest will be critical in deciding XRP’s course in the coming months. As always, financiers should stay vigilant and consider both the openings and dangers inherent in the volatile cryptocurrency market.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why is XRP seeing a surge in whale activity?

Whales are accumulating XRP in large quantities due to growing optimism surrounding several regulatory and adoption catalysts on the horizon that could precipitate massive gains in the cryptocurrency’s value over the coming months.

2. What price levels are critical for XRP right now?

While resistance at $2.50 per token remains a tough nut to crack, holders are watching the support level at $2.20 like a hawk, as a defence of this mark would bolster expectations of an impending upswing to new heights.

3. How does whale accumulation impact XRP’s price?

The heavy buying observed by these deep-pocketed investors often provides a moderating level of stability during volatile periods, increases trading volumes, and signals strong conviction in XRP’s potential, foreshadowing massive rallies that may be on the cusp of emerging if accumulation continues its recent clip.