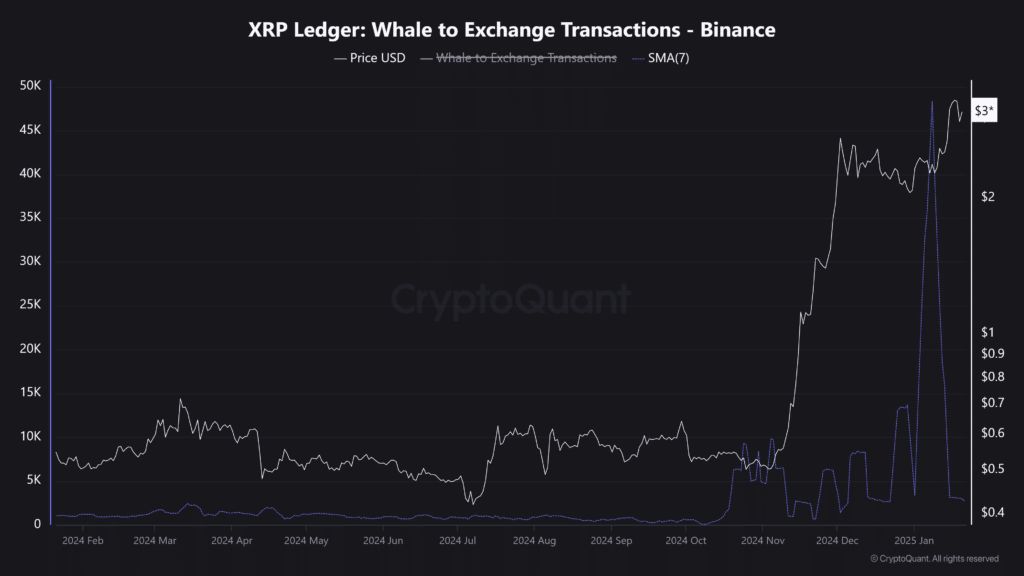

As the crypto market takes a breather, XRP, the cryptocurrency often referred to as the “dark horse” of the market, finds itself at a crucial juncture. With 270 million XRP flooding Binance owing to XRP whales, speculation is rife: are these key players cashing out, or are they positioning for another breakout? Watching $3 emerging as a critical support level, the stakes couldn’t be higher. Taking a look at the market dynamics, we analyze the historical patterns to determine whether XRP can defy the odds yet again.

Whale Deposits Hit Binance: Profit-Taking or Strategic Repositioning?

According to news sources, in the past 24 hours, Binance reportedly recorded an inflow of 270 million XRP tokens. This large-scale movement has sparked debates across the community. Typically, whale activity signals one of two things: profit-taking at critical price levels or strategic repositioning for future gains.

With XRP hovering around $3—just 11% below its yearly high of $3.40; key holders face a tough decision. Will they hold on and gamble on the broader market’s recovery, or will they take profits to mitigate risk?

Market Retreat: A Reality Check for Optimists

Bitcoin’s rise to $109K yesterday was followed by a sharp pullback, erasing $502.51 million in long positions and driving the market down by 6.2%. XRP, however, remained relatively resilient, losing only 1.22% and outperforming most Altcoins.

Still, XRP’s performance doesn’t exist in a vacuum. Its BTC trading pair (XRP/BTC) is trending downward, with bearish signs appearing in the Moving Average Convergence Divergence (MACD) indicator. The question is: Can XRP defy these signals and sustain its $3 support?

The Ripple Effect: Whale Confidence Amid Market Uncertainty

XRP’s recent surge- doubling in value and increasing its market cap by 33%; has been fueled by XRP whales accumulation. Since the post-election rally, billions of XRP tokens have exchanged hands, with another $100 million reportedly flowing in before Donald Trump’s inauguration.

However, the landscape is shifting. Despite no significant sell-offs yet, any break below $3 could push XRP whales into defensive mode, opting to protect their margins rather than risk deeper losses. The decision point is fast approaching.

Historical Patterns: Will XRP Whales Buy the Dip?

Crypto markets thrive on historical trends. During the second Fed clash earlier, XRP defied bearish sentiment with a 6.53% rally while Bitcoin stumbled. This is making many think history could repeat itself.

The futures market offers clues. Open Interest (OI) has dropped by over 4%, suggesting traders are bracing for a correction or have already exited risky positions. A clean-out of leveraged longs could pave the way for new capital inflows, potentially sparking another XRP rally.

What Lies Ahead: Consolidation or Breakout?

XRP’s near-term outlook hinges on two critical factors:

Broader Market Recovery: A rebound could boost investor confidence, stabilizing prices.

Whale Activity: If whales shift from selling to accumulation, XRP might revisit $3.50.

The high-stakes nature of this moment reveals the appeal of XRP’s “high-risk, high-reward” dynamic. With some sharing a bias that Bitcoin might be losing its luster among some investors, XRP remains gallant, positioning itself as the go-to Altcoin for bold plays.

Conclusion

XRP stands at a crossroads, with $3 as its make-or-break level. XRP Whales’ activity, market sentiment, and historical patterns all point to a pivotal moment. Whether the token surges toward $3.50 or consolidates below $3, one thing is clear: XRP remains a key player in the crypto verse.

For investors and enthusiasts, the message is simple: keep a close eye on the whales. Their next move could define XRP’s trajectory in the days to come.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why are XRP whales depositing tokens on Binance?

Whales often move large volumes of tokens to exchanges like Binance for liquidity. This could indicate potential profit-taking or readiness to buy on dips.

2. What happens if XRP falls below $3?

A break below $3 might trigger a sell-off as investors look to protect their margins. Conversely, it could also prompt opportunistic buying if confidence in XRP’s long-term potential remains strong.

3. How does XRP Whales activity impact XRP’s price?

Whales hold significant influence in the market. Their buying or selling decisions can create price volatility or stabilize key levels, depending on their strategy.

4. Can XRP reach $3.50 soon?

While historical patterns suggest the potential for a rally, achieving $3.50 will depend on broader market recovery and whale confidence in XRP’s future trajectory.