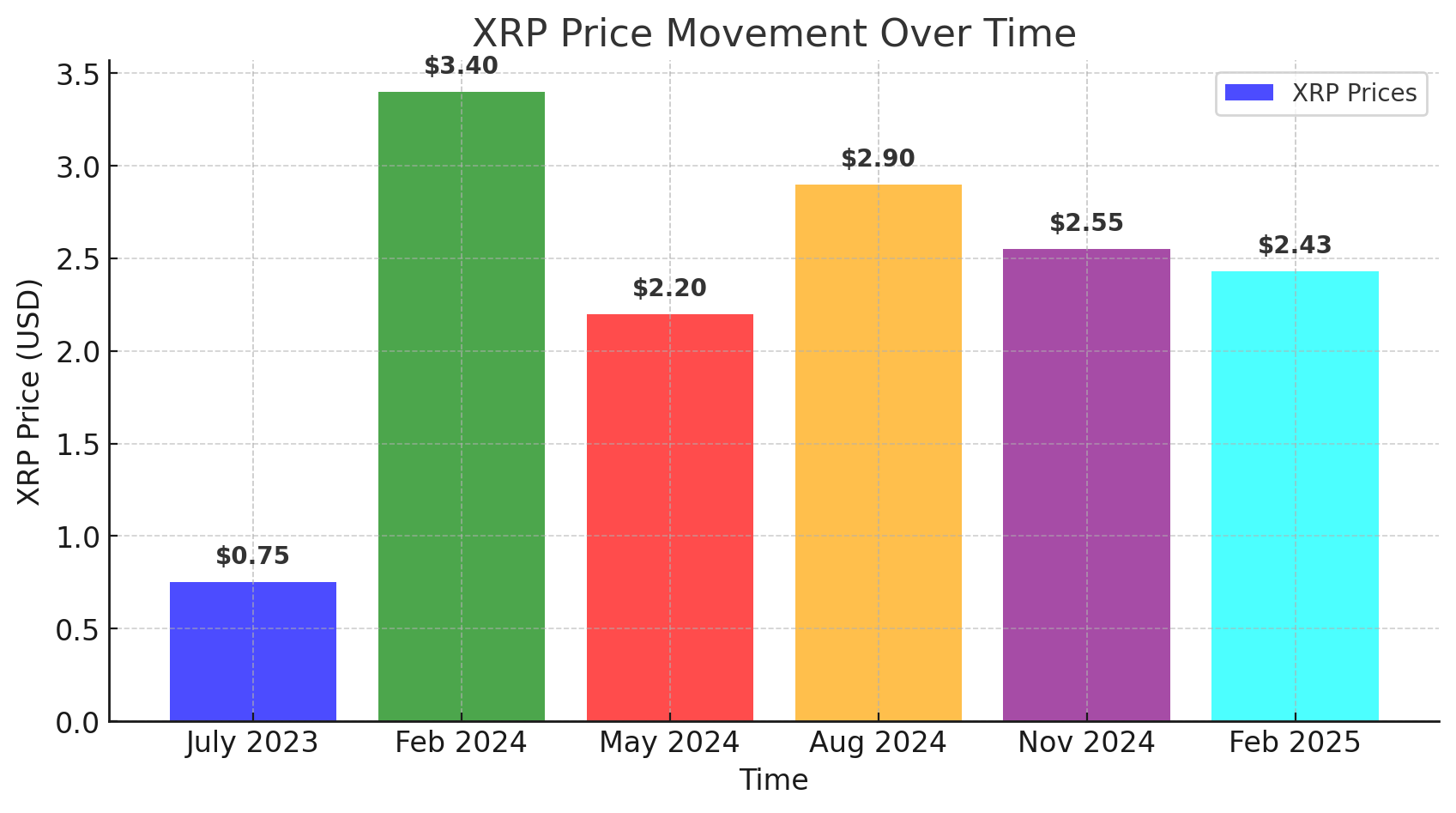

Few tokens have captured the public’s attention, such as XRP. As of February 10, 2025, XRP is trading at $2.43, reflecting a slight dip of 1.62% from the previous day. This modest decline belies the dynamic journey XRP has undertaken in recent times.

The Rollercoaster Ride of XRP

XRP’s price trajectory has been anything but linear. In July 2023, the token experienced a meteoric rise of 230%, only after enduring significant pullbacks of approximately 55% and 60%. Such volatility is not uncommon in the crypto sphere, but for XRP, these fluctuations have often been precursors to substantial gains.

Reflecting on these patterns, crypto analyst EGRAG CRYPTO noted,

“Investors who seized opportunities during these downturns reaped considerable rewards during subsequent rallies.”

This sentiment underscores the importance of strategic patience in crypto investments.

Current Market Dynamics

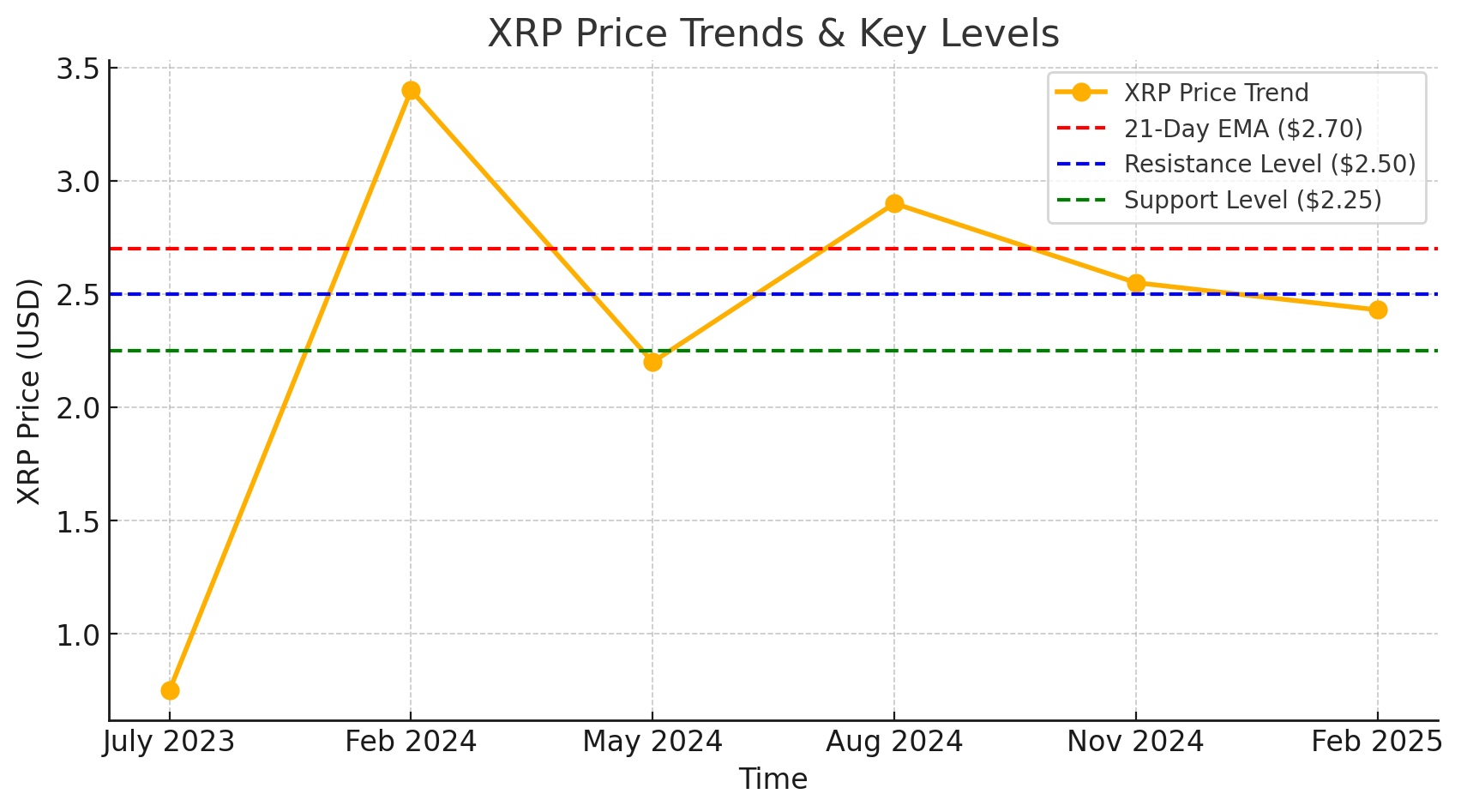

Presently, XRP finds itself in a consolidation phase, oscillating between the Fibonacci 0.5 level at $2.45 and the 0.382 level at $2.27. This range-bound movement suggests that the market awaits a catalyst to determine its next direction.

Technical analysts emphasize the significance of the 21-day Exponential Moving Average (EMA) at $2.70. A decisive move above this threshold could signal renewed bullish momentum. However, the true test lies at the Fibonacci 0.702 level at $2.80. Surpassing this point would likely affirm the bulls’ dominance.

Conversely, if XRP fails to maintain support, it could revisit the broader range between $2.06 and $2.65. A dip below $1.77 doesn’t necessarily spell the end of the bullish trend, as history has shown XRP’s resilience with swift recoveries following downturns.

Factors Fueling Anticipation

Several elements contribute to the current optimism surrounding XRP:

- Regulatory Developments: The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has been a focal point for investors. Recent developments suggest a potential resolution, which could remove a significant overhang on XRP’s valuation.

- Institutional Adoption: Ripple’s efforts to integrate XRP into traditional financial systems have borne fruit, with numerous institutions exploring or adopting Ripple’s payment solutions. This growing acceptance bolsters XRP’s utility and, by extension, its value proposition.

- Market Sentiment: The broader crypto market’s performance often influences individual tokens. With major cryptocurrencies like Bitcoin and Ethereum experiencing renewed interest, altcoins such as XRP stand to benefit from the trickle-down effect.

Looking Ahead: Predictions for 2025

Forecasting XRP’s future is inherently speculative, but several analysts have ventured predictions based on current trajectories:

- Arthur Azizov, CEO of B2BinPay, anticipates XRP reaching a price range of $5 to $7 in the first half of 2025. He attributes this optimism to Ripple’s advancements and the potential easing of regulatory pressures.

- Hani Abuagla of XTB offers a broader outlook, suggesting that XRP could trade between $5 and $100, depending on various factors, including market adoption and regulatory outcomes.

- Ryan Lee of Bitget Research provides a more conservative estimate, projecting XRP’s price to range between $1.8 and $8.4, with some scenarios envisioning peaks above $10.

It’s essential to approach these predictions with caution. The crypto market is notoriously volatile, and while the potential for significant gains exists, so too does the risk of substantial losses.

Conclusion

XRP’s journey is emblematic of the broader cryptocurrency landscape: fraught with volatility but laden with opportunity. As the market continues to mature and external factors play out, XRP remains a token to watch. Investors are advised to stay informed, exercise due diligence, and consider both the potential rewards and inherent risks.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What is XRP?

XRP is a digital asset designed for fast and low-cost cross-border payments, primarily utilized within the Ripple payment network.

Why is XRP’s price so volatile?

Like many cryptocurrencies, XRP’s price is influenced by market sentiment, regulatory news, technological developments, and broader economic factors.

How does the Ripple vs. SEC case affect XRP?

The legal dispute centers on whether XRP should be classified as a security. The outcome could have significant implications for XRP’s regulatory status and its adoption.

Is XRP a good investment?

Investment decisions should be based on individual risk tolerance and thorough research. While XRP offers potential due to its utility in payments, it also carries risks inherent to the crypto market.

Glossary of Key Terms

Fibonacci Levels: Technical analysis tools used to identify potential support and resistance levels based on the Fibonacci sequence.

Exponential Moving Average (EMA): A type of moving average that gives more weight to recent prices, making it more responsive to new information.

Bullish/Bearish: Terms used to describe market sentiment. ‘Bullish’ indicates optimism with expectations of price increases, while ‘Bearish’ denotes pessimism with expectations of price declines.

Altcoin: Any cryptocurrency other than Bitcoin.

Regulatory Overhang: Uncertainty in the market due to potential or ongoing regulatory actions that may affect an asset’s value.