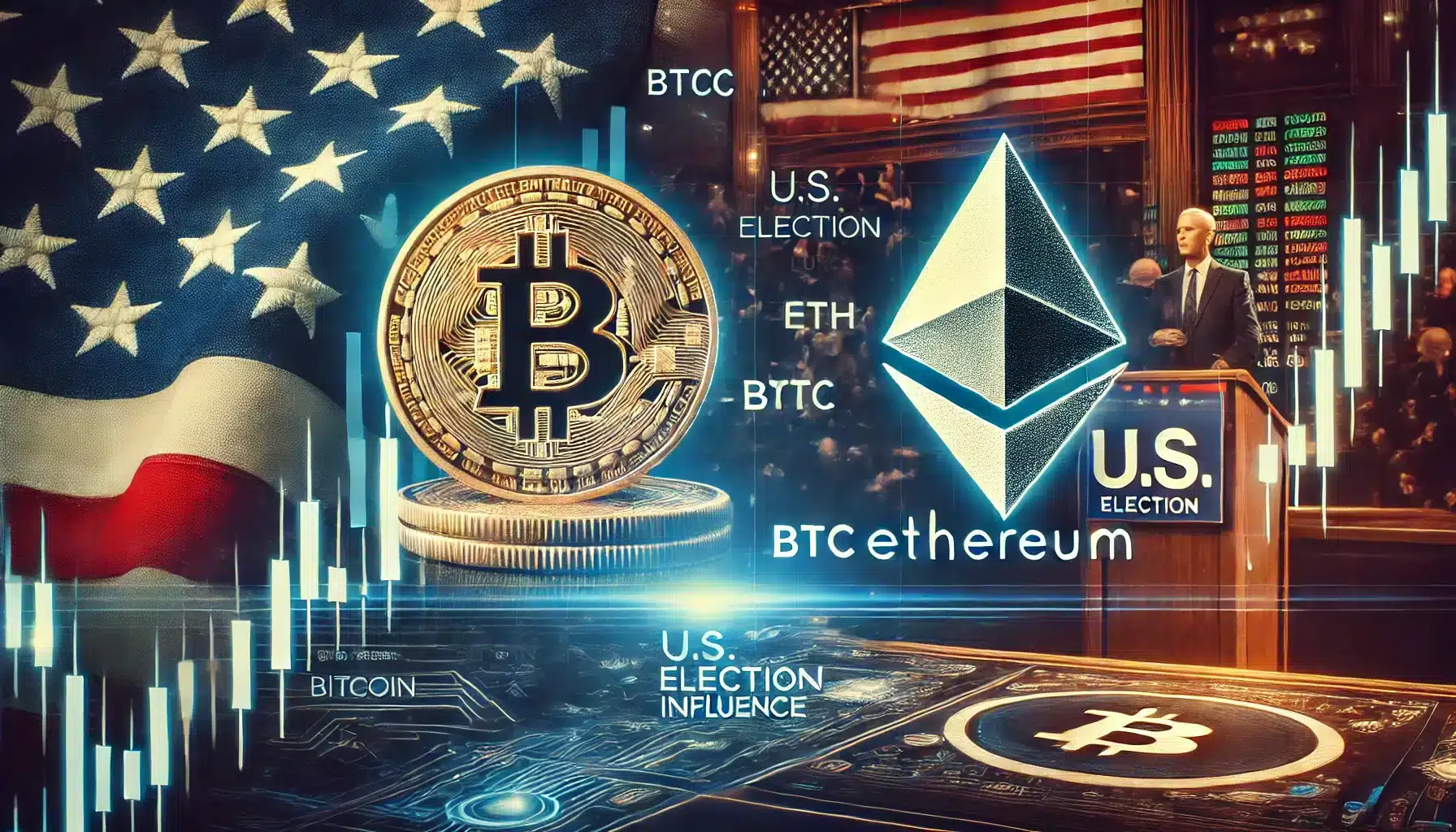

With just days to go before the 2024 U.S. Presidential Election kicks off on November 5, the crypto market is bracing for potential shifts. Historically, key elections have brought significant impacts on Bitcoin, Ethereum, and other cryptocurrencies, with some seeing substantial gains following previous results. This year, the unique stances of candidates Donald Trump and Kamala Harris on crypto could play a crucial role in shaping market sentiment.

How Have Previous U.S. Elections Impacted Crypto?

Looking back, U.S. presidential elections have often sparked notable price increases across crypto markets. In 2016, after Donald Trump was elected, Bitcoin surged from $700 to nearly $7,000, while Ethereum achieved a massive 2,500% return. Similarly, after the 2020 election, Bitcoin rose dramatically, achieving a 400% gain in the following year and reaching $63,254. Analysts suggest that the 2024 election could similarly act as a catalyst, possibly kicking off another crypto bull run.

Major Crypto Transfers Hint at Possible Volatility Ahead

Analysts, including those at Grayscale, predict post-election momentum for Bitcoin and Ethereum, as previous trends have shown. This year, Trump’s pro-crypto stance and Harris’s more cautious approach are creating uncertainty. Trump has actively supported crypto-friendly policies and even proposed making the U.S. the “crypto capital of the world.” His support for Senator Cynthia Lummis’s proposal for a national Bitcoin reserve could bode well for the crypto sector, and some analysts forecast that a Trump presidency could drive Bitcoin to six-figure valuations.

On the other hand, Kamala Harris is expected to support the development of blockchain technology without endorsing a comprehensive crypto reform. Her administration would likely focus on blockchain-related advancements but without aggressive moves to influence crypto markets directly. Thus, Harris’s influence on crypto prices may be more indirect.

Market Reaction Remains Muted

According to Polymarket, Trump’s victory odds dropped by 4.5% days before the election, leading to a pause in crypto market movement. Bitcoin and altcoin prices have stalled as investors wait for clearer signals. Polymarket data indicates that investors are closely watching the outcome to decide their risk exposure, reflecting the impact of election sentiment on trading behavior.

Experts caution that election-related uncertainty, combined with the candidates’ differing crypto policies, could lead to sudden price fluctuations in Bitcoin, Ethereum, and altcoins like XRP, DOGE, and TRUMP. With 180,000 BTC recently transferred to major investors and continued interest through ETFs, the crypto market may remain in a holding pattern until election results are in.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!