Bitcoin (BTC) fell by 6.77% over the weekend and is once again close to the year 2025 low. This decline in Bitcoin was attributed to increased apprehension in the US economy that has boosted the prospects of a downturn. US Treasury Secretary Howard Lutnick expressed his confidence in the economy when everyone else seems to be worried. Wall Street and crypto investors still stay conservative at least due to the increasing amount of risk.

Key Developments in the U.S. Economy and Bitcoin Market

U.S. Treasury Secretary Howard Lutnick said that there would not be a recession. In an interview on this show “Meet the Press” he dismissed Wall Street doubters saying that the American economy is stable. Lutnick further associated the event to a previous skepticism over the political career of Donald Trump. He said that the economy will keep on expanding regardless of the apprehension voiced by big banks such as JPMorgan and Goldman Sachs.

He identified the tariff initiatives by President Trump as one of the factors for the growth. He insists that these tariffs will put pressure to other countries which will lead to reduction of tariffs barriers and enable access to $1.3 trillion of investments. He predicted that this will boost growth in the United States over the upcoming two years.

Bitcoin’s Response to Economic Concerns

However, according to Lutnick, things changed rapidly and badly for Bitcoin as it started a sharp fall. As a result of these concerns, Bitcoin fell to roughly $80,000, in tandem with the market’s bearish sentiments. This is in line with other cryptos other than Bitcoin such as Ethereum (ETH), Solana (SOL), and XRP (XRP) are among the many to have declined in value this fall. Even popular meme coin such as DOGE and ADA declined by about 12%.

U.S. Jobs Report Shows Slower Growth

The report on employment rate of February was released recently, indicating that 151,000 new jobs were created in the economy. This is in line with expectations but is accompanied by a slightly worse unemployment rate; for it increased to 4.1%. Moreover, the initial estimates of the new job additions in January were reduced, hence indicating a decline in the tempo of jobs generated.

These are messages that trigger confusion, mixed signals are a cause of concern. Despite the relative stability in the labor market, possible indicators of deceleration can already be observed to some extent. This rising unemployment, as well as the slow growth in job creations, put into question the growth rate of the economy.

Wall Street’s Growing Concerns About a Recession

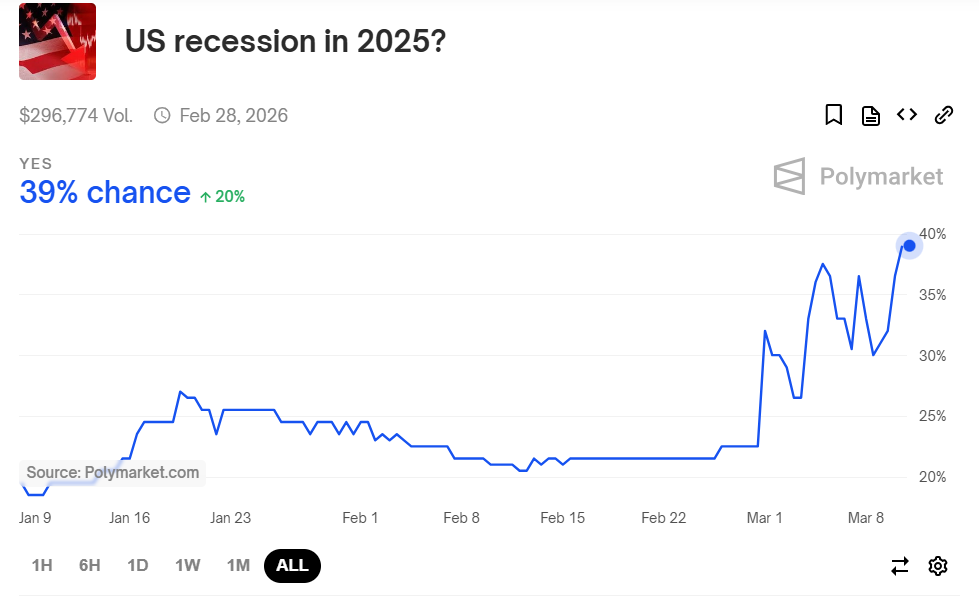

In spite of Lutnick’s statement, many people on Wall Street fear a recession. Some of the leading Wall Street firms, such as JPMorgan and Goldman Sachs, have sounded alarms. They believe that the tariff approach and imbalance of trade are key reasons that may lead to a recession. Such concerns are evidenced by the increasing probability of a recession on Polymarket, a prediction market.

The probability is up to 39%, which means that there is a higher likelihood of a recession in 2025. This is a 16% increase in the recent weeks. Recently, people have been getting ready for the decline to occur, yet many have doubts, thinking that it is unlikely.

The Impact of Tariffs on the U.S. Economy

In as much as equity markets concerns, one of the contentious topics of discussion is tariffs. For this reasons, Lutnick fosters the tariff strategy arguing that it will curb the trade deficit as well as decrease the borrowing costs. He postulates that by adopting this measure, interest rates will also drop, easing the burden on the American homeowners bearing costly mortgage.

U.S. Economic Outlook and Recession Risks

This type of recession is still present as there are indications that the US economy has slowed down in some aspects. The real GDP growth for Q1 2025 is projected to be a decline according to the GDPNow model of the Atlanta Fed. This may mean contraction, which is among the leading signifies of a downturn in the economy. There are others which predict a recession by only 3% before May.

For now, a long one, the situation is described by many specialists as a transition period. Despite the decrease in the growth rate, one cannot speak about the recession of the economy yet. However, the increasing likelihood of a down turn has made investors to be very cautious.

Conclusion

As fundamental data point to a deceleration of economic activity both in the United States and globally, the path of the economy and Bitcoin is uncertain. As for the future, Lutnick stays positive but Wall Street and digital currency traders do not stay that hopeful. Bitcoin takes its cues from the overall economic tension, which indicates that financial markets are preparing for a storm.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

1- What could cause the Bitcoin value to go lower over the weekend?

Bitcoin fell by 6.77% because the concerns over the USA economy and its potential recession have climbed up.

2- What measures is U.S. Treasury Secretary taking over this issue of recession?

Lutnick disagrees with the notion that the US economy is in a recession and attributes the tariffs and direct foreign investments as key to the future growth.

3- What impact are tariffs having on the economy?

Lutnick assures that increased use of tariffs in a particular industry will decrease the trade deficit and therefore, cut costs of borrowing hence increasing growth of the economy.

4- Will there be a recession in the USA in the year 2025?

Some people see an increase in probabilities of a recession, while others do not think so, many of them calling it the ‘transition phase’.

Appendix: Glossary of Key Terms

Bitcoin (BTC): A type of digital currency that operates independently of centralized authorities and is employed for investment purposes due to its high instability.

Recession: Economic recession can also be defined economic downturn that takes place when the GPD reduces in the subsequent two quarters and unemployment increases.

Tariffs: Tariffs measures which are levied on imported goods with an aim of protecting home industries or balance of trade, which has an impact on International relations.

GDP (Gross Domestic Product): The aggregate of the worth of all final products and services manufactured and sold in a particular country in a given time frame.

Polymarket: An open-source marketplace in which parties make a bet regarding the potential occurrence of certain events, such as economic or political changes.

References

CoinDesk – coindesk.com

NBC News – nbcnews.com

PolyMarket – polymarket.com

CoinMarketCap – coinmarketcap.com

Bureau of Labor Statistics – bls.gov

BBC – bbc.com