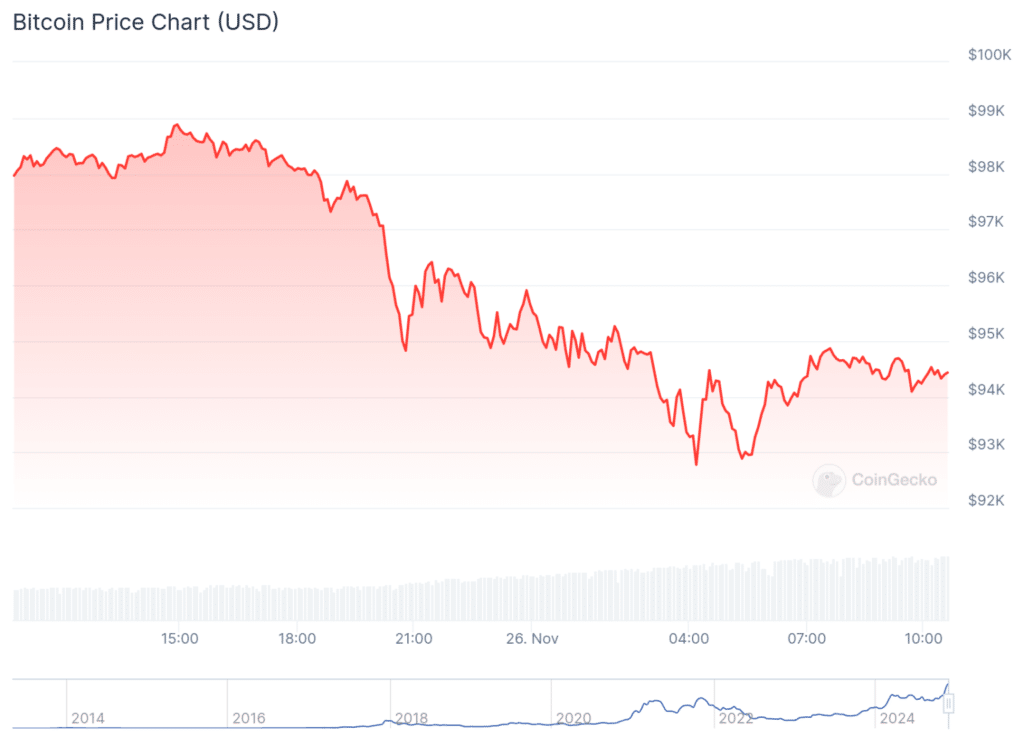

Bitcoin is going through its longest correction since the start of the price uptrend following the US election and Donald Trump’s victory. Although still unable to cross the $100,000 mark, the cryptocurrency fell below $93,000, indicating a 4.13% decline within one day. Though, it quickly bounced back and traded back over $94,130 at the time of writing.

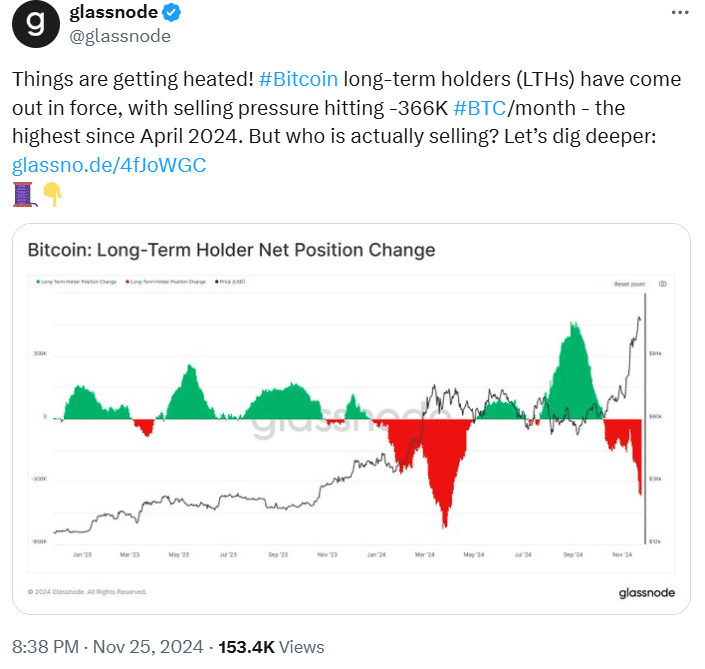

In November, the price of Bitcoin was rising to new record highs, which led to many early investors selling their coins. According to the data provided by analytical platfrom Glassnode, the sell pressure is the highest since April 2024 and the majority of the coins are being sold by the addresses which held BTC for 6 to 12 months.

These investors who bought their Bitcoin at lower prices have been selling huge chunks of Bitcoin daily, averaging 25,600 per day. This group brought in the increase from nearly $74,000 to almost $99,000 and thus locked in gains.

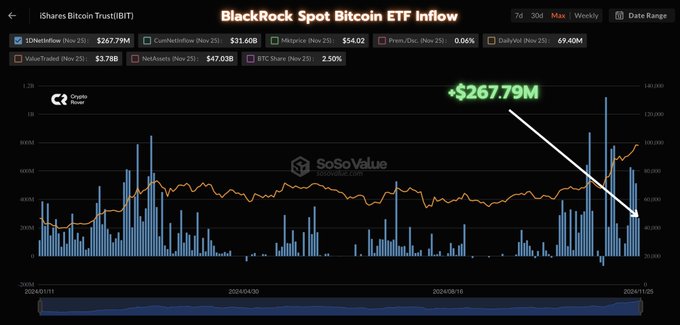

Bitcoin ETF Inflows Persist

Nevertheless, this selling pressure is still evident, but BTC is still attracting institutional investors. Since the US elections, US-based spot Bitcoin ETFs have seen more than $7 billion in inflows taking the total AUM in these funds to more than $105 billion. However, the progress has decelerated in the last few days.

On November 25, Bitcoin ETFs had a net outflow of $438 million, with the largest player, the Bitwise Bitcoin ETF, having $280 million. However, BlackRockInc’s Bitcoin Exchange Traded Fund (ETF) experienced a net investment of $267.79 million, which affirms that institutions are still bullish on cryptocurrency regardless of the changes in the price of BTC.

Bitcoin Key Support Levels

In a recent YouTube video, Crypto Rover expressed his opinion on the current state of affairs and pointed out that the main reason for the decline in BTC prices is the sharp rejection at the $100,000 mark. Rover said that there were many sell orders at this price level, and that when there are such big sells, the prices pull back. He explained $94,000 as a critical level of support which BTC has been able to bounce back from.

If this level stands, Bitcoin may be on the verge of range-bound trading before it tries to move higher. However, if it penetrates through the $94,000 level, the next support may be around $86,000 to $87,000. Rover said that from the current price action, BTC is trapped in what appears to be a symmetrical triangle, which is a sideways trading pattern that precedes a breakout.

Retail interest in the crypto market is also growing as evidenced by the growth of short-term holders. This increasing retail investor interest could lead to an altcoin price rise as well, given that Bitcoin is still trapped within a trading range. In the past, the majority of token price action occurs during the month of November with more substantial price action occurring in December. If this pattern continues, cryptocurrency may bounce back in the next several weeks when the market returns to the growth trajectory.

Bitcoin’s Bullish Long-Term Outlook

While in the short run the price can be quite volatile, the majority of the experts still expect the further growth of Bitcoin prices. The recent correction is a normal pullback after a strong move up as part of a higher degree correction. BTC has critical support levels, which are around $94,000; therefore, its long-term trend is still bullish. The recent retracement is not seen to disrupt the overall uptrend as most analysts believe that Bitcoin will hit new high in 2024.

In short, the market will first pay attention to the support levels of Bitcoin to assess if it can provide a rebound in the short term. If BTC remains above $94000 and surges past $100,000 it could open up another rally. The crypto market has continued to attract retail and institutional investors, while maintaining sound fundamentals, and while there have been some setbacks, these do not negate the bright future still ahead for cryptocurrency.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!