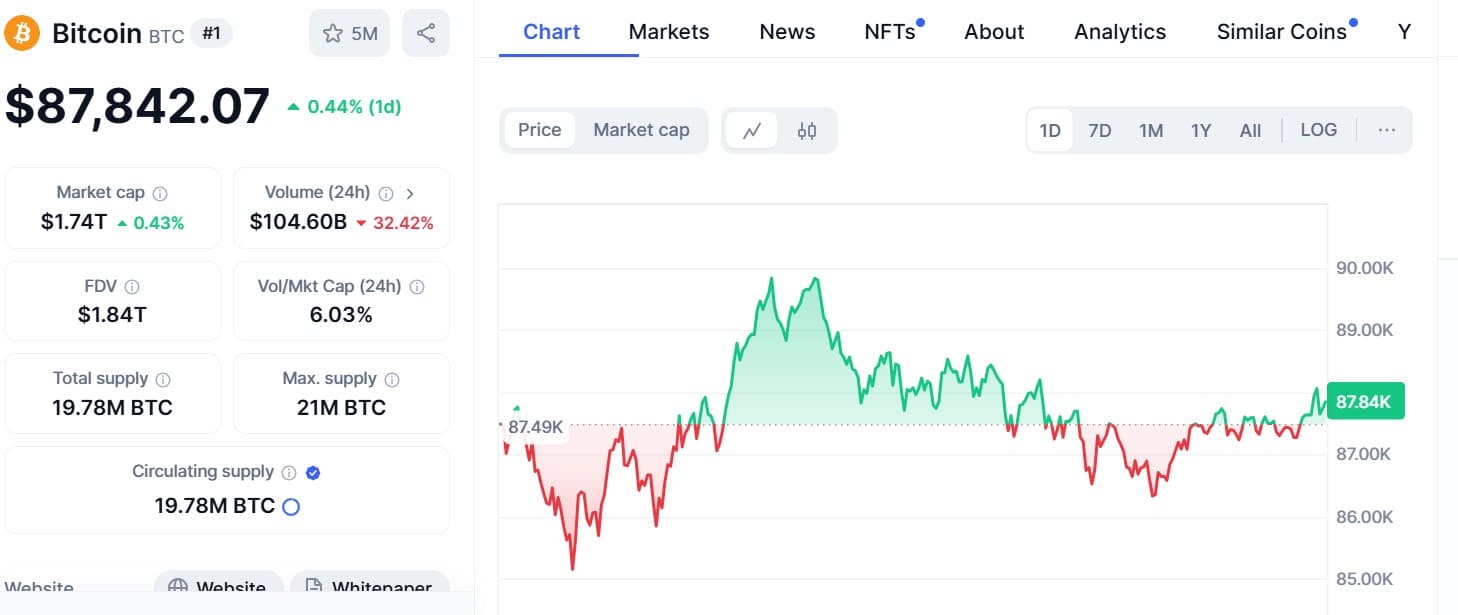

Bitcoin Price flirts $90K as ‘Trump Trade’ Keeps Fueling Markets. The new Bitcoin hype reportedly attracted the investors globally again with the amount touching $90,000 on Tuesday afternoon in accordance to Coinbase insertion. This record-high increase is actually due to the increased market buoyancy that results from the recent changes in the political and economic landscape. The accomplishment is causing renewed speculation on Bitcoin’s ability to scale new heights by year-end, but the forecasts remain divided among analysts.

Market Boost As ‘Trump Trade’ Rally Continues

The “Trump Trade” which implies that there was elevated market expectation depending on Donald Trump’s re- election campaign has benefited several financial markets. Such price increase to above $90,000 is reflected after the campaign by Trump in the re-election process and is most likely to affect other broad economic policies such as those for digital assets. “Given the expectation that the Trump administration will release friendly measures towards cryptocurrencies, the market has taken a bullish outlook,” explains Julien Auchecorne of Auros Ventures. It is also a microcosm of a larger rally, as the total market value of cryptocurrencies hit $3.1 trillion.

The upswing in the value of digital currencies is well illustrated by Bitcoin, which has risen by 115 % since January 1 when it was trading at about $42,000. This has been supported by lower borrowing costs from the highly dovish Federal Reserve and its lowered interest rates supporting risk assets such as Bitcoin.

Record Gains Set New Precedent for Bitcoin Price

As Bitcoin price rises above $90,000, the data show that it has a record single-day increase setting a future high roll. Monday saw the Bitcoin rise by $83k the biggest single day dollar-value gain, as per data from Galaxy Research. The rally shows that investors consider Bitcoin price as a highly believes-in product in today’s environment especially given Trump expected business-friendly policies.

The rise reaches new heights due to Fed decisions as S&P 500 flirted with 6,000 points with its record high. Most analysts suggest that so long as borrowing costs are low, risk assets such as Bitcoin will remain popular. In this up trending situation, crypto investors believe that its’ upward trend is sustainable and there’s potential for more gains in the near term.

But now the view is much more complicated, and there are question marks on the way to navigate forward. Global markets and there behavior to changing geopolitics situation such as east Europe market has always been volatile. Experts argue that despite the spectacular growth of Bitcoin price, the outside economical factors can still have impact on the Bitcoin price rise.

Experts Predict Higher Targets by Year-End

Bitcoin is still a positive bet according to Bitwise’s CIO Matt Hougan who expects the leading crypto to break through $100k before year-end. Hougan remains optimistic for greater regulation of Bitcoin price and other digital assets owing to the future legislation that might affect the market. “With today’s world and the current market demands, we can easily reach $100k by the end of the year” Hougan said. He also opines that Bitcoin might rise to $200k by the year 2025 if the existing market outlook remains bullish.

Other financial executives like Bradley Duke, the European Head at Bitwise, also support Hougan, saying that there is solid market support. Duke is now confident in Trump’s second term, which, he is convinced, will mark a ‘golden era’ for crypto assets since they expect the administration to support pro-crypto regulations. Duke went on to elaborate that should Trump’s government push through his plans to put into effect policies like supporting Bitcoin mining or establishing a national crypto reserve, then Bitcoin’s technological trajectory would probably be further cemented.

Nonetheless, some analysts dare to speak about even more. While such indicators do look sweet to the eye, some forecasters would not just stay passive. The crypt market is still unpredictable, shifts in the economic policy or unexpected bureaucratic barriers can affect the Bitcoin future rates. However, for now, many of them keep having high expectations on the profitability of Bitcoin during the beneficial economic environment.

Looking Ahead: What’s Next for Bitcoin Price?

With Bitcoin price displaying its recent achievements, this cryptocurrency has much to look forward to and much to be afraid of in the near future. It is believed that Trump’s administration’s planned regulations would be favorable for both blockchain systems and crypto markets. In addition, as the Federal Reserve is now signalling that it is not planning to raise interest rates anytime soon, the situation looks promising for further expansion in the sphere of distributed digital currencies.

Still, market change susceptibilities including geopolitical risks, elevated national debt and environmental factors associated with the crypto mining may act as challenges to the market growth. Experts point out that while the present condition is looking quite hopeful as far as Bitcoin is concerned, these points had the potential to affect the future movement of the coin quite badly.

For now, the story of Bitcoin price goes on, and the market is divided on what direction the cryptocurrency will head next. The future few months may unveil more information about where exactly Bitcoin may fit into the financial panorama. Keep following TheBITJournal to keep an eye on Bitcoin price.

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!