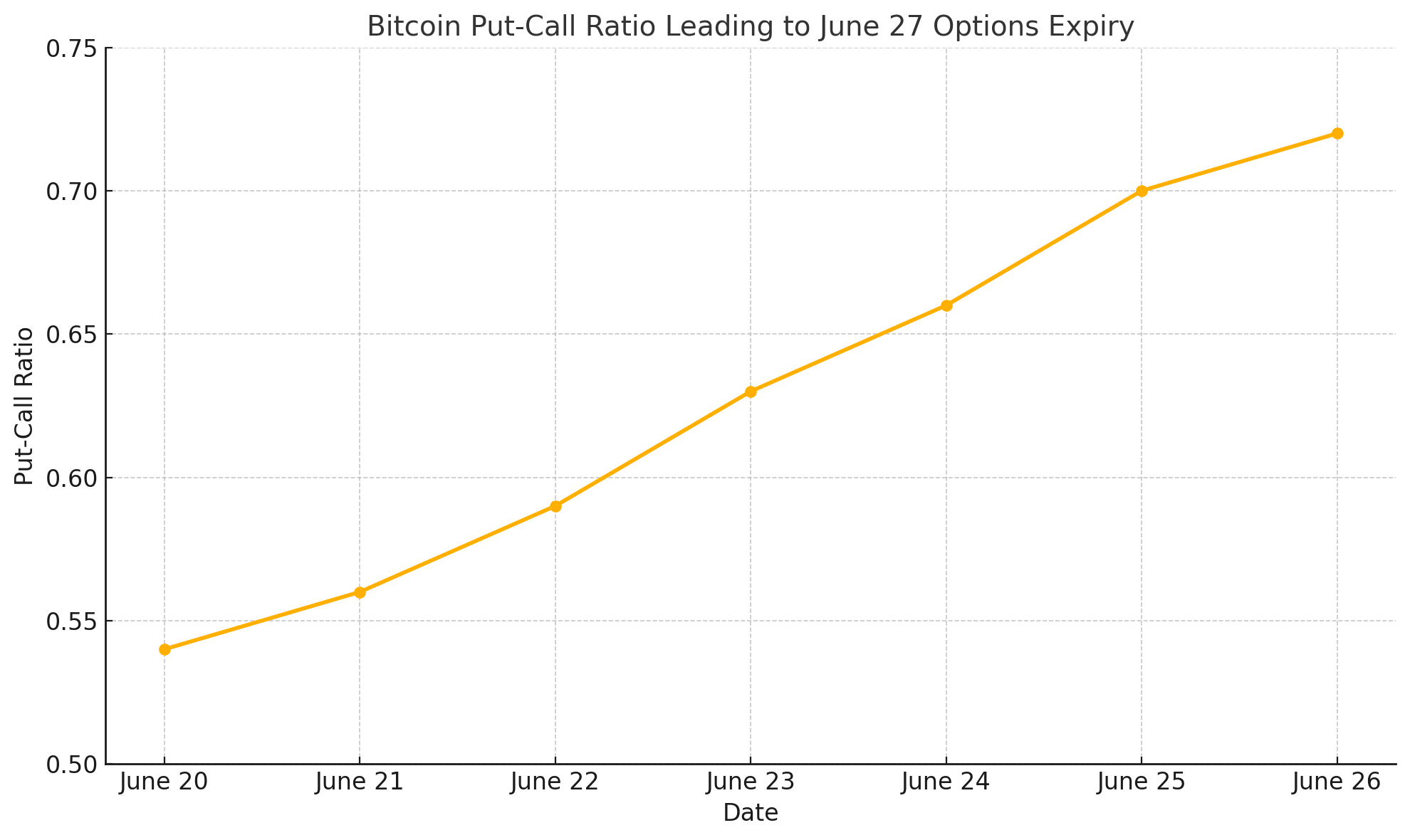

The Bitcoin put call ratio has leapt to 0.72 on Deribit just days before 141,271 contracts, worth roughly $14 billion, settle on June 27, raising fresh questions about how Friday’s quarterly expiry could jolt spot prices. Many traders see a high Bitcoin put call ratio as a flashing-red bearish alert. Yet the details behind this week’s jump reveal a more nuanced picture that may leave both bulls and bears second-guessing their playbooks.

Options Mechanics 101: Cash-Secured Puts Dominate

Deribit data show that nearly one-fifth of calls expiring Friday are already in-the-money, yet the Bitcoin put call ratio keeps grinding higher because dealers are writing cash-secured puts to earn yield while expressing willingness to buy BTC on dips. In other words, the “P” in the Bitcoin put call ratio is being inflated by strategic accumulation, not outright panic hedging, so the usual bearish read-through could be blunted.

Strike Map and “Max-Pain” Gravity

More than forty percent of total open interest disappears at this quarterly close, with the largest concentration of activity sitting between $100,000 and $105 000. That band is also the max-pain zone, where the Bitcoin put call ratio suggests the most contracts expire worthless, a dynamic that often pulls spot toward the level in the hours before settlement.

Historical CME data echo the theme: open-interest clusters near the 100 k line have pinned price during three of the last four large expiries.

| Key Strikes | OI Calls | OI Puts |

|---|---|---|

| $100 000 | 7,810 | 8,544 |

| $105 000 | 6,122 | 5,990 |

| $110 000 | 4,311 | 3,285 |

The Bitcoin put call ratio therefore hints at balanced gamma around $102 k, implying choppy but contained swings unless an external catalyst pushes BTC through the range.

Volatility Metrics Disagree With the Headline Fear

Even as the headline Bitcoin put call ratio spikes, thirty-day implied volatility on June-dated contracts hovers near 37 percent, well below the 49 percent average seen before March’s halving rally. Reduced IV coupled with a higher Bitcoin put call ratio often indicates that traders are selling premium, not rushing to pay for protection.

OTC desk Wintermute confirms that the busiest flow this week has been short straddles at 105 k and short puts at 100 k, trades that lean on time decay rather than directional bets, explaining why the Bitcoin put call ratio can rise even as sentiment stays neutral.

Post-Expiry Scenarios: Pin, Pop, or Drop?

Pin: If spot hovers near $102 k into 08:00 UTC settlement, delta-neutral market makers could unwind hedges quietly, cooling volatility and letting ETF inflows steer the next trend.

Pop: A surprise macro bid—say, stronger-than-expected ETF intake, could lift BTC past $108 k. In that case, the Bitcoin put call ratio would likely sink as ITM calls are rolled higher, a setup that historically precedes 5 percent rallies within 48 hours.

Drop: A swift move under $100 k forces dealers long puts to sell spot, creating a feedback loop. The elevated Bitcoin put call ratio tells us plenty of ammunition exists for such a gamma squeeze, but only if bears trigger it.

Analyst Takeaway

The Bitcoin put call ratio has reached its loftiest perch of 2025, yet the composition, cash-secured income trades, not stressed hedges, means downside follow-through is far from guaranteed. Seasoned traders may watch relative changes in the Bitcoin put-call ratio after expiry rather than its absolute level today to gauge real sentiment shifts.

Conclusion

A record $14 billion quarterly expiry always warrants respect, and the Bitcoin put call ratio supplies the simplest pulse check. Still, context matters: income-seeking structures, muted implied volatility, and a crowded $100 k–$105 k strike range all argue for a controlled settlement unless an unforeseen catalyst fires. Traders should stay nimble, but blanket bearishness based solely on a rising Bitcoin put call ratio could prove as costly as ignoring it altogether.

Summary

The Bitcoin put call ratio has spiked to 0.72 ahead of a $14 billion options expiry on June 27, raising volatility fears. However, much of the increase stems from cash-secured puts and yield strategies rather than bearish hedging. With strike clusters between $100K–$105K and muted implied volatility, Friday’s expiry may see range-bound movement unless macro news jolts sentiment.

FAQs

What is the Bitcoin put call ratio?

It measures the ratio of open interest in put options versus call options for Bitcoin. A higher value suggests more put activity, often interpreted as cautious or bearish sentiment.

Is a high Bitcoin put call ratio always bearish?

Not necessarily. This week’s ratio spike is driven by income strategies like cash-secured puts, which don’t always reflect bearish outlooks.

When is the next Bitcoin options expiry?

The current quarterly expiry is on June 27, 2025. The next major expiry cluster is expected on July 26, 2025.

Glossary of Key Terms

Bitcoin put call ratio: A metric comparing open interest in puts vs. calls, used to gauge trader sentiment.

Max pain: The price level at which most options expire worthless, minimizing payouts to traders.

Implied volatility (IV): A forecast of market volatility embedded in option prices; higher IV often implies market uncertainty.

Cash-secured put: An options strategy where traders sell put options while holding enough cash to buy the asset if assigned.

Gamma squeeze: A rapid price move triggered by option hedging activity, often after large expiries.

Open interest (OI): Total number of outstanding options contracts that have not been settled.