Bitcoin’s strength is again on display as it holds firm above $105,000, even after a weekend of intense volatility that led to nearly $1 billion in liquidations. While global markets tremble under geopolitical pressures and leveraged positions unwind, Bitcoin strength appears resilient, fueling hope that a new phase of accumulation is underway.

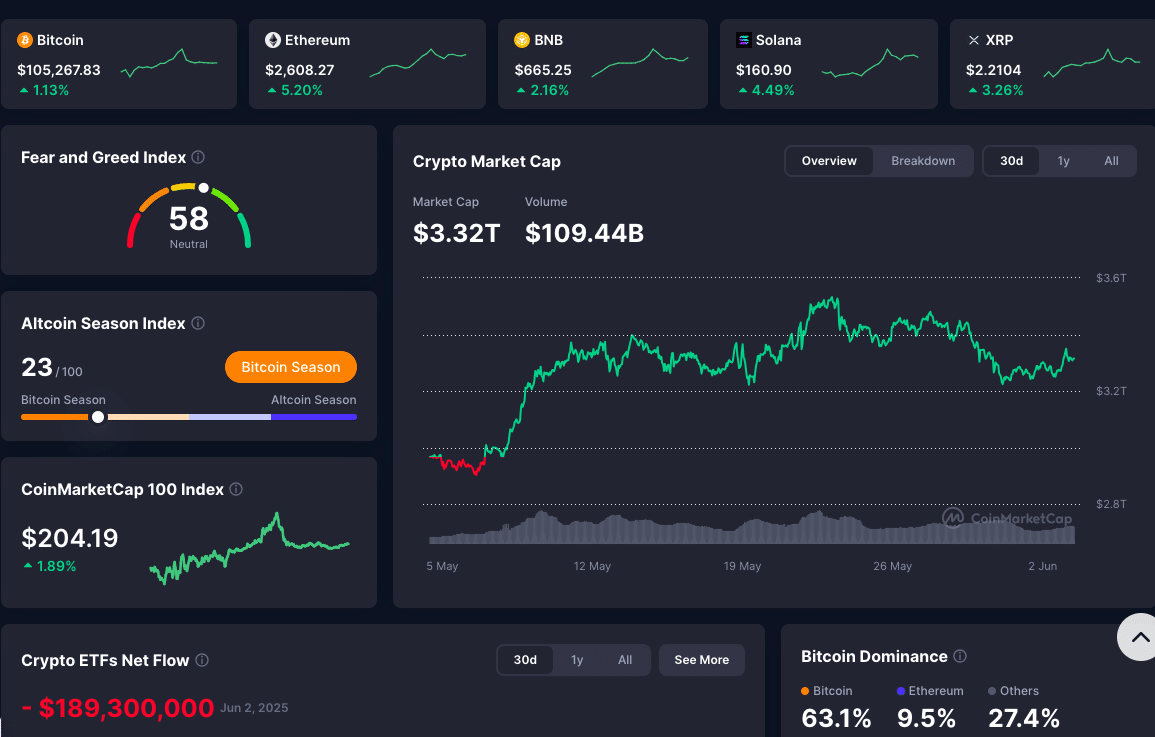

As of writing, Bitcoin strength keeps BTC trading around $105,267.83, showing remarkable stability despite the noise. This durability is bolstering investor confidence and setting a tone for cautious optimism in a market still rattled by macro uncertainties.

Ethereum and Dogecoin Lead Altcoin Recovery

Leading the pack in altcoin gains, Ether (ETH) has surged by 5.2%, currently trading at $2,608.27. The rise in ETH follows a major internal restructuring at the Ethereum Foundation aimed at optimizing protocol development and ecosystem scaling as well as the recent Pectra upgrade.

Dogecoin (DOGE), often viewed as a sentiment-driven asset, climbed 3% to $0.1950, as risk appetite showed signs of revival. Altcoins like Solana (SOL), Cardano (ADA), XRP, and BNB Chain also saw gains of 2.16%, with the CoinDesk 20 Index (CD20) up by 2%, reaffirming renewed market optimism.

Traders Brace for Potential Cooling Period

Even with Bitcoin strength holding firm, some analysts urge caution. Following weeks of sharp upward movement, BTC now faces a technical pause. Ryan Lee, Chief Analyst at Bitget Research, highlighted that the $105,000 level signals a “natural cooling” in the market after a strong rally.

His analysis projects a consolidation zone between $103,000 and $108,000, with $100,000 acting as critical psychological support. If breached, downside targets may fall toward $97,000 or even $93,000.

Lee emphasized that on-chain metrics still show strong whale accumulation, a typical precursor to bullish reversals—signaling that dips may serve as buying opportunities. This consistent Bitcoin strength amid volatility supports the theory that institutional confidence remains intact.

Technical Outlook Remains Constructive

From a technical standpoint, Bitcoin strength is reinforced by robust market structure. BTC continues to outperform traditional asset classes year-to-date, with even legacy investors beginning to treat it as a macro hedge.

Ethereum, however, shows signs of hesitance. Lee pointed out repeated rejections near the $2,800 mark, indicating a resistance ceiling. Without a clean breakout above $2,810, ETH’s momentum may stall, despite its current strength. Still, analysts believe the long-term structure for ETH remains bullish.

Macro Headwinds Continue to Sway Markets

Geopolitical tensions, particularly ongoing trade skirmishes between the U.S. and China, have injected new volatility into global markets. Singapore-based QCP Capital emphasized that these frictions are top of mind for investors, especially with major policy deadlines looming in early July. Traders are keeping an eye on fiscal updates, potential tariffs, and central bank rate decisions, all of which could sway Bitcoin strength and broader crypto sentiment.

Despite these macro risks, Bitcoin strength is helping the crypto market outperform traditional equities. Augustine Fan, Head of Insights at SignalPlus, noted that long-term holders and early adopters remain in selling mode, taking profits as mainstream money continues to accumulate. This dynamic has contributed to steadier price behavior than some feared.

Institutional Interest Reinforces Bitcoin Strength

The rise in Bitcoin strength is not occurring in a vacuum. Institutional interest continues to build, with exchange-traded funds (ETFs) attracting billions in inflows. Bitcoin has solidified its image as a portfolio stabilizer amid economic uncertainty, especially after new data showed the U.S. economy contracted by 0.2% in Q1 2025.

Meanwhile, anecdotal evidence shows private funds and corporate treasuries continuing to increase their BTC allocations, citing hedging benefits and long-term yield potential. This sustained interest suggests Bitcoin strength may persist even through choppy market conditions.

Market Sentiment Remains Cautiously Optimistic

The overall market tone remains cautiously optimistic. While Bitcoin leads, many traders are selectively rotating into altcoins, hoping to capitalize on short-term momentum. ETH, DOGE, and other majors have benefited from this capital movement, but BTC’s dominance still hovers near yearly highs.

Analysts caution that overconfidence could be dangerous. A mix of high leverage, geopolitical turmoil, and technical resistance levels could create unexpected headwinds. Still, with Bitcoin undeterred so far, the market narrative is skewing bullish unless proven otherwise.

Conclusion: Bitcoin Strength Holds the Line Amid Uncertainty

As we head into another week of potential macro shocks, Bitcoin strength is emerging as the bedrock of the crypto market. With BTC holding firmly above $105,000, investor appetite remains healthy. Although technical indicators suggest a potential short-term cooling, longer-term signals, including whale accumulation and institutional flows, point to sustained bullishness.

For traders and investors alike, the key will be monitoring whether this Bitcoin strength can withstand external pressure and internal overextension. For now, the trend appears to favour resilience over retreat.

FAQs

What is the significance of Bitcoin strength at $105,000?

Bitcoin holding above $105,000 demonstrates strong market demand and signals that investors remain confident despite recent volatility.

How is Ethereum contributing to overall Bitcoin strength?

Ethereum’s restructuring and development focus is boosting investor confidence across the crypto ecosystem, indirectly supporting Bitcoin strength by improving market sentiment.

Could geopolitical tensions impact Bitcoin strength?

Yes, rising tensions between the U.S. and China may inject volatility. However, Bitcoin strength has historically benefited from such uncertainty as investors seek hedges.

Glossary

Bitcoin Strength: A term used to describe the resilience and price stability of Bitcoin during volatile or uncertain market conditions.

Altcoins: Cryptocurrencies other than Bitcoin, often more volatile but capable of outsized returns during bullish cycles.

Whale Accumulation: Large investors (whales) buying significant quantities of cryptocurrency, typically signaling confidence in the market.

Death Cross: A bearish technical pattern where a short-term moving average crosses below a long-term moving average.

On-Chain Metrics: Blockchain data used to analyze investor behavior and market trends, such as wallet activity and transaction volumes.