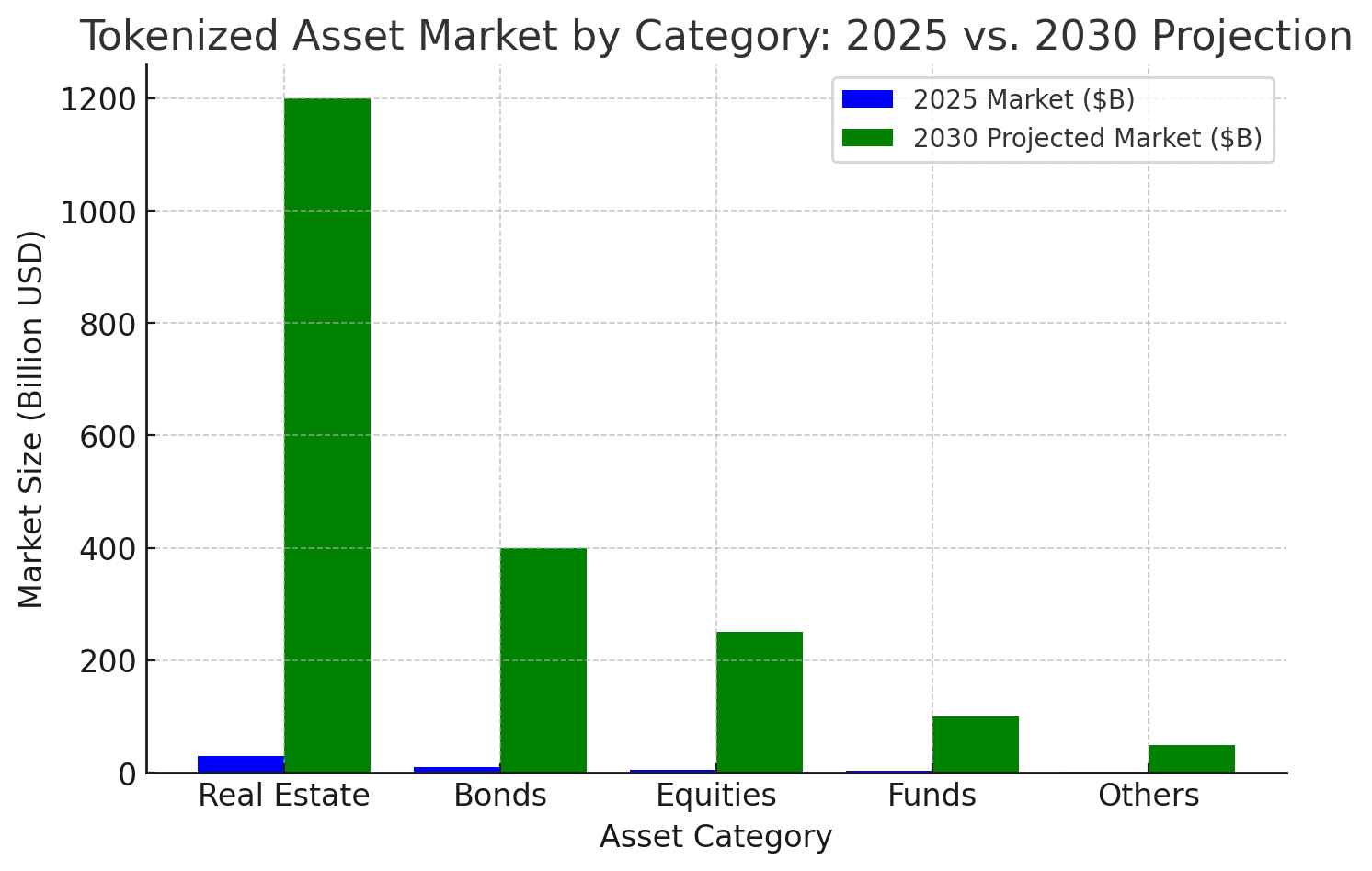

The financial landscape is undergoing a significant transformation with the rise of asset tokenization—a process that converts real-world assets into digital tokens on a blockchain. As of March 2025, the market for tokenized assets has surpassed $50 billion, with projections suggesting it could reach approximately $2 trillion by 2030.

This growth is driven by the increasing adoption of asset tokenization, which involves converting traditional assets like real estate, bonds, and equities into digital tokens on blockchain platforms. Notably, real estate leads this trend, accounting for about $30 billion of the current tokenized market.

Understanding Asset Tokenization

Asset tokenization involves creating digital representations of physical or intangible assets on a blockchain, enabling fractional ownership and more accessible investment opportunities. This process enhances liquidity, allowing assets that were once illiquid to be bought and sold with greater ease. For instance, real estate properties can be divided into smaller shares, making it possible for a broader range of investors to participate without the need for substantial capital.

Key Benefits of Tokenization

Increased Liquidity: Tokenization enables fractional ownership, allowing more investors to participate in markets that were previously inaccessible.

Enhanced Transparency: Blockchain technology provides an immutable and transparent ledger of all transactions, reducing the potential for fraud and increasing trust among investors.

Improved Efficiency: By utilizing smart contracts, tokenization automates processes such as compliance checks and transaction settlements, reducing administrative costs and time delays.

Broadened Accessibility: Fractional ownership through tokenization can make owning different types of assets accessible to many more people in varying financial circumstances.

Challenges and Considerations

Despite its advantages, asset tokenization faces several challenges:

Regulatory Uncertainty: The evolving nature of blockchain technology means that regulatory frameworks are still catching up, leading to uncertainty for issuers and investors.

Technological Risks: As with any digital system, tokenization platforms are susceptible to cyber threats, requiring robust security measures to protect assets and data.

Market Adoption: Widespread acceptance of tokenized assets depends on the willingness of traditional financial institutions and investors to embrace new technologies and adapt to changing market dynamics.

Real-World Applications and Case Studies

Several notable developments highlight the growing adoption of asset tokenization:

Real Estate: Companies like Lofty and RealT are pioneering the tokenization of real estate, allowing investors to purchase fractional ownership in properties, thereby lowering the barrier to entry in the real estate market.

Financial Instruments: Financial institutions such as State Street are exploring the tokenization of bonds and money market funds to enhance liquidity and streamline operations.

Asset Management: Major asset managers, including Janus Henderson, are venturing into tokenization to improve efficiency and reduce costs in fund management.

Future Outlook

The trajectory of asset tokenization suggests a transformative impact on global financial markets. While conservative estimates project the tokenized market to reach $2 trillion by 2030, more optimistic forecasts suggest figures as high as $10 trillion, driven by institutional adoption and regulatory support. Integrating blockchain technology into traditional finance is expected to democratize access to various asset classes, enhance liquidity, and foster a more efficient and transparent financial ecosystem.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is asset tokenization?

Asset tokenization is the process of creating digital tokens on a blockchain that represent ownership of real-world assets, enabling fractional ownership and more accessible investment opportunities.

How does tokenization enhance liquidity?

By dividing assets into smaller, tradable units, tokenization allows investors to buy and sell fractions of assets, thereby increasing market liquidity.

What are the risks associated with asset tokenization?

Challenges include regulatory uncertainty, technological vulnerabilities, and the need for broader market adoption.

Which asset classes are being tokenized?

Asset classes such as real estate, bonds, equities, and funds are being tokenized to improve accessibility and efficiency.

How is blockchain technology utilized in tokenization?

Blockchain provides a secure, transparent, and immutable ledger for recording and verifying tokenized asset transactions.

Glossary

Asset Tokenization: The process of converting ownership rights in an asset into digital tokens on a blockchain.

Blockchain: A decentralized digital ledger that records transactions across a network of computers.

Fractional Ownership: Dividing an asset into smaller shares, allowing multiple investors to own a portion.

Liquidity: The ease with which an asset can be bought or sold in the market without affecting its price.

Smart Contracts: Self-executing contracts with the terms directly written into code, facilitating automated and secure agreements.

In conclusion, asset tokenization is poised to revolutionize the financial industry by making investments more accessible, transparent, and efficient. As the market continues