Bitcoin (BTC) reached $84,000 on Monday due to strong market gains across risk assets, pushing up the United States’ stock values. The whole cryptocurrency space reacted well today with a 1.8% increase.

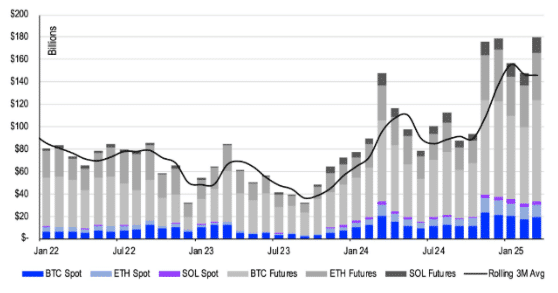

ETH maintained its position above $1900 with a 2.8% surge as major altcoins, including SUI, AAVE, ICP, and NEAR, exceeded 5% increases. The value of SOL tokens increased by 3% with the overall cryptocurrency market, although the debut of SOL futures on the CME did not impact investor sentiment.

Stock Market Volatility May Influence Bitcoin’s Next Move

Ethena’s ENA token gained 7% value after Securitize decided to build a unique blockchain with the company. The organization seeks to connect DeFi technology with common financial systems by creating structures that many people can use.

Investors took more risks because of their positive outlook on stocks, which boosted cryptocurrency value. Investors worry about the impact of general economic problems on their investments. Technical indicators on the S&P 500 chart indicate to LMAX Group’s Joel Kruger that U.S. stock markets may likely correct which could affect the cryptocurrency market.

Kruger explains economic conditions including global trade tensions, U.S. slowdown concerns plus Fed accommodations limits create real fear about stock decline. He indicated that Bitcoin could experience a market decline that brings prices back to their previous $73,000 to $74,000 level in March 2024 before heading upward again.

Coinbase’s David Duong Calls for QT Program End

Financial markets expect the FOMC meeting this week to result in no changes to interest rates because that is what most market participants predict. Experts suggest watching the Fed’s balance sheet resurgence plans but suggest this action to potential investors.

According to David Duong research head at Coinbase Institutional the central bank should either stop or end its QT program because financial stability requires minimum banking reserves to equal 10-11% of Gross Domestic Product. According to Duong in his Monday report bank reserve levels are nearing 10-11% of GDP which signals the Fed might bring its QT program to conclusion.

Crypto Prices Expected to Rebound After Recent Dip

The crypto market holds positive long-term potential according to Duong since investors sold their holdings mainly due to economic uncertainties and difficulty accessing funds. The market could see increased asset prices when his prediction for a sales recovery becomes a reality in the following period.

Duong believed crypto prices would reach a bottom spot during the following weeks before beginning new peak levels in 2019.

Investors expect a prolonged price increase as Bitcoin passes $84,000 and alternative coins resist selloff pressure. Digital assets will continue to depend on the influence of economic conditions as well as stock market fluctuations alongside the Federal Reserve.

Conclusion

The cryptocurrency market keeps gaining positive outlook even with recent price swings because Bitcoin maintains $84,000 support while other digital currencies recover. Experts warn that economic conditions and Fed decisions determine what happens next with cryptocurrencies. The market will likely stabilize and grow when people find it easier to use their money.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why did Bitcoin rise above $84,000?

Strong stock market performance and increased investor confidence boosted Bitcoin and the broader crypto market.

2. Did SOL futures on CME impact Solana’s price?

No, Solana gained 3%, but investor sentiment remained unchanged.

3. What could trigger a crypto correction?

Stock market instability, global trade tensions, and Fed policies may push Bitcoin to $73K-$74K.

4. How does the Fed affect crypto prices?

A pause or end to QT could improve liquidity and support higher prices.

Glossary of Key Terms

Altcoin – Any cryptocurrency other than Bitcoin.

SOL Futures – Contracts speculating on Solana’s price.

DeFi – Blockchain-based financial services without banks.

QT (Quantitative Tightening) – Fed policy reducing market liquidity.

S&P 500 – A key U.S. stock market index.

Risk Assets – Volatile investments like stocks and crypto.