Virtual Protocol (VP) is gaining attention in the crypto market due to its unique technological advancements and growing adoption. Investors are eager to understand how the asset will perform in the coming weeks and years. Looking at the stats, we provide a comprehensive analysis of Virtual Protocol’s price predictions, examining key influencing factors, market trends, and expert insights. Using real-time data, technical analysis, and fundamental research, we aim to offer a reliable forecast for VP’s price trajectory.

Overview Table

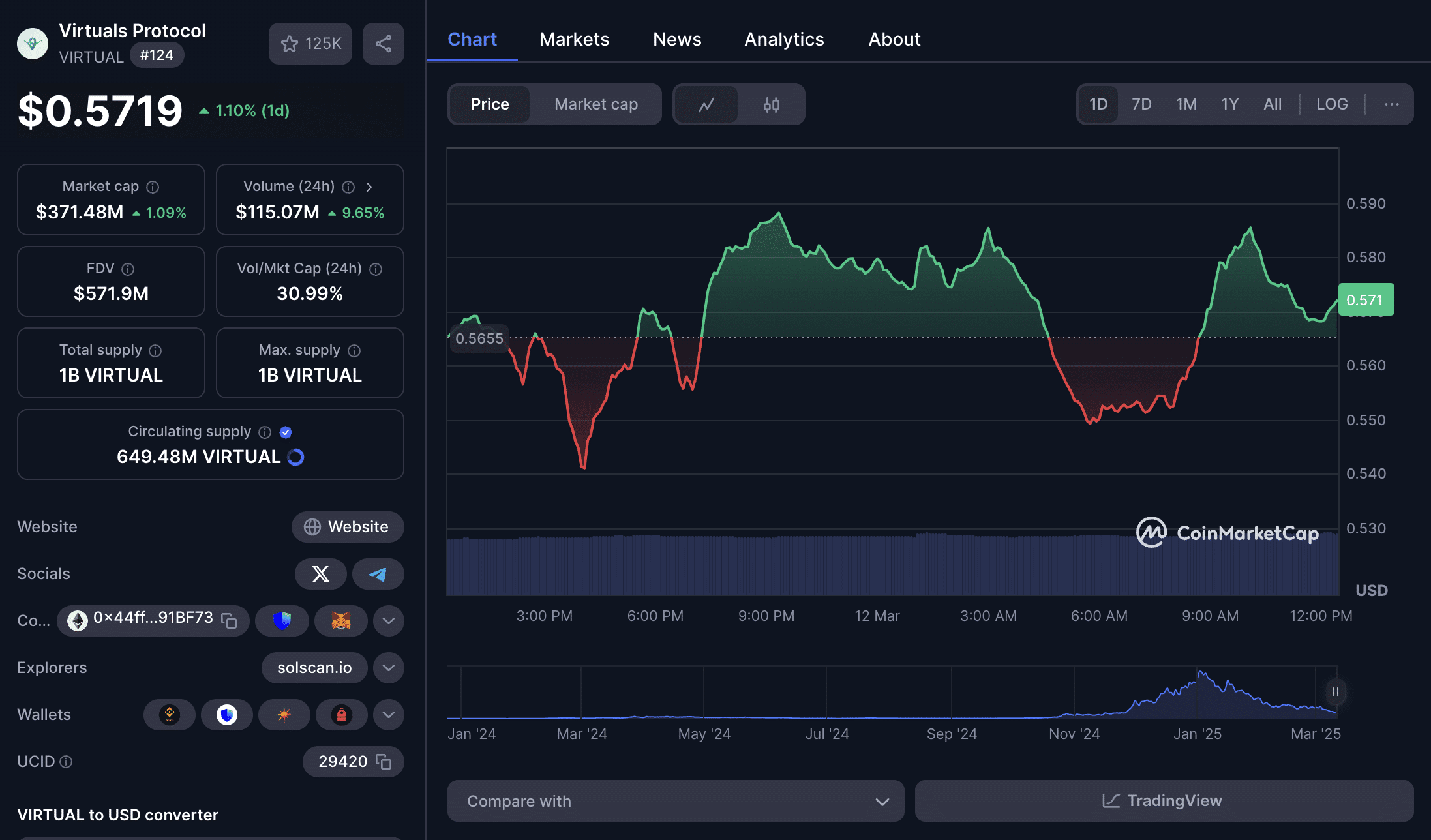

| Factor | Data/Estimate |

| Current Price | $0.5719 |

| Market Cap | $465.95 million |

| 24h Trading Volume | $101.63 million |

| All-Time High | $5.07 |

| All-Time Low | $0.020179 |

| Circulating Supply | 649,414,230.36 VIRTUAL |

What is Virtual Protocol?

Virtual Protocol is a decentralized blockchain platform designed to optimize transaction speeds while maintaining high security and scalability. Unlike traditional blockchain networks, VP integrates an innovative consensus mechanism that reduces congestion and enhances transaction throughput. As an emerging player in the industry, VP has positioned itself as a strong competitor to major platforms like Ethereum and Solana. This section explores the fundamentals of Virtual Protocol, shedding light on its key features, consensus model, and use cases.

Key Features of Virtual Protocol

Virtual Protocol distinguishes itself through several unique attributes. Its high-speed consensus algorithm allows for near-instant transactions with minimal fees, making it a viable option for decentralized applications (dApps) and financial services. Additionally, its smart contract capabilities provide developers with a seamless experience to deploy and manage decentralized applications efficiently. The protocol also focuses on interoperability, enabling cross-chain transactions and fostering a more connected blockchain ecosystem.

Factors Affecting Virtual Protocol’s Price

The price of Virtual Protocol is influenced by a variety of elements, ranging from market sentiment to technological developments. Understanding these factors is crucial for making informed investment decisions.

- Market Demand and Adoption: The increasing adoption of VP by developers and institutions plays a vital role in its price trajectory. A surge in demand for its services, such as smart contract deployment and decentralized finance (DeFi) integrations, can lead to a positive price movement. Partnerships with mainstream companies and institutional endorsements further enhance credibility and market confidence.

- Technological Upgrades: Upgrades and improvements in Virtual Protocol’s network significantly impact its value. Enhancements in security, scalability, and transaction efficiency can attract more users, leading to increased market interest. Any delays or technical challenges in the rollout of these upgrades, however, might negatively affect the price.

- Macroeconomic and Regulatory Factors: Global financial conditions, inflation rates, and governmental regulations have a substantial impact on cryptocurrency prices. Positive regulatory clarity and legal recognition of blockchain projects often boost investor confidence, while restrictive policies can result in a market downturn.

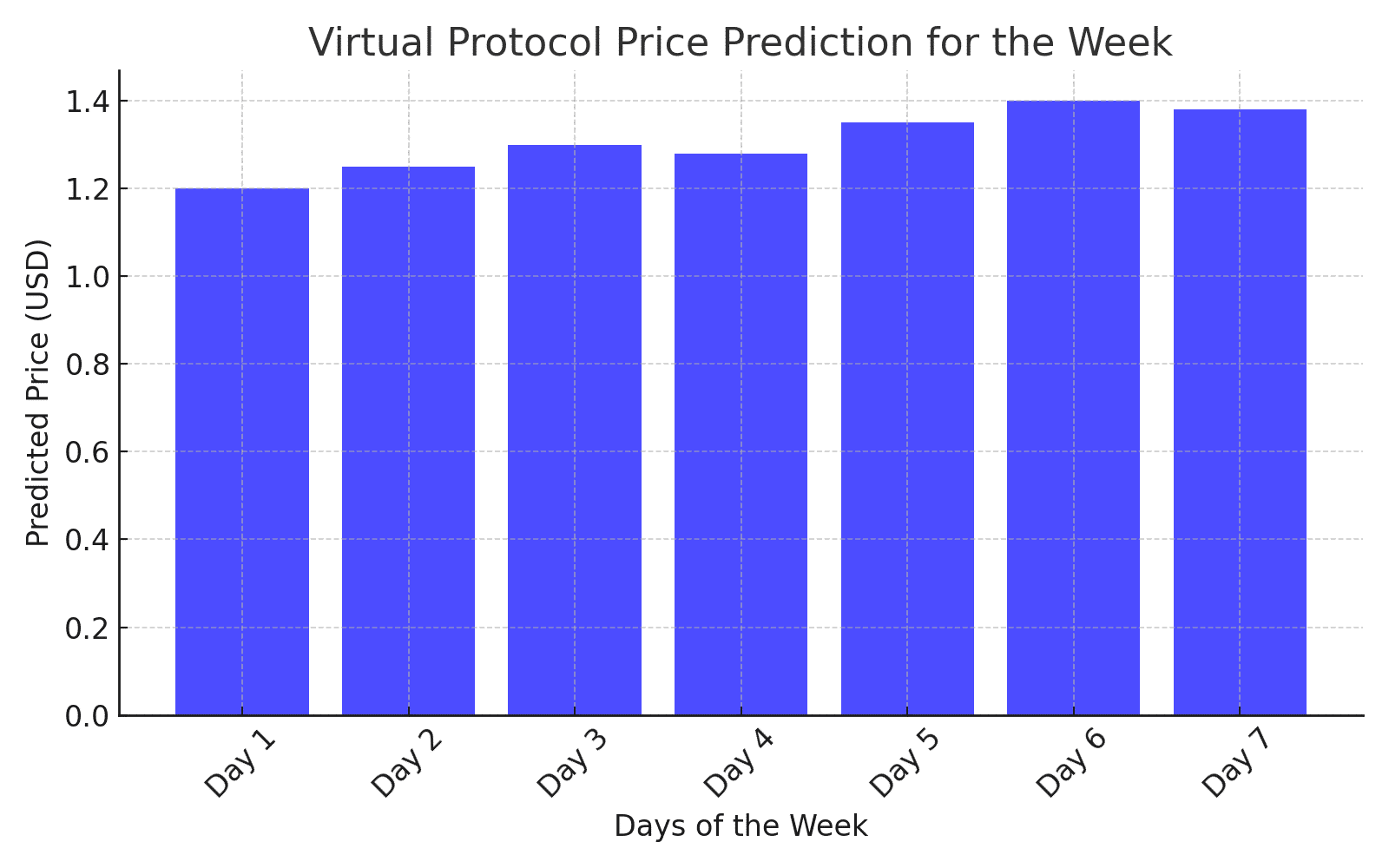

Virtual Protocol Price Prediction for This Week

This week’s price prediction for Virtual Protocol is based on technical indicators, market trends, and historical price movements. Traders and analysts observe various factors, including resistance levels, support zones, and trading volumes, to forecast short-term fluctuations.Market indicators suggest a potential price breakout, given the increasing trading volume and positive investor sentiment. However, external market factors such as Bitcoin’s price movement and macroeconomic events could introduce volatility.

| Date | Predicted Price Range |

| Day 1 | $0.57 – $0.66 |

| Day 2 | $0.63 – $0.67 |

| Day 3 | $0.61 – $0.65 |

| Day 4 | $0.60 – $0.64 |

| Day 5 | $0.62 – $0.66 |

| Day 6 | $0.63 – $0.67 |

| Day 7 | $0.64 – $0.68 |

Given the increasing trading volume and positive investor sentiment, market indicators suggest a potential price breakout. However, external market factors such as Bitcoin’s price movement and macroeconomic events could introduce volatility.

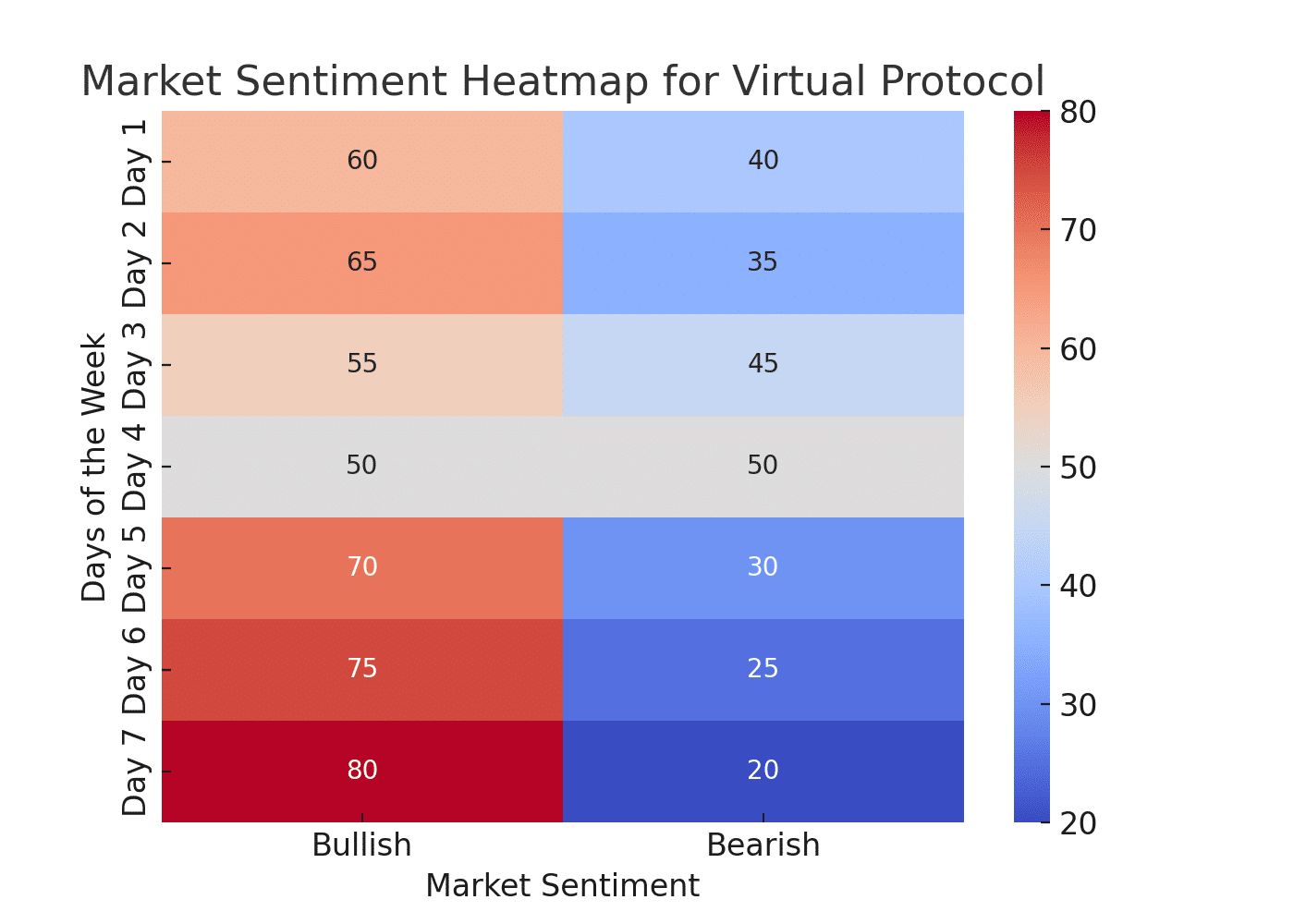

Technical Analysis & Market Sentiment

Technical analysis is crucial in determining Virtual Protocol’s price trends and possible future movements. Experts utilize indicators such as the Relative Strength Index (RSI), Moving Averages (MA), and the Moving Average Convergence Divergence (MACD) to assess the asset’s momentum.

As of March 12, 2025, Virtual Protocol (VIRTUAL) is trading at approximately $1.35, reflecting a significant decline from its all-time high of $5.15 on January 2, 2025.

Technical indicators present a mixed outlook:

- Relative Strength Index (RSI): The 14-day RSI is at 38.22, suggesting that VIRTUAL is approaching oversold territory, which could indicate a potential buying opportunity.

- Moving Averages: VIRTUAL is trading above its 50-day Simple Moving Average (SMA), signaling a possible bullish trend.

Market sentiment has shifted recently:

- Fear & Greed Index: The index currently reads ‘Greed,’ indicating heightened investor optimism.

While Virtual Protocol has experienced a notable price decline, technical indicators and market sentiment suggest potential for stabilization or recovery. Investors should consider these factors alongside their risk tolerance and investment strategies.

Expert Insights on Virtual Protocol’s Future

Industry experts and analysts have weighed in on Virtual Protocol’s potential for growth. Many believe that the project’s technological innovations and strategic partnerships could drive significant price appreciation in the long run.

Bullish Predictions

Some analysts predict that VP could see exponential growth if it continues to improve scalability and adoption. They cite its interoperability features and institutional partnerships as key factors in sustaining long-term value. Additionally, favorable market conditions and increasing demand for decentralized applications could propel its price upwards.

Bearish Risks

On the other hand, skeptics argue that competition from more established blockchain platforms could hinder VP’s growth. Security vulnerabilities, lack of adoption, or regulatory hurdles could also negatively impact its price.

Conclusion

Multiple factors, including technological advancements, market sentiment, and external economic conditions influence Virtual Protocol’s price prediction. As the project continues to develop, its future price trajectory will depend on its ability to scale, attract users, and compete in the evolving blockchain industry. Investors should remain cautious, conduct thorough research, and stay updated with market trends before making investment decisions.

FAQs

1. Is Virtual Protocol a good investment?

Virtual Protocol shows promise due to its innovative technology and adoption, but investors should conduct their own research before investing.

2. What factors influence VP’s price?

Market demand, technological advancements, regulatory developments, and overall crypto market trends all affect VP’s price.

3. How high can Virtual Protocol’s price go?

Predictions vary based on market conditions and adoption, but some analysts foresee long-term growth if the project continues to develop successfully.

4. What are the key support and resistance levels for VIRTUAL?

The immediate support level is at $0.60, with resistance around $0.70. A breach below the support could lead to further declines.

Glossary

RSI (Relative Strength Index): A technical indicator used to determine whether an asset is overbought or oversold.

MACD (Moving Average Convergence Divergence): A momentum indicator that signals changes in an asset’s price trend.

Market Cap: The total value of a cryptocurrency circulating supply.

Moving Averages (MA): Indicators used to analyze price trends over a specific period.

Scalability: The ability of a blockchain network to handle an increasing number of transactions efficiently.

Decentralized Applications (dApps): Applications that operate on a blockchain network without central authority.