Bitcoin’s price recently rebounded to $68,000 after finding support at the $65,500 mark. On-chain data reveals intriguing signs, as wallets holding more than 100 BTC have increased by 297 over the past two weeks, signaling a rise in whale holdings. Here’s a closer look at what this means for the market.

Whale Holdings Hit Record Levels

Following a recent price surge, Bitcoin whale holdings have reached an all-time high, with over 297 new wallets holding 100 BTC or more. This development has fueled bullish sentiment around Bitcoin’s potential. The swift accumulation of BTC by whales suggests growing confidence in the asset class and may even indicate an upcoming market correction.

Bitcoin Whale Holdings Near 670,000 BTC

According to The Bit Journal, total BTC held by these large investors has now exceeded 670,000 BTC, sparking new optimism among Bitcoin enthusiasts. Many BTC investors are hopeful that this accumulation phase could lead to a market rally, as optimism rises across the crypto community.

Key Metrics Show Potential for Price Stability

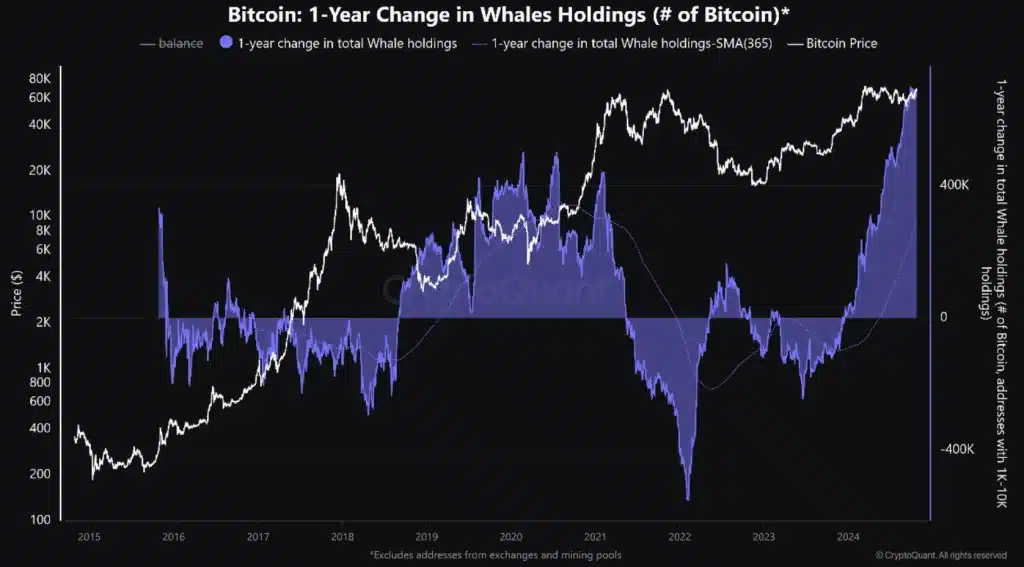

CryptoQuant, a leading crypto analysis site, notes that whale activity often correlates with slight downward adjustments or sideways price movements for BTC. This trend may be a precursor to a mid- to long-term correction. CryptoQuant explains that Bitcoin’s real growth phases often start when whales begin gradually reducing their holdings, leading to a negative percentage change.

Dormant Bitcoin Whales Show Movement

Santiment reports a marked uptick in new Bitcoin whale wallets holding more than 100 BTC, while wallets with less than 100 BTC decreased by 20,629 over the same period. These findings were confirmed by CryptoQuant, which observed that whales often stabilize their positions after market corrections or panic sales, a pattern that seems to be playing out again.

Caution Among Investors as ETF Holdings Grow

With ETF holdings also seeing strong inflows, investors are treading carefully. BlackRock’s BTC ETF, IBIT, has amassed roughly 30,000 BTC over nine consecutive trading sessions, now holding more than 2% of Bitcoin’s circulating supply. With BTC yet to break the $69,000 resistance, market participants remain cautious about the next major price movement.

Despite recent gains, Bitcoin must surpass the $69,000 threshold to continue its upward trajectory. CryptoQuant has cautioned that Bitcoin’s inability to set a new record by the upcoming U.S. presidential election could raise concerns about the current bull cycle’s longevity.

All Eyes on the U.S. Presidential Election

Crypto analyst Justin Bennett highlights three critical factors for investors. Unlike past bullish phases, the current cycle has seen few resets. This deviation suggests that investors should monitor developments closely as they consider new positions in Bitcoin. Given that the U.S. election may drive BTC prices higher, as previously reported by The Bit Journal, anticipation is high.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!