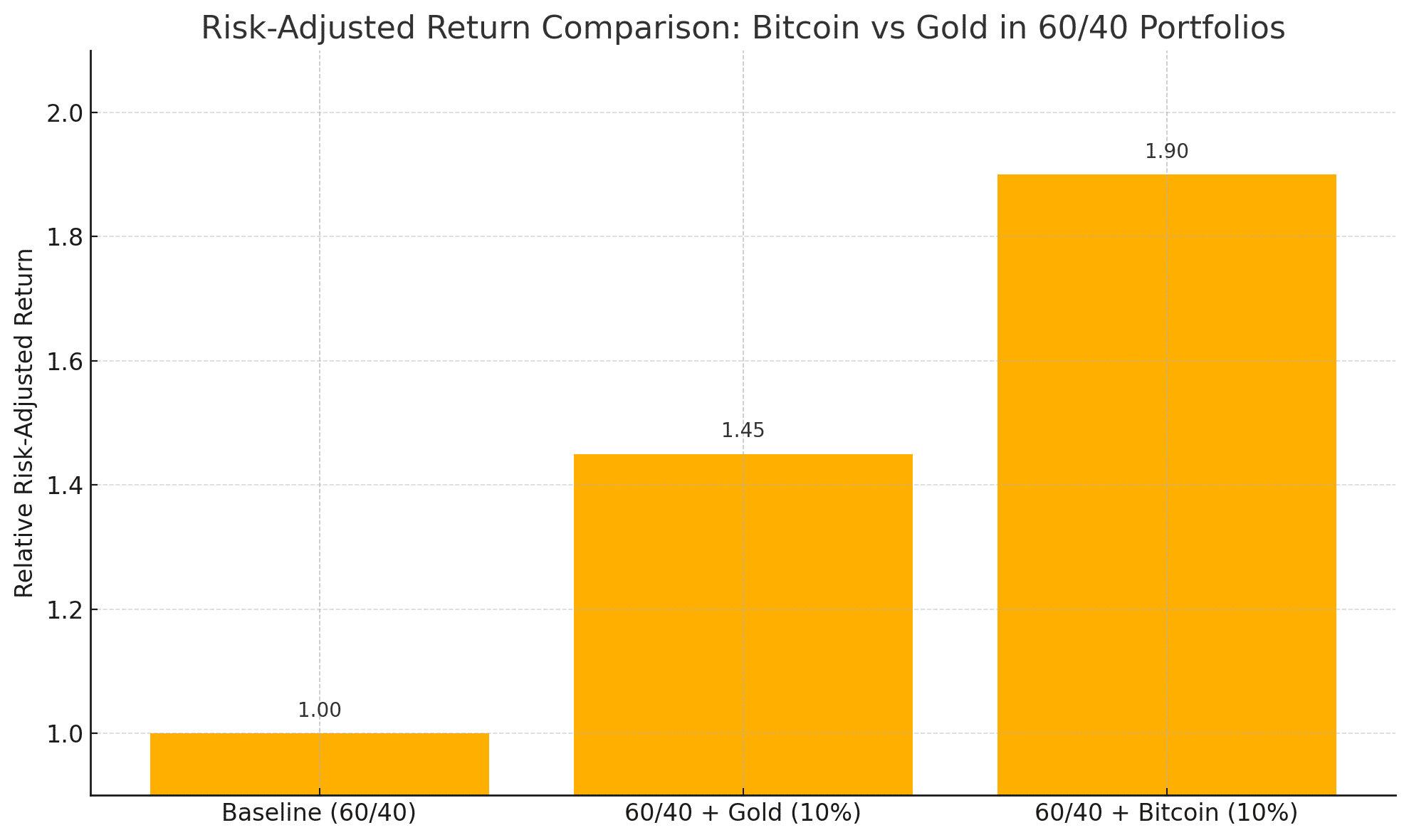

A new wave of financial data has reignited the debate over Bitcoin’s role in modern investment portfolios. According to a recent CryptoSlate report, allocating just 10% of a traditional 60/40 equity-bond portfolio to Bitcoin has historically increased risk-adjusted returns by nearly 90%, outclassing gold by more than 2x in risk efficiency.

This finding challenges long-held conventions around asset allocation. The traditional 60% equities and 40% bonds mix has been a retirement-fund favorite for decades. But now, BTC is disrupting that standard by proving it can enhance returns without skewing risk excessively, when used in moderation.

“Bitcoin’s volatility is often misunderstood, it’s not about minimizing risk, it’s about maximizing return per unit of risk,” noted a Seeking Alpha analyst.

How Bitcoin Compares to Gold and Equities

Data comparisons between portfolios holding gold versus Bitcoin tell a compelling story. Gold, often seen as the go-to hedge, adds only moderate improvements to the risk-return profile. BTC, however, provides a risk-adjusted uplift of 90% when making up 10% of the portfolio.

| Asset Allocation | Risk-Adjusted Return Uplift | Volatility | Diversification Benefit |

|---|---|---|---|

| 60/40 + Bitcoin (10%) | ~+90% | High | Very High |

| 60/40 + Gold (10%) | ~+45% | Medium | Moderate |

| Traditional 60/40 | Baseline | Moderate | Baseline |

While Bitcoin’s inherent volatility remains high, it delivers outsized gains per unit of risk, an essential factor for modern portfolio theory. The Sharpe ratio, which measures risk-adjusted performance, improved dramatically in models that included BTC over a 10-year backtest.

The Institutional Signal Is Clear: Sharpe First, Fear Later

This isn’t just theory. Multiple institutional-grade reports and wealth advisory firms, including Bloomberg Intelligence and Morningstar, have echoed similar sentiments. A Morningstar-backed analysis showed that portfolios with 5% to 15% BTC allocations consistently outperformed gold-heavy portfolios, especially during macroeconomic turbulence.

Moreover, Bitcoin’s correlation to stocks and bonds remains relatively low, providing an effective diversification buffer. In other words, BTC zigged when others zagged—particularly during inflation spikes, rate hikes, and debt ceiling drama.

“We’re not betting on Bitcoin forever outperforming stocks,” said one strategist. “It’s about making the downside sting less for each unit of upside.”

Bitcoin: A Volatile Friend That Delivers

Of course, Bitcoin isn’t without caveats. The crypto asset comes with high drawdown potential, sharp price swings, and event-driven volatility. However, when applied judiciously, these traits are outweighed by the long-term efficiency boost.

Critically, portfolios must be rebalanced regularly to maintain risk discipline. A surging Bitcoin allocation can drift beyond intended exposure without active management, potentially increasing downside during bear markets.

Also, it’s worth noting that these findings are based on historical backtests, primarily from 2013 to 2023. While the trend favors BTC so far, future outcomes may vary significantly based on macro conditions and regulatory factors.

10% Bitcoin: Not Too Big, Not Too Small

For traditional and institutional investors seeking exposure without taking on crypto-native risk, a 10% BTC allocation appears to strike the right balance.

High diversification effect

Maximized Sharpe ratio uplift

Reduced reliance on gold or commodities

Crypto exposure without full commitment

This data-backed strategy makes the case for responsible BTC integration rather than speculative overexposure. With ETFs, custody solutions, and regulatory clarity improving, portfolio managers now have safer entry points to implement such strategies.

Final Thoughts: Bitcoin as the New Age Portfolio Enhancer

From niche asset to risk-return powerhouse, Bitcoin is reshaping how portfolios are constructed. Whether you’re a wealth manager, a retirement planner, or a crypto-curious investor, the evidence is mounting: a small slice of BTC can go a long way in delivering long-term portfolio efficiency.

While volatility and regulatory uncertainty persist, BTC’s potential to amplify traditional investment strategies is no longer theoretical, it’s quantifiable. And if the numbers hold, ignoring Bitcoin in modern asset allocation may soon be seen as a bigger risk than including it.

FAQs

What is a 60/40 portfolio?

A traditional investment portfolio composed of 60% stocks and 40% bonds, aimed at balancing growth and risk.

How much Bitcoin should be allocated to a traditional portfolio?

Studies suggest 5–15% BTC allocation enhances risk-adjusted returns. 10% has shown the most balanced improvement historically.

Is BTC more efficient than gold for portfolios?

Yes. Based on recent backtests, BTC’s risk-adjusted return improvement is nearly double that of gold at the same 10% allocation.

Does BTC make the portfolio more volatile?

Yes, but it also offers significantly higher return potential, making it more efficient per unit of risk—if rebalanced properly.

Glossary of Key Terms

60/40 Portfolio – A balanced investment strategy using 60% equities and 40% fixed income.

Risk-Adjusted Return – A measure of investment return factoring in the amount of risk taken.

Sharpe Ratio – A metric that shows how well an asset compensates investors for the risk taken.

Backtest – The process of testing a strategy using historical data to gauge potential performance.

Volatility – The degree of variation in trading prices over time, indicating risk.