Bitcoin is at the center of attention as its options ETF begins trading today, sparking optimism across the crypto market. This development has strengthened predictions that BTC could potentially hit $200,000 in the near future. Additionally, the resurgence of the U.S. Spot Bitcoin ETF highlights increasing institutional interest, making this a pivotal moment for the cryptocurrency.

Bitcoin Options ETFs Launching Today

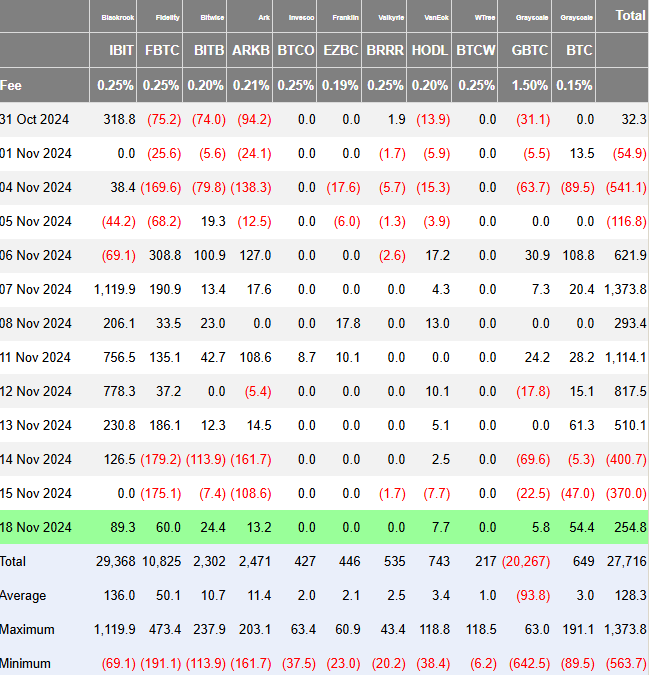

According to Bloomberg, Nasdaq is set to approve options trading for BlackRock’s Bitcoin ETF starting today. This milestone allows investors to trade derivatives based on Bitcoin, the largest cryptocurrency by market cap. The approval follows the success of the U.S. Spot Bitcoin ETF, which recently recorded significant inflows, including $254.8 million on November 18, marking consecutive strong performances last week.

During Bloomberg’s ETF IQ program, Alison Hennessy, Nasdaq ETP Listings Manager, confirmed that the options ETP would begin trading “tomorrow.” She expressed confidence in strong investor interest following its listing on IBIT. Another Nasdaq spokesperson also confirmed the launch, noting it comes shortly after the U.S. Commodity Futures Trading Commission (CFTC) greenlit the Bitcoin Options ETF. This move has fueled widespread optimism in the market.

BTC Price Outlook: $200,000 in Sight?

Bitcoin is currently trading around $91,800, experiencing a daily trading volume surge of 52%, reaching $73.59 billion. The leading cryptocurrency hit a 24-hour high of $92,596, posting a monthly gain of 34%. Additionally, open interest in BTC futures has risen by over 1.5%, signaling strong confidence in the crypto market.

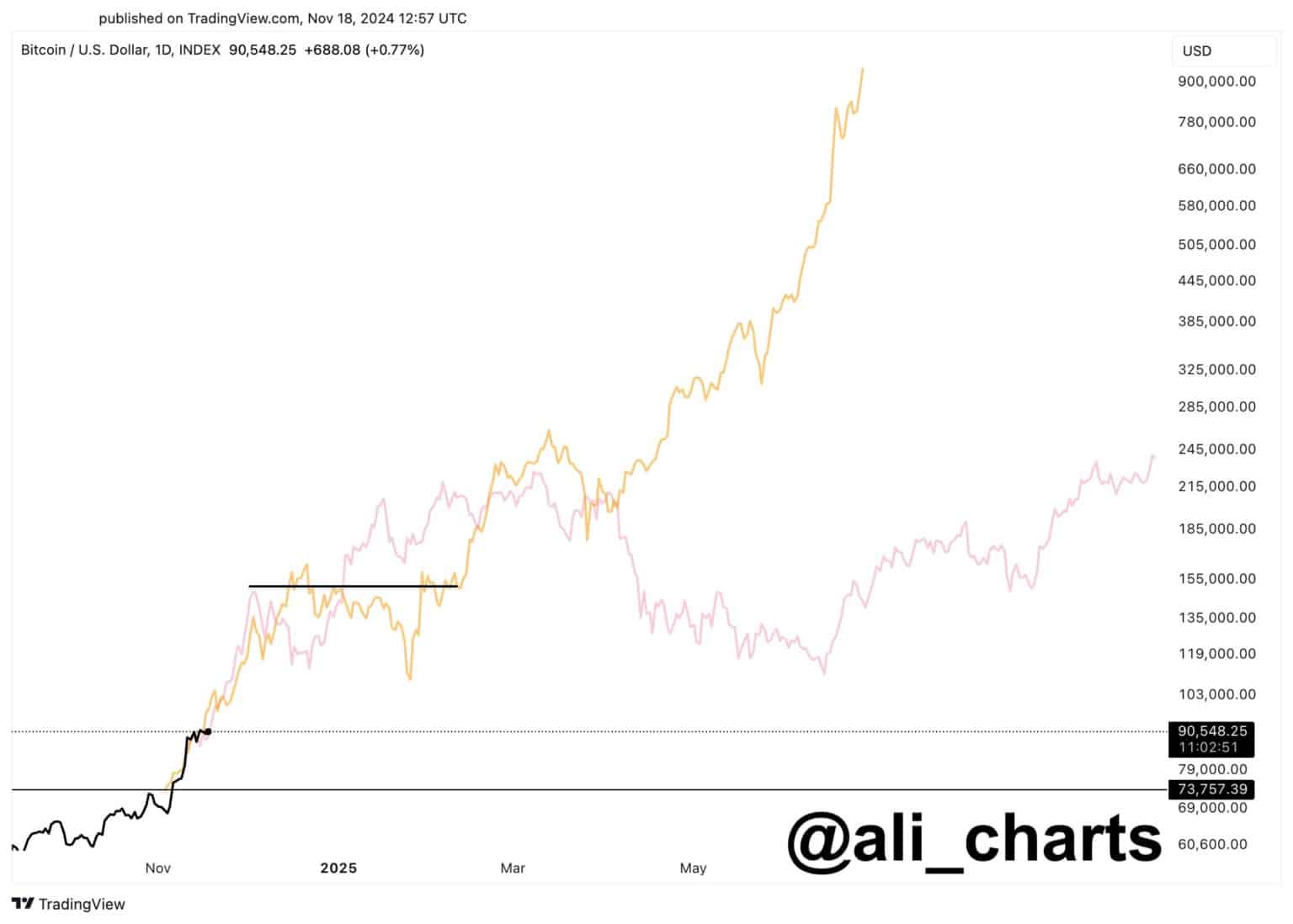

As anticipation builds around the Bitcoin Options ETF, experts believe it could further drive BTC prices. A recent BCA Research report predicts that Bitcoin’s price could reach $200,000 as it continues its march toward $100,000. Prominent crypto analyst Ali Martinez echoed similar sentiments, suggesting Bitcoin could hit $150,000 in the next phase of its market cycle. Likewise, Crypto Rover and Fundstrat’s Tom Lee forecast an imminent rally, with BTC breaking past the $200,000 mark.

Institutional Interest Bolsters Market Optimism

The launch of Bitcoin options ETFs is more than just a milestone; it underscores growing institutional interest in crypto assets. From BlackRock to Nasdaq, major players are increasingly integrating Bitcoin-based products into their offerings. This surge in demand is expected to bolster BTC’s momentum, potentially solidifying its status as a mainstream financial instrument.

Final Thoughts

As Bitcoin enters a critical trading day, all eyes are on its price movement in response to the options ETF launch. With predictions pointing to a historic rally, The Bit Journal believes this is a defining moment for both Bitcoin and the broader cryptocurrency market. Whether BTC will achieve its ambitious targets remains to be seen, but the current developments set a promising stage.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!