Following the recent U.S. presidential election, cryptocurrency markets have surged, spurred by pro-crypto candidate victories that have bolstered confidence in the sector. The boost has sparked price increases across many digital assets, including Bitcoin (BTC), which saw an all-time high of $76,243 in the Asian trading session. The total crypto market cap rose 2.2% in the last 24 hours, now sitting at $2.66 trillion, with Bitcoin currently trading around $75,386.

Long-Term Targets for Bitcoin

Many analysts believe the current bull market for BTC has yet to peak. Crypto analyst Ali Charts suggests that based on historical trends, Bitcoin typically hits a new peak 8-12 months after breaking its previous all-time high. According to these data points, the next major high could arrive between July and November 2025.

Renowned analyst Peter Brandt has also weighed in, predicting that Bitcoin could reach a range of $130,000 to $150,000 by the summer of 2025. This projection is supported by Bitcoin’s Relative Strength Index (RSI), which has consistently held above 70 on both weekly and monthly charts. Matt Hougan, CIO of Bitwise, echoes this bullish sentiment, predicting that this period could mark a “golden age” for cryptocurrencies due to increased adoption and market maturity.

Rising Trading Volumes and Open Interest

Bitcoin’s trading volume and open interest (OI) have reached record levels recently, with open interest surging to $45.41 billion, a 13% rise since November 5. Notably, there is a significant risk of short position liquidations totaling around $1.26 billion, which could create upward pressure on Bitcoin’s price.

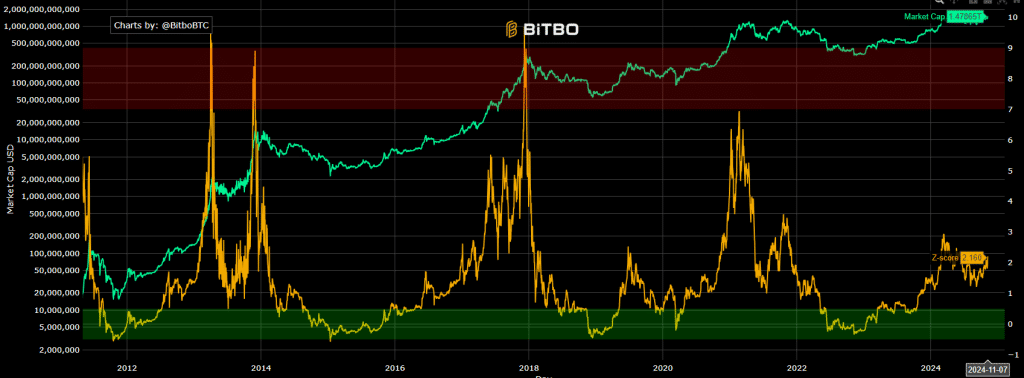

Moreover, Bitcoin’s Market Value to Realized Value (MVRV) ratio stands at 2.16, indicating there is still room for price growth. With the MVRV reaching as high as 2.87 in March, the market may be on the verge of another upward trend.

Can the Market Sustain Its Momentum?

According to market experts, the outlook for Bitcoin and other crypto assets remains positive. However, as The Bit Journal has reported, this market is highly volatile, so investors should proceed cautiously. If conditions hold, Bitcoin may be primed for another major rally in the near future.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!