A recent crypto update on July 10 shows that investment managers REX Shares and Tuttle Capital Management started two new exchange-traded funds (ETFs) that allowed high-conviction Bitcoin traders to double down on short or long positions with 200% exposure to the volatility of Bitcoin prices.

Alex O’Donnell, founder and CEO of Umami Labs, noted that:

“The two funds — the T-REX 2X Long Bitcoin Daily Target ETF (CBOE: BTCL) and the T-REX 2X Inverse Bitcoin Daily Target ETF (CBOE: BTCZ) — do not hold spot Bitcoin directly.” These funds operate on financial derivatives that deliver 2x leverage and inverse exports to BTC.

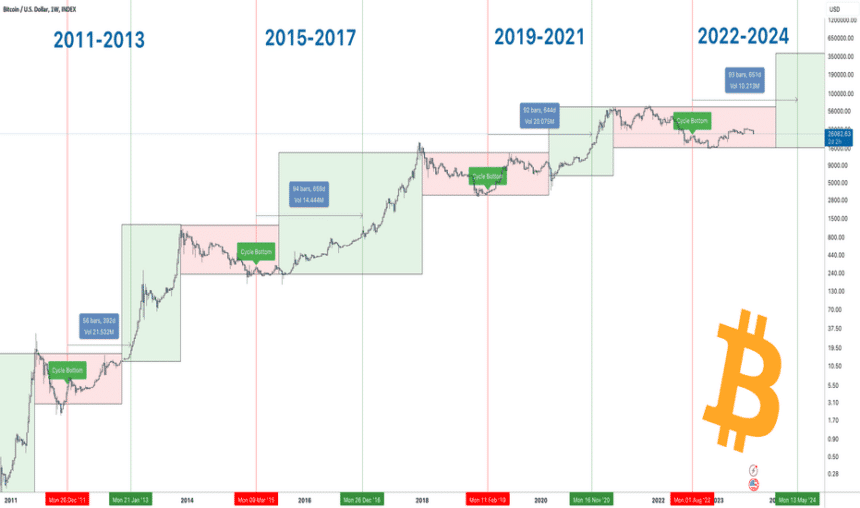

With the present Bitcoin price volatility, experts note a significant interest in Bitcoin ETFs, with white-hot inflows in the past week amid a sharp pullback in spot prices influenced by multi-billion-dollar bitcoin liquidations by Germany’s government and Mt. Gox, the Japanese crypto exchange that has begun repaying users. According to a crypto update by Farside Investors, the inflow of BTC ETFs has been approximately $650 million since July 5.

Leveraged Exposure to the Bitcoin Price Volatility

Based on reports, The ETFs boosted REX Shares’ existing category of “T-REX” products, which include funds offering advantaged exposure to mega-cap tech stocks such as Apple (AAPL), Nvidia (NVDA), and Tesla (TSLA). In June, REX Shares went beyond $5 billion in assets under management (AUM), with its T-REX funds generating upward of $1 billion since last year.

According to a report by crypto trading firm GSR Markets, leveraged ETFs tend to significantly underperform relative to the underlying spot asset and other strategies for gaining leveraged exposure to asset prices. The report listed the challenges of maintaining fixed leverage targets amid Bitcoin price volatility.

The Constant Leverage Trap and Management Fees

Experts point out that the constant leverage trap is a situation whereby funds are forced to buy low and sell high in an attempt to maintain a certain fixed leverage position. This has a gross effect on Bitcoin price volatility. Leveraged ETFs are known for charging high management fees, which adds extra drag to their performance.

Rex Shares’ two new ETFs each charge management fees of 0.95%. That is significantly higher than spot BTC ETFs — such as Franklin Templeton Digital Holdings Trust (EZBC), VanEck Bitcoin Trust (HODL), and iShares Bitcoin Trust (IBIT) that are expected to charge about 0.2%. This fee will only become effective once promotional discounts become ineffective.

Bitcoin traders will be affected by activists influenced by the high targets. This development will also influence the broader market of altcoins like Ethereum (ETH).

Bitcoin ETFs and Market Dynamics

Bitcoin’s price volatility continues to draw high-conviction traders looking to capitalise their profit margins. The introduction of the T-REX 2X Long Bitcoin Daily Target ETF and the T-REX 2X Inverse Bitcoin Daily Target ETF provides these traders with new and improved tools to stabilise their positions in m the ongoing fluctuations in Bitcoin’s (BTC) market.

A recent crypto update notes that there is a wave for these developments, which highlights the growing interest in Bitcoin price volatility as a medium for seamless transactions in the digital asset space. The Bitcoin ETF market is ever-changing, and traders are advised to monitor all these changes and developments closely in order to make well-informed decisions. The market dynamic is expected to influence Ethereum (ETH) and other altcoins.

Conclusion

In conclusion, the launch of these new ETFs provides high-conviction Bitcoin traders with extra opportunities to engage with the Bitcoin price volatility. As the market for Bitcoin ETFs continues to develop, cryptocurrency trading will be shaped by the strategies and products that best navigate the inherent volatility of Bitcoin and enjoy better profit margins. This will create better value for traders who demand bigger profit margins and flexible investment options.

Stay updated with more news from The BIT Journal, on the recent developments in the cryptocurrency space.