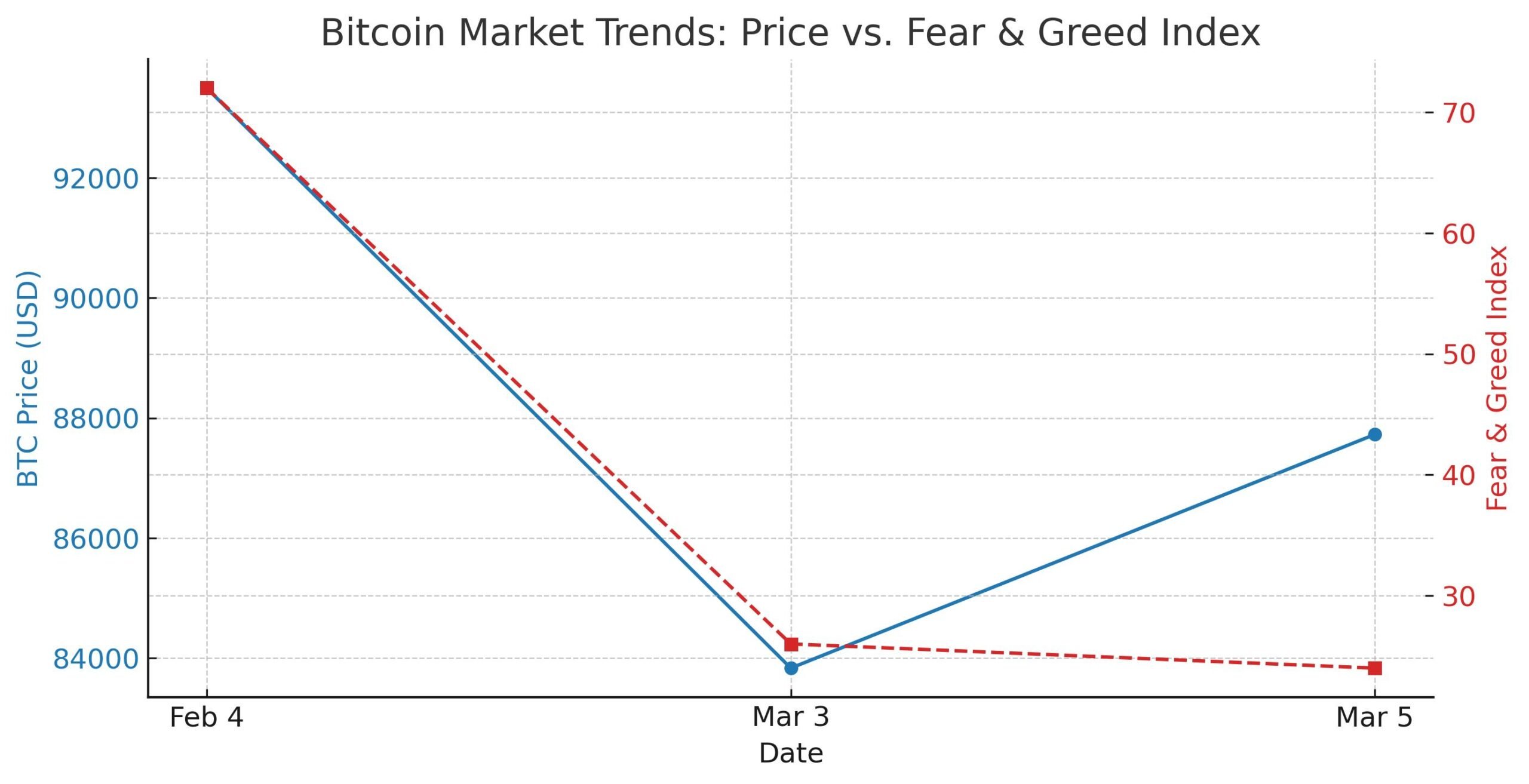

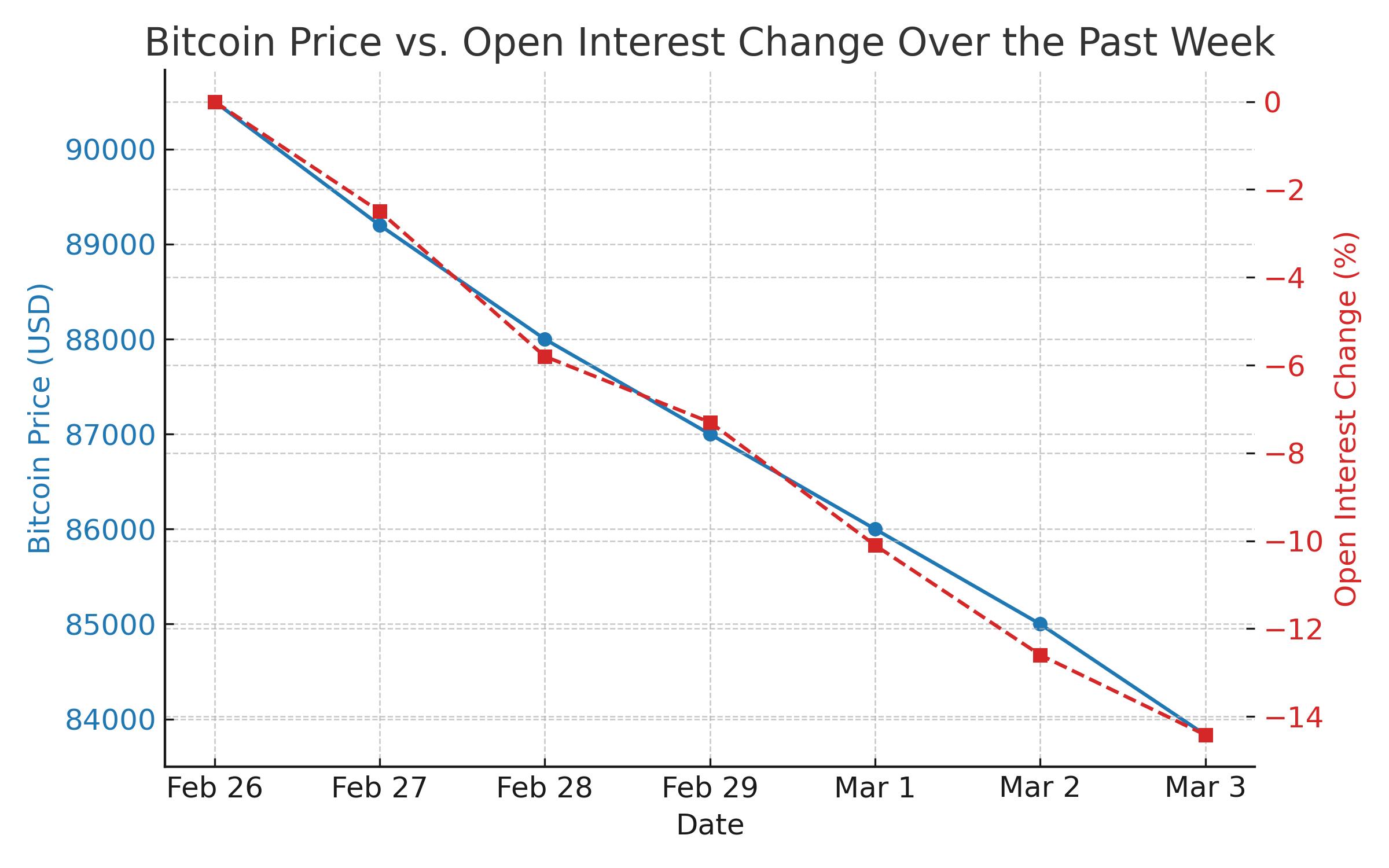

Bitcoin market has been sending mixed signals; while Bitcoin’s price has retreated from recent highs, several key metrics are indicating the market might be setting up for another big move—perhaps to $100K. On March 3, Bitcoin was at $83,833 with a 24 hour trading volume of $68.86 billion. Open Interest (a measure of outstanding derivatives contracts) has dropped 14.42% over the past week and the Crypto Fear & Greed Index is at 24, extreme fear. With technicals showing oversold conditions, some analysts think this could lead to a rebound.

Recent Market Data: A Quick Look

Bitcoin’s recent performance has been volatile. Over the past 24 hours it has been down 8.86% and over the last week 6.27%. With 20 million BTC in circulation, Bitcoin’s market cap is around $1.6 to 1.7 trillion. As at the time of this writing however, BTC price is $87,728.

The big drop in Open Interest is a key factor in the current market sentiment. A 14.42% drop is historically seen before market resets as leveraged positions are liquidated and real buying interest emerges.

Investor sentiment has also shifted dramatically. The Crypto Fear & Greed Index was at 72 on Feb 4, extreme greed. Now it’s at 24, extreme fear. This kind of shift in sentiment has historically preceded buying opportunities as lower prices attract long term investors.

Technical Analysis: Indicators Pointing to a Bounce

Key Indicators

Bitcoin’s chart looks oversold and ready to bounce.

- Bollinger Bands: Bitcoin is at the lower Bollinger Band at $81,606. Trading at this band often means oversold, set up for a bounce.

- Middle Bollinger Band: $92,327. If it can stay above this level it’s a strong bullish sign.

- Money Flow Index (MFI): 25.72. Below 30 means oversold and investors perceive the asset as undervalued.

- Open Interest: 14.42% drop in Open Interest over the past week means reduced speculation and potential market reset.

Technical Indicators Table

| Indicator | Current Value | Implication |

|---|---|---|

| Current Price | $87,728 | Below the key resistance at $94K |

| Open Interest (7D Change) | -14.42% | Suggests reduced speculation; potential market reset |

| Crypto Fear & Greed Index | 24 | Extreme fear; potential for buying opportunities |

| Lower Bollinger Band | ~$81,606 | Indicates oversold conditions |

| Middle Bollinger Band | ~$92,327 | Acts as initial resistance level |

| Money Flow Index (MFI) | 25.72 | Confirms oversold conditions |

If Bitcoin holds $81,606 and attracts buyers, a move to $85K could be the first leg up in a bounce. But if support breaks, further down we may go.

Fundamental Analysis: Beyond the Charts

Investor Sentiment and Market Psychology

Crypto Fear & Greed Index is a key metric to gauge market sentiment. A drop from 72 (extreme greed) to 26 (extreme fear) means investors are panicking now, which has been a precursor to market bounces. When fear is high, contrarian investors see opportunity to buy at lower prices and potentially spark a rebound.

Open Interest and Speculative Activity

14.42% reduction in Bitcoin’s Open Interest means speculative traders are pulling back, which will reduce market volatility. This means leveraged positions will clear and long term investors can step in and stabilize the market.

Macro-Economic Influences

Several macro events will impact Bitcoin’s short term:

- U.S. Consumer Price Index (CPI): Upcoming CPI report will give inflation data. Lower than expected inflation will boost risk on sentiment.

- Federal Reserve Interest Rate Decision: Upcoming rate decision will impact liquidity and investor risk appetite. Dovish will be good for Bitcoin, hawkish will increase volatility.

These macro events will decide if Bitcoin can hold supports and bounce back to higher targets.

Expert Insights: Divergent Views on Bitcoin’s Future

Market Analyst Opinions

Several experts have weighed in on Bitcoin. Pseudonymous trader Rekt Capital said on X (formerly Twitter):

“History suggests the bottom may be in on this downside move, but that doesn’t mean Bitcoin won’t go below $93,500 again. Market needs actual buyers to drive a sustained recovery.”

Axel Adler, well known crypto analyst said while buying activity around $81,000 is good, a clean break above the middle Bollinger Band at $92,327 is key to confirm a trend reversal.

Institutional Perspectives

Kyle Chasse, founder of Master Ventures said institutional buying is necessary for a sustained move. He said:

“Many in the institutional space agree that once the noise clears, Bitcoin will get renewed buying and increased liquidity.”

MVRV Z-Score: A Historical View

MVRV Z-Score is a key metric to measure Bitcoin’s market value relative to its realized value. A cooling down of this score has been a precursor to major up moves. In this case, declining MVRV Z-Score means Bitcoin is in a consolidation phase before the next move up.

Bitcoin To $100K?

Bitcoin’s path to $100K will depend on many factors. Here are a few possible scenarios:

Scenario 1: Bullish Bounce

- Conditions: Real buying interest appears, institutional investors step in and key macro data (CPI, Fed rates) is good.

- Outcome: Bitcoin stabilizes above $81,606, breaks $92,327 and gradually moves to $94K and then $100K.

- Indicators: Recovery in Open Interest, improving MFI and market sentiment shifting from fear to optimism.

Scenario 2: Continued Downside

- Conditions: $81,606 support fails and more liquidations and selling.

- Outcome: Bitcoin could go deeper into corrections, possibly to levels below $81K before a more substantial recovery.

- Indicators: Low sentiment on Fear & Greed Index, declining Open Interest and no institutional buying.

Scenario 3: Sideways

- Conditions: Mixed macro signals and institutional caution leads to consolidation.

- Outcome: Bitcoin will trade in a range, possibly between $83K and $94K until a catalyst triggers a break out.

- Indicators: Stable Open Interest and neutral MVRV Z-Score (neither over nor under valued).

While historical patterns and technicals look good for a bounce, the path to $100K is uncertain. Investors should watch key levels and macro events.

Conclusion

Analysts believe Bitcoin’s current situation with 14.42% drop in Open Interest, extreme fear on Crypto Fear & Greed Index and oversold conditions is a reset. This is tough in the short term but might be setting up for a big bounce.

The interplay of technicals (trading at lower Bollinger Band and depressed MFI) and fundaments (less speculation and upcoming events) is complex. Although Bitcoin is below the critical resistance of $94K, the setup is in place for a gradual move to $100K if real buying interest returns and macro is good. Investors should be careful and watch key support and resistance levels. With big events coming up, the next few weeks will determine if Bitcoin will move back to $100K or not.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What does 14.42% Open Interest drop mean?

Speculators are unwinding and the market is resetting and long term buying opportunities are opening up.

2. Why is Crypto Fear & Greed Index important?

It measures overall market sentiment. 24 is ‘extreme fear, which has been a setup for a bounce when the market is oversold.

3. What are the key levels for Bitcoin to recover?

Support at $81,606 and resistance at $92,327 and $94K. ‘Break above these levels could mean higher prices.

4. What macro events will affect Bitcoin’s price?

The upcoming U.S. CPI release and Federal Reserve interest rate decision can influence investor sentiment and liquidity, either allowing a rebound or extending the correction.

5. Can Bitcoin reach $100K?

While history and techs provide a ‘base for hope, $100K will require sustained buying, good news and institutional involvement.

Glossary

Open Interest: Total ‘outstanding derivative contracts that have not been settled, representing market activity.

Crypto Fear & Greed Index: A ‘measure of market sentiment, where lower is fear and higher is greed.

Bollinger Bands: A technical indicator’ that uses standard deviations to show overbought/oversold conditions relative to a moving average.

Money Flow Index (MFI): A volume ‘weighted oscillator that measures buying and selling pressure.

MVRV Z-Score: A valuation metric that compares ‘Bitcoin’s market cap to its realized cap to gauge market cycles.

Institutional Investors: Large entities like hedge’ funds, pension funds or banks that invest big in the market.

Market Reset: A phase where ‘excessive positions get liquidated, often leading to a healthier market for long term buyers.

References

Legal Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are inherently volatile and carry significant ‘risk. Readers should conduct their own research or consult a professional advisor before making any investment decisions.