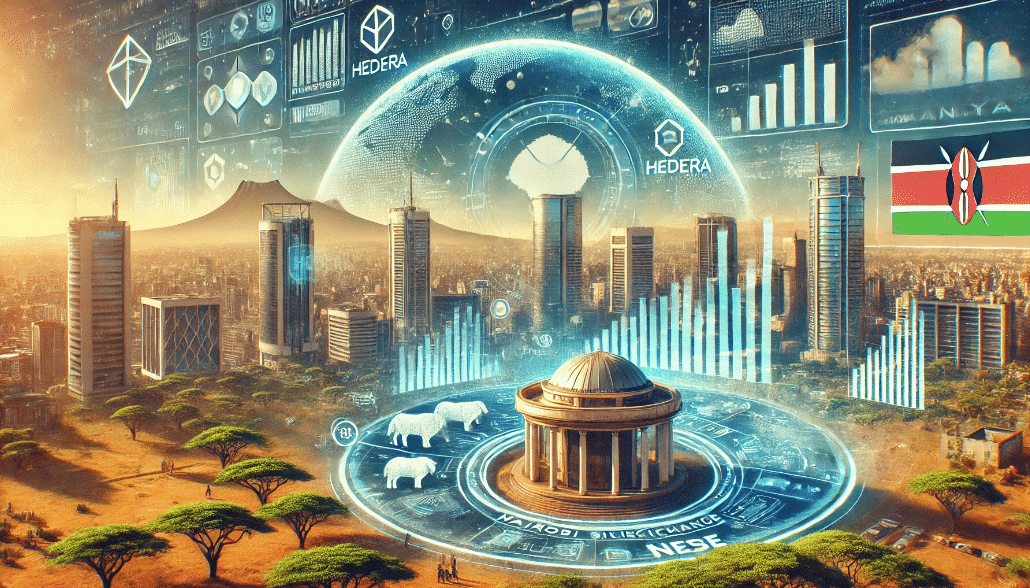

The Nairobi Securities Exchange (NSE) has partnered with Hedera to boost African tokenization efforts. The collaboration represents a major stride toward modernizing the continent’s financial infrastructure and adopting blockchain technology in African markets. They are becoming the 32nd member of the Hedera Council and paving the way for secure, efficient digital asset trading.

Under the partnership, the parties intend to open new investment routes while offering a regulated market for digital assets. The NSE, through utilizing Hedera’s advanced DLT, will help enable secure trading and improve the transparency of the trading process. By offering tokenized assets, NSE is looking to expand the opportunities for investors in Africa and beyond.

‘This aligns with the NSE’s strategic goals of developing market infrastructure,’ said Frank Mwiti, the NSE’s chief executive. Tokenization, he stresses, can change the African industries because of the potential for innovation and different financial products in the region. Through Hedera’s technology, NSE plans to deliver on increasing demand for cutting-edge, compliant financial solutions.

Hedera and NSE Boost Cross-Border Trading Access

As part of the joint initiative, the NSE designated the Hedera node as a tokenized securities and digital asset exchange. Hedera’s USDC-backed platform will support secure remittances, while the infrastructure will facilitate cross-border transactions. This will make it easy for local and international investors to engage in efficient and secure asset trading.

Beyond enhancing cross-border financial transactions, the platform is meant to make it easier for African businesses to access solutions to capital. Opening up global liquidity channels will allow African investors to be more part of the worldwide economy. Through this partnership, local businesses have cost-effective financing options for economic growth and market expansion.

Co-Chair of Hedera’s Membership Committee, Bill Miller, stresses that the NSE’s market expertise in empowering the adoption of digital assets in Africa is invaluable. Kenya’s economic position as one of Sub-Saharan Africa’s largest economies, as well as its potential for Hedera’s technology, he points out. As a strategic alliance, we believe that blockchain innovations can support Africa’s blossoming digital transformation through this alliance.

NSE-Hedera Alliance Expands Digital Investment Options

The union between NSE and Hedera is a natural consolidation, as financial inclusion is the region’s direction towards digital assets. This tokenization will help African investors buy products such as stablecoins like USDC that protect against inflation. The platform is trying to attract domestic and international investors with increased demand for digital assets.

The NSE expects tokenization to open investment opportunities and make finance more inclusive in Africa in line with its mandate. The pairing will offer faster, secure investment and investment protection services through efficient and regulated asset exchanges. Investors in the region looking for stability in their currency in exchange for stability will find this approach attractive.

By integrating with Hedera, the NSE will boost investment options and scale up the overall existing financial infrastructure. Running this with high regulatory standards and security is expected to foster confidence from local investors. This will enable the NSE to meet the requirement for providing innovative financial services to a broad range of investors.

Africa Embraces Stablecoins Amid Economic Volatility

Between the two, the NSE partnership with Hedera shows that Africa’s demand for digital assets has grown exponentially in recent times. As reported by Korea Blockchain Week, Africa is growing significantly in its adoption of digital currency. Stablecoins attract many users for their role as a haven in the sea of high economic volatility and unstable local currencies.

You can see this trend with Trust Wallet, with millions of weekly downloads and consistent user growth in Africa. But as the digital economy grows in Africa, the demand for a secure and regulated trading environment becomes essential. Based on the Hedera platform, the NSE looks to address these needs by creating a trusted framework for digital asset exchange.

Africa’s adoption of tokenized assets is propelled by the need for secure, easily accessible financial products. The NSE, with 12.65 billion in market capitalization and 100 million transactions per day, is in a position to drive this transformation. Hedera’s high-performance technology will be a catalyst for providing a robust platform that will support the growth requirements of African markets in the future.

This collaboration between NSE and Hedera steps up the global tokenization technology expansion. The NSE can use Hedera’s DLT capabilities to offer seamless asset exchange and attract new regional investors. This partnership will facilitate Africa’s integration into the global digital economy, leading to easy investment and financial growth.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!