Large holders of cryptocurrency, also known as crypto whales, have been really busy this week. On-chain trackers reported several big moves involving Bitcoin and popular altcoins. Bitcoin saw multiple billion-dollar transactions.

Institutions and early adopters are adjusting their positions and these whale moves are tied to price action. How do these whale transactions impact the market? How do these moves affect the broader crypto rally.

Big Bitcoin Whale Transactions

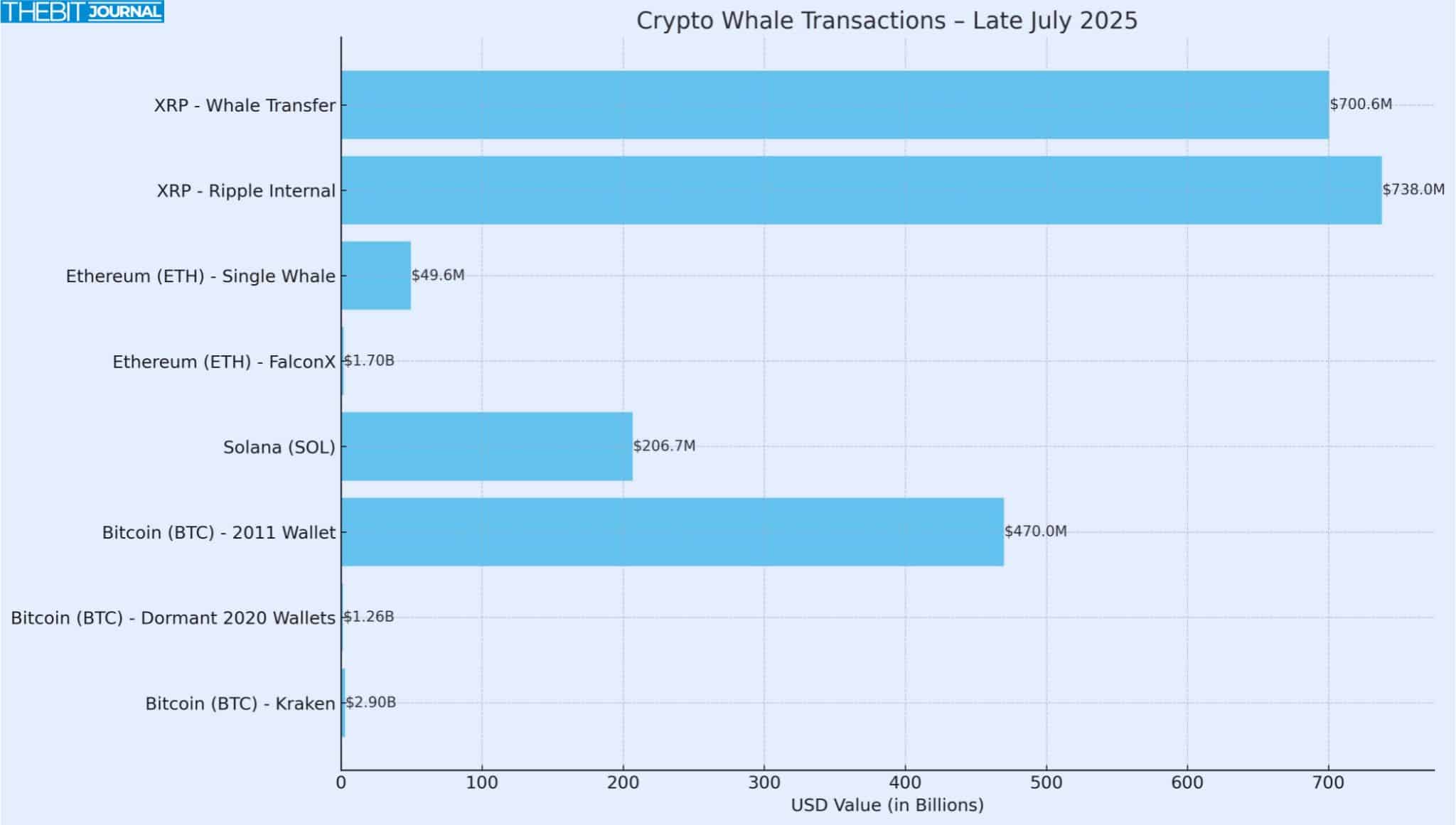

A major whale withdrawal took place on the Kraken exchange recently. Over 25,400 BTC estimated at about $2.9B left Kraken in less than 2 hours; 7 identical 4,166 BTC ($495M each) transactions. These large withdrawals suggest an institution might be accumulating Bitcoin into cold storage.

Again, three long dormant wallets; all first funded in Dec. 2020, emptied their balances, moving 10,603 BTC ($1.26B) to new addresses. Lookonchain, the on-chain analytics platform noted all three were linked to the same address, but who controls them is unknown.

A wallet which has been dormant since 2011 woke up with a 3,962 BTC ($470M) transfer. Whale Alert and Lookonchain confirmed a small test transfer from that wallet. These reactivations often trigger trader speculation about upcoming sales.

Ethereum Whale Activity

Ethereum whales were active too. On-chain analytics show seven new wallets accumulated a total of 466,253 ETH ($1.7 billion) over the past few days. Most of these coins came from institutional platform FalconX, so it was a coordinated accumulation. One wallet reportedly received 138,345 ETH ($505M) in five days. Reports also shared that a single whale also bought about $49.56 million worth of ETH.

Institutions buying this much is considered bullish for Ethereum. They lock up supply, potentially reducing sell-side pressure and often coincide with increasing trading volumes. Analysts say sustained ETH accumulation at this scale can support the price and possibly trigger rallies if spot price breaks above key resistance.

Other Crypto Whale Moves (Solana, XRP)

Whale Alert recorded about 1,080,000 SOL ($206.7M) leaving Coinbase in two consecutive transactions. This rapid movement (540k SOL + 539,999 SOL) in under 5 minutes suggests a single large entity was accumulating SOL off-exchange. As a result, market reports shared that SOL rallied 8% that day.

The XRP ledger also saw two big transfers. About 210.7M XRP ($738M) was moved between Ripple-owned wallets; a routine internal transfer according to analysts. More interestingly, a whale shift of 200,000,005 XRP ($700.6M) between unknown wallets was flagged. The latter transfer was tweeted by Whale Alert and caused a price drop. XRP’s price went from $3.45 to $3.02.

Many in the community thought the big move might be profit-taking by a dormant holder.

These altcoin whale moves may not be as big as Bitcoin’s but they still get attention. Solana’s whale driven volume helped sustain the price increase, while the XRP transfer shook investor confidenceas seen by the short term price drop).

Summarized Table for this Week’s Crypto Whale Transfers

These moves highlight how a few holders can shuffle extremely large sums:

| Asset (Crypto) | Amount | USD Value | Reference |

| Bitcoin (BTC) | 25,400 BTC | $2.9 billion | Withdrawn from Kraken in 43 min. |

| 10,603 BTC | $1.26 billion | Moved from three 2020-vintage dormant wallets. | |

| 3,962 BTC | $470 million | 14-year-old wallet reactivated. | |

| Solana (SOL) | 1,079,999 SOL | $206.7 million | Large withdrawals from Coinbase. |

| Ethereum (ETH) | — | $49.56 million | Whale purchase of ETH. |

| 466,253 ETH | $1.7 billion | 7 new wallets amassed ETH (from FalconX). | |

| XRP | 210,669,117 XRP | $738 million | Transferred within Ripple-controlled wallets. |

| 200,000,005 XRP | $700.6 million | Moved to a new anonymous wallet. |

Whale Transactions Impact

Whale transactions often precede or amplify market moves. This week’s data shows both bullish and bearish effects:

Big withdrawals from exchanges (e.g. Kraken and Coinbase) tend to mean accumulation. Indeed, Bitcoin’s price reclaimed $120,000+ after the Kraken outflows. Large ETH purchases removed millions of coins from circulation and helped prop up Ethereum’s up trend. When whales move coins to cold wallets or private custody, it means big players have strong long term confidence.

Conversely, sudden whale sales or transfers can trigger profit taking or volatility. The previously reported sale of 80,000 BTC from a Satoshi-era wallet had traders on edge, but it didn’t kill the rally. The recent XRP whale move bumped XRP’s price down 15%. These moves create temporary excess supply or panic and often follow by market corrections.

In the end, this week’s crypto whale activity contributed to the volatility. Bitcoin’s short term dips this week (hit $116K) happened during these big transfers. But prices bounced back quickly, so experts say the market is digesting the whale moves without panic. Traders and analysts are treating these whale moves as signals; accumulating on whales’ bullish cues and hedging during big sell offs.

Crypto whales are liquidity drivers. When they buy, they absorb supply and can spark rallies. When they sell, they flood the market and can kill rallies. In this current crypto bull run partly driven by ETF inflows and macro factors, the whale transactions are defining the support/resistance levels and institutional interest.

Conclusion

Based on the latest research, crypto whale activity this week had a noticeable impact on the market. Bitcoin saw big sells and big buys and the price bounced around $118–120K. Ethereum whales were net buyers and added over $1.8 billion in new ETH to private wallets.

Altcoins like Solana and XRP had whale driven volume. In general, whale buys are supporting the current bull run by reducing supply and big transfers and sells are injecting short term volatility. Traders are advised to keep an eye on these on-chain signals: they often precede market moves, for better or for worse. Read about the recent notable crypto whale move.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

In late July 2025, crypto whales made headlines again. Big holders moved $2–3B worth of Bitcoin out of exchanges. Ethereum saw fresh whale buys of $1.7B. On-chain trackers also caught big Solana and Ripple transfers, 1.08M SOL and 210M XRP. Overall, this week’s whale activity showed strong institutional interest and added volatility to the crypto market.

FAQs

What is a “crypto whale”?

A crypto whale is an individual or entity holding a very large amount of cryptocurrency.

Why do whales move coins after years of dormancy?

Reasons vary. It might be profit-taking (selling at higher prices), portfolio rebalancing, moving to exchanges to sell, or simply consolidating into new addresses.

How do whale moves affect regular investors?

Whale transactions can move market sentiment and prices. A big sell-off might scare small investors into selling (causing a dip). Conversely, whale accumulation (buying big) can drive prices up and encourage retail traders. Smart traders follow whale moves as a clue for the market. But always do your own research and don’t follow the whales.

Glossary

Whale: A very large cryptocurrency holder or wallet. Often any entity holding thousands of coins.

On-Chain Analytics: Tools that analyze blockchain transaction data to track addresses and flows.

Dormant Wallet: A blockchain address that has held coins without moving them for a long time (e.g. years).

Cold Wallet: A secure storage for crypto offline (hardware wallets, paper wallets), used for long-term holding.

All-Time High (ATH): The highest price ever reached by a cryptocurrency. Bitcoin hit a new ATH (~$123K) in July 2025.

Profit-Taking: Selling an asset after it has risen in price to lock in gains, often done by whales when prices peak.

Sources

Whale_alert

Tradingview

Blockchain.news

Binance.com

Icobench.com

Rootdata.com

Ainvest.com