In the unpredictable world of cryptocurrency, even the slightest movements can have significant consequences. Recently, over $1.7 billion worth of dormant Bitcoin was suddenly transferred, sparking discussions about what this could mean for the market. The sudden reactivation of these long-held assets has left many wondering if this signals potential selling pressure, or if it is just another routine event in Bitcoin’s volatile history.

Dormant Bitcoin Comes to Life

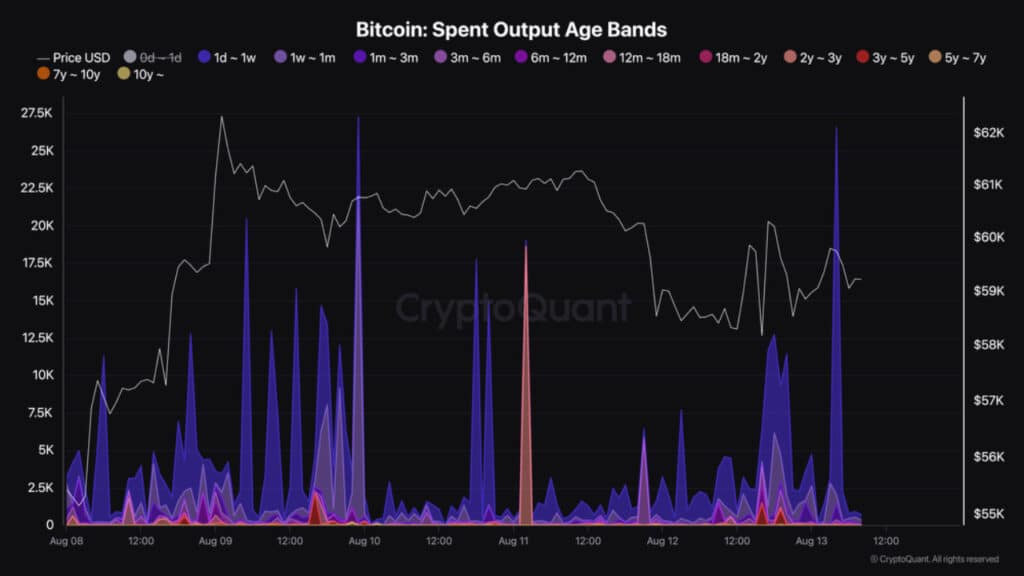

Imagine a hidden stash of valuable coins, untouched for years, suddenly being brought to the surface. This is essentially what happened between August 11 and 12 when more than 29,000 Bitcoins, worth over $1.7 billion, were moved after being dormant for up to three years. The cryptocurrency community took notice of this activity, considering its possible implications.

This wasn’t a minor transaction. According to a report by CryptoQuant, a well-known onchain analysis platform, a pseudonymous analyst named XBTManager noted that on August 11, a total of 18,536 Bitcoins, which had been inactive for two to three years, were moved onchain. Additionally, 5,684 Bitcoins that had been dormant for three to six months were also transferred on the same day. The next day, August 12, another 4,986 Bitcoins, inactive for three to twelve months, and 2,394 Bitcoins that hadn’t been moved in three to five years, were also reactivated.

Possible Implications for the Market

What does this sudden movement of long-inactive Bitcoin mean? XBTManager explained that when such dormant Bitcoin is suddenly transferred, it often indicates a potential increase in selling pressure. “When these long-dormant Bitcoin are moved, it often leads to increased selling pressure in the market. In times of low liquidity, this can create downward pressure on prices, which could potentially continue,” the analyst stated.

The concern is that with Bitcoin’s liquidity not being as strong as during more optimistic market phases, this sudden influx of Bitcoin back into circulation could lead to a drop in prices. Investors and traders are closely monitoring the market, contemplating whether this movement is a precursor to a more significant downturn or just another event in Bitcoin’s turbulent journey.

A More Optimistic Outlook

Despite concerns about increased selling pressure, not all analysts are pessimistic. Tony Sycamore, an analyst at IG Markets, provided a more hopeful perspective. In an investment note shared on August 14, he suggested that Bitcoin might be poised for recovery, despite the recent $500 billion crypto market sell-off that occurred on August 5 and 6.

Sycamore pointed out that Bitcoin had benefited from an improvement in overall risk sentiment and a decrease in US yields following lower-than-expected Producer Price Index data from the United States. With the market having cleared out some excess following a false break below $50,000, Sycamore believes Bitcoin could see gains, potentially reaching trend channel resistance near $70,000 in the near future.

Market Sentiment: A Mix of Uncertainty and Accumulation

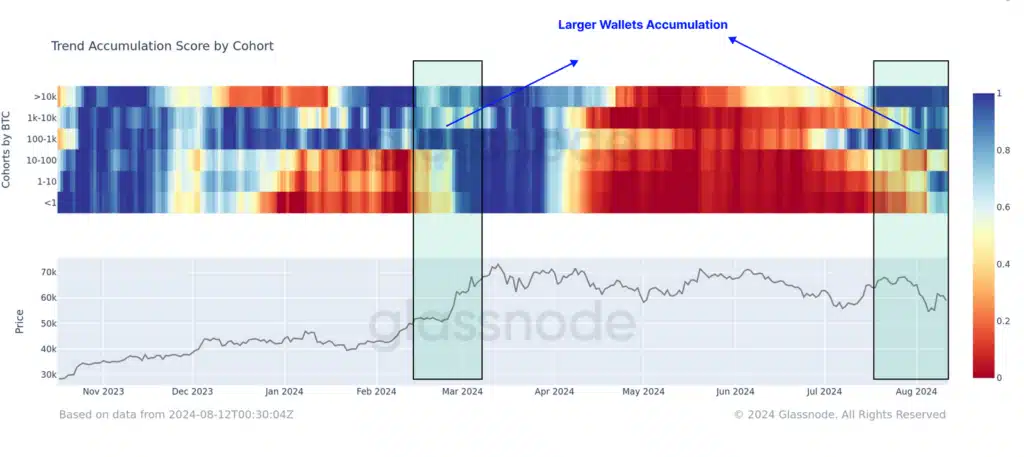

The market remains a complex environment filled with mixed signals. In a report released on August 13, analysts at Glassnode highlighted the current market’s uncertain nature. They noted that after Bitcoin hit a new all-time high in March, the market entered a period of extensive “supply distribution,” meaning that Bitcoin was being moved frequently as market participants responded to price changes.

However, Glassnode’s analysts have observed a shift in this trend. “Over the last few weeks, this trend is showing early signs of reversing, particularly for the largest wallet sizes which are often associated with ETFs. These large wallets appear to be returning to a regime of accumulation,” they wrote.

In a market where even small changes can have large effects, this shift towards accumulation could indicate growing confidence among significant Bitcoin holders. Despite the prevailing uncertainty, the analysts concluded that there is an “undertone of high conviction” among Bitcoin holders.

Dormant Bitcoin: Possible Repercussions

The recent movement of dormant Bitcoin has certainly caught the attention of the crypto community, leading to speculation about whether a market correction is imminent or if this is just another typical fluctuation. While some analysts warn of potential downward pressure, others see a path to recovery, supported by improving macroeconomic conditions.

Ultimately, the Bitcoin market remains as unpredictable as ever. Whether this recent activity leads to a downturn or becomes another chapter in Bitcoin’s unpredictable history depends on various factors. For now, the market remains on edge, waiting to see where Bitcoin’s path will lead.