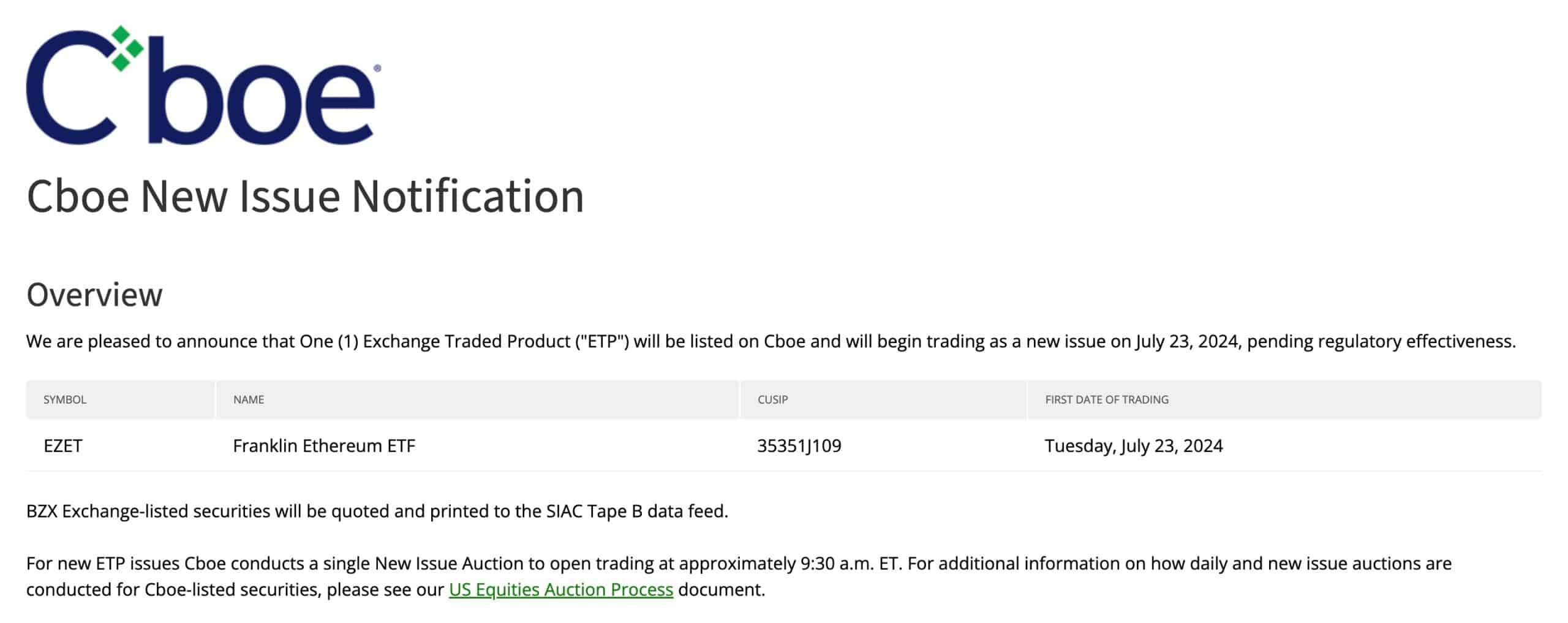

The Chicago Board Options Exchange (CBOE) has confirmed that five spot Ethereum exchange-traded funds (ETFs) will begin trading on July 23. This Ethereum ETF launch marks a significant milestone in the mainstream adoption of digital assets and is expected to attract substantial investor interest.

The announcement was made on July 19, with the CBOE stating that these spot Ethereum ETFs are scheduled to trade “pending regulatory effectiveness.” According to reports, the U.S. Securities and Exchange Commission (SEC) had already approved rule changes on May 23, permitting the listing of several spot Ether ETFs . However, each fund issuer’s S-1 registration statement still required individual approval from the regulator before the new products could begin trading.

The Ethereum ETF Launch: Who’s Involved?

The five spot Ethereum ETFs set to launch include:

- 21Shares Core Ethereum ETF

- Fidelity Ethereum Fund

- Invesco Galaxy Ethereum ETF

- VanEck Ethereum ETF

- Franklin Ethereum ETF

To gain an early market advantage, virtually all of these issuers have announced plans to waive or discount fees temporarily to compete for market share once the products begin trading. Industry analysts believe that this Ethereum ETF launch could attract billions in net inflows in the months following the launch.

Market Implications of the Ethereum ETF Launch

This Ethereum ETF launch has the potential to create a significant impact on the market. According to Cointelegraph, increased demand from institutions looking to fill their exchange-traded funds with Ether might trigger a supply crunch. The Ethereum Exchange Reserve, a metric tracking the amount of Ether available for purchase on cryptocurrency exchanges, is currently at multi-year lows. This scarcity could drive up the price of Ether, especially in the face of heightened demand.

The Kaiko report also highlighted Ether’s 1% market depth, suggesting that lower liquidity might lead to increased price volatility. This could propel Ether’s price higher and potentially see it outperform Bitcoin in percentage terms.

Predicting the Impact: Expert Opinions on the Ethereum ETF Launch

Tom Dunleavy, an institutional analyst, believes that inflows into Ethereum ETFs could hit $10 billion this year, with capital flows reaching as much as $1 billion per month. “I expect a very positive price impact, sending us to new all-time highs by early Q4,” Dunleavy told newsmen.

Matt Hougan, Chief Investment Officer at Bitwise, echoed similar sentiments. According to Hougan, Ethereum stakers are less likely to sell their assets compared to Bitcoin holders. He noted that 28% of Ether’s supply is already sequestered, citing increased withdrawals from exchanges to cold storage as an indication that Ether holders expect future price appreciation.

In an effort to attract investors, the ETH ETF issuers are employing aggressive strategies, including the temporary waiving or discounting of fees. These competitive maneuvers aim to capitalize on the Ethereum ETF launch and secure a significant share of the market. This race to attract investors could yield a surge in net inflows, further bolstering the price and market presence of Ethereum.

Potential Supply Crunch and Price Volatility

The upcoming Ethereum ETF launch is likely to create a high-demand scenario, potentially leading to a supply crunch. As noted, the Ethereum Exchange Reserve is at multi-year lows, which means there is limited supply available on cryptocurrency exchanges. This scarcity, combined with the anticipated demand from institutional investors, could result in substantial price increases.

Additionally, with Ether’s current low market depth, any significant demand could amplify price volatility. This could create an environment where Ether’s price spikes substantially, driven by the surge in buying pressure from both retail and institutional investors.

Conclusion: A Pivotal Moment for Ethereum

The Ethereum ETF launch on July 23 is set to be a pivotal moment for the cryptocurrency market. With the SEC’s approval and the listing of five prominent spot Ethereum ETFs on the CBOE, the stage is set for increased mainstream adoption and substantial market activity.

Experts predict significant inflows, a potential supply crunch, and increased price volatility, factors that could see Ether reaching new all-time highs by the end of the year. As the market eagerly awaits this Ethereum ETF launch, all eyes will be on the trading debut on July 23 and the subsequent market movements.

For now, investors and analysts alike are watching closely, ready to capitalize on what promises to be one of the most significant developments in the cryptocurrency market in recent years. The Ethereum ETF launch on July 23 marks a new chapter in digital asset trading, one that could define the future trajectory of Ethereum and its position in the financial world. The BIT Journal will be providing continuous updates and in-depth analysis as this pivotal event unfolds, ensuring readers are well-informed on every development.