In the first quarter of 2025, Solana charged ahead with a headline-grabbing meme coin surge, capturing more than half of all decentralized exchange (DEX) volume. But while traders rode the hype, Ethereum quietly retook its position as crypto’s economic anchor, less flash, more substance.

Now that the meme coin glitter is fading, the debate heats up: Ethereum vs Solana—who’s really winning in 2025?

Solana’s Q1 Explosion: Volume, Meme coins, and Momentum

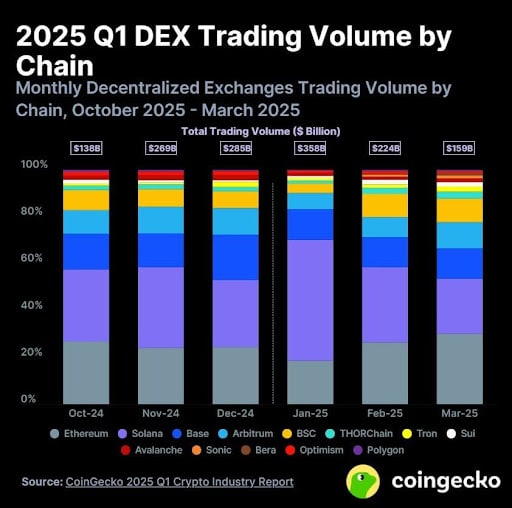

The numbers were quite impossible to ignore. In January 2025 alone, Solana had $258.74 billion in DEX trading volume, a market-leading 45.83% share, according to KuCoin’s January report. The surge was largely driven by the meme coin craze, mostly the politically charged Official Trump [TRUMP] token that put Solana in the spotlight.

This wasn’t a one-off. Solana held the DEX volume crown for five straight months into February thanks to an ecosystem built for speed and simplicity. Its Proof of History (PoH) consensus allows for 65,000 transactions per second with fees in the fraction of a cent. With wallets like Phantom integrating DEXs directly, the chain was a hot spot for fast-paced retail traders.

From a volume perspective, Solana looked unstoppable. Even new entrants on the block like Sonic [S] and Berachain [BERA] were gaining traction, and Ethereum dipped below 20% DEX share for the first time.

Ethereum’s Quiet Comeback: Depth Over Noise

However, Solana’s volume didn’t tell the whole story. As March rolled around, Ethereum started to claw back and finished Q1 with a 30.1% DEX market share, a comeback that was more than just a number. It was a return to fundamentals. What really sets Ethereum apart isn’t trading spikes, but deep, long-term capital concentration.

As of late Q1, Ethereum had $203 billion in total app capital, nearly 10x Solana’s $22.9 billion and more than Tron’s $70 billion. That capital wasn’t just parked in speculative tokens. It powered stablecoins, real-world asset (RWA) tokenization, blue-chip NFTs, and the core infrastructure of DeFi lending and derivatives protocols.

Ethereum’s value proposition in 2025 is clear: not just high throughput, but high trust. It’s the protocol that institutional players, developers, and regulatory-compliant projects continue to build on.

The Price Picture: Two Giants, One Tough Quarter

The real kicker in the Ethereum vs Solana story this year is the market performance. Despite ‘its foundation strength, Ethereum has underperformed Solana in 2025, down around 56% year-to-date, ‘compared to Solana’s 40% drop.

As of April 18, ‘Ethereum was at $1,586.49, while Solana was at $135.11. The gap grew wider in March when Solana started to recover, while Ethereum stayed flat.

Solana’s appeal to retail traders, NFT minters and memecoin gamblers is showing up in relative strength even in a risk off market.

But price action doesn’t define value. Both are bruised, but Solana is less battered, not necessarily better.

DEX Volume vs. Economic Activity: What Really Matters?

So who’s winning? If the question is about speed, low fees and short term user activity, Solana has the upper hand. Its DEX volume dominance in Q1 peaking at over 52% in January shows it’s a retail favorite.

But if we measure long term value, developer activity, capital retention and real world utility Ethereum is in a league of its own. It’s home to the largest share of: Tokenized RWAs, Stablecoin TVL (total value locked), Blue chip DeFi platforms, Layer-2 scaling innovations like Arbitrum and Optimism

Even in a bear market, Ethereum’s stack is still evolving. Developers are working on EIP-4844 (Proto-Danksharding) to enhance Layer-2 scalability a move to keep Ethereum competitive on cost and performance.

Final Verdict: Ethereum Holds the Crown, Solana Holds the Spotlight

Solana had a great quarter. Its meme coin-fueled rally and efficient architecture got it to the top of the DEX volume charts. But volume doesn’t equal value. Ethereum’s dominance in real app capital, infrastructure reliability and developer preference makes it the backbone of DeFi even if it’s out of favor with speculators.

So, in 2025, the Ethereum vs Solana debate comes down to this: Do you value short-term growth or long-term credibility?

Solana may be faster. But Ethereum is the protocol the crypto economy relies on when the hype dies down.

FAQs

What’s driving Solana’s growth in DEX market share?

Solana’s growth is due to its high transaction throughput, low fees and appeal to retail traders during the meme coin trading surge of early 2025.

Why is Ethereum still more valuable despite lower DEX volume?

Ethereum has the largest app capital base, powering real-world asset tokenization, DeFi, and stablecoin ecosystems, so it’s more significant in structure.

Has Solana replaced Ethereum in developer activity?

No. Solana has gained traction but Ethereum still leads in developer count, GitHub contributions and Layer-2 innovation.

Which blockchain is more resilient to bear markets?

Ethereum’s ecosystem depth gives it more long term resilience, but Solana’s relative price strength in Q1 2025 shows growing robustness.

Will Ethereum regain DEX volume dominance later in 2025?

If upcoming scaling upgrades lower fees and improve UX, Ethereum may recapture significant DEX volume, especially as institutional projects ramp up.

Glossary of Key Terms

DEX (Decentralized Exchange) – A crypto trading platform without intermediaries.

App Capital – Total value of assets in applications built on a blockchain.

PoH (Proof of History) – Solana’s consensus mechanism for fast transaction ordering.

RWA (Real-World Assets) – Physical assets tokenized for on-chain representation.

EIP-4844 – Proposed Ethereum upgrade to increase efficiency and lower costs on Layer-2.

Soruces

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments are volatile and may result in loss. Please consult a licensed financial advisor before investing.