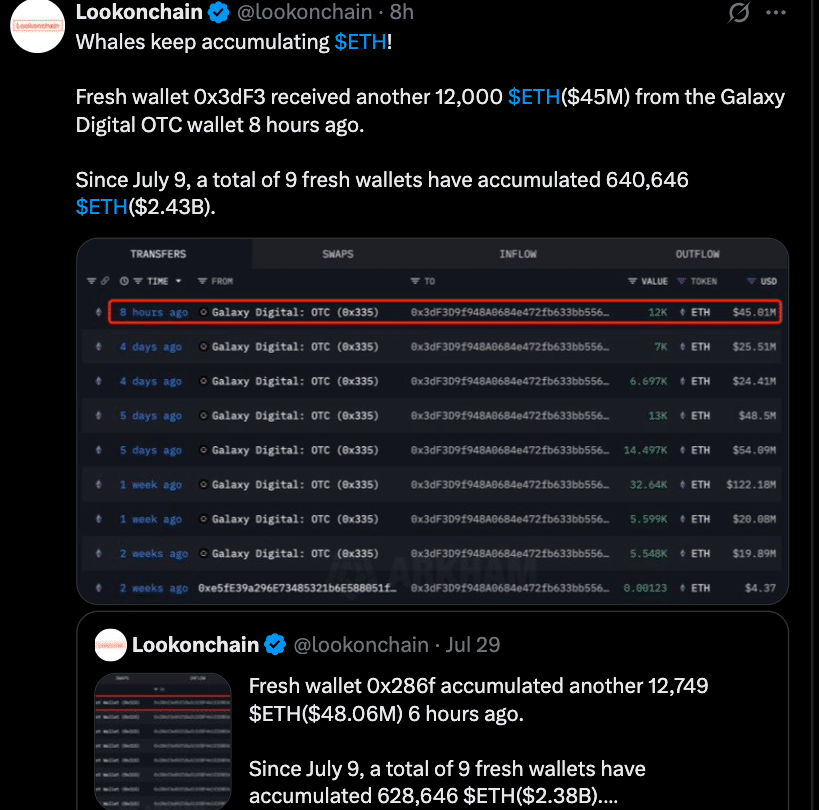

According to the latest market reports, Ethereum is seeing a massive $ETH accumulation surge as 9 new wallets have collectively accumulated 640,646 ETH worth around $2.43 billion since July 9.

Noting the most recent, one of those wallets (0x286f) just added another 12,000 ETH (about $45 million). Data from Lookonchain and other blockchain analytics platforms suggests these large purchases are institutional players or whales positioning for long term.

Positioning or Reserve Buildup? What it Means for $ETH Market

While wallet identities are anonymous, the size, timing and coordination of these buys point to deliberate positioning. On-chain analysts think wallets funded by intermediaries like Kraken, FalconX, Galaxy Digital and Binance are used to separate capital allocations, preserve privacy or prepare $ETH reserves for institutional treasury strategies. This is in line with the trend of institutions quietly accumulating $ETH for future deployment.

Accumulation at this scale can put pressure on supply and reduce liquidity. Ethereum has already seen parallel buying from whale clusters: wallets holding between 1,000 to 10,000 $ETH have reportedly increased their holdings to 14.3 million ETH, now 18.6% of the total supply. Sources note this is the strongest whale accumulation since 2018.

Such accumulation often precedes big moves, especially in tight ranges or when inflows meet ETF driven institutional momentum.

Other On-Chain Indicators Support Accumulation

More data shows Ethereum is still attracting capital. US-based ETH ETFs have seen $1 billion in net inflows by mid-June, and the network has seen 1 million new wallets per week on average, up from previous years, according to Santiment. Whale clusters have also been accumulating, with addresses holding over 10,000 ETH increasing their balances by 9% YTD, indicating growing institutional conviction.

Market Outlook: Signals are Bullish

$ETH is accumulating as prices are consolidating around $3,800 and facing resistance at $4,000. Analysts say sustained whale accumulation increases the chances of a breakout. If this continues with ETF inflows and network growth, $ETH might retest or break $4,000.

But if accumulation stops or profit taking kicks in, momentum might slow and $ETH could stay range-bound around $3,200. Counting daily whale buying and ETF flows will be important to see if this $ETH accumulation surge is a short-term blip or a long-term trend.

Conclusion

Base on the latest research, this ETH accumulation surge revealed nine new wallets have accumulated 640,646 ETH ($2.43 billion) since July 9, including one address that bought 12,000 ETH ($45 million) most recently. Analysts think this is deliberate buying, in line with institutional behavior, and on-chain signals of conviction.

Additional data also shows major whale cohorts and ETH ETFs are accumulating. Price is near resistance, but supply is decreasing and network is growing. This ETH accumulation surge means renewed investor confidence, though charts and flows must align for a breakout.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Nine new wallets have bought 640,646 ETH ($2.43 billion) since July 9, including one address that bought 12,000 ETH ($45 million). This is buying, not selling. Institutional behavior, on-chain signals of conviction. Major whale cohorts and ETH ETFs are accumulating. Price is at resistance, but supply is decreasing and the network is growing.

FAQs

What is an $ETH accumulation surge?

New wallets buying a lot of $ETH, nine new addresses have bought over $2.43 billion worth of $ETH since July 9.

Why are new wallets buying large $ETH positions?

They’re likely institutional players using new addresses to compartmentalize large reserves or investments.

How rare is this kind of buying?

This is the most intense whale accumulation in years, similar to 2017-18 market cycles.

What does it mean for the Ethereum price?

Large accumulation reduces $ETH available for trading, which can tighten supply and set up a price breakout.

What could stop this accumulation?

Whales selling, inflows stopping or broader market weakness could slow down momentum and keep ETH range-bound.

Glossary

Fresh wallet – New or dormant on-chain account.

Whale cohort – Addresses holding 1,000-10,000 ETH.

ETF inflows – Net inflows into Ethereum ETFs.

On-chain analytics – Analysis of public blockchain data.