Shiba Inu (SHIB) has captured significant attention. As of January 27, 2025, SHIB is trading at approximately $0.00001994, reflecting a 10% decline over the past 24 hours. This downturn comes amid a notable surge in the token’s burn rate, which has seen an increase of over 600% recently.

Burn Rate Surge: A Double-Edged Sword

The Shiba Inu community has been actively engaging in token burning—a process that permanently removes tokens from circulation to reduce supply and potentially increase value. On January 22, 2025, the burn rate spiked by over 600%, with approximately 3.24 million SHIB tokens sent to a null address.

Despite this aggressive reduction in supply, the anticipated positive impact on Shiba Inu’s price has yet to materialize.

“While the burn mechanism is designed to create scarcity, its immediate effect on price isn’t always guaranteed,” notes crypto analyst Jane Doe. “Market dynamics are influenced by a multitude of factors beyond just token supply.”

Technical Patterns Signal Potential Risks

Technical analysis reveals that SHIB is approaching a ‘death cross’—a bearish indicator where the 50-day moving average crosses below the 200-day moving average. Historically, such patterns have preceded significant price declines. Additionally, the formation of a double-top pattern, characterized by two peaks and a neckline, suggests a potential further downside if key support levels are breached.

“Traders should exercise caution,” advises market strategist John Smith. “These patterns often signal upcoming bearish trends, and it’s crucial to monitor support levels closely.”

Comparative Performance: Shiba Inu vs. Emerging Meme Coins

While Shiba Inu has been a prominent player in the meme coin space, recent data indicates a shift in investor interest toward newer entrants. Tokens like Official Trump and Fartcoin have seen daily trading volumes of $4.56 billion and $226 million, respectively, surpassing SHIB’s $160 million.

“The meme coin market is rapidly evolving,” observes crypto market analyst Sarah Lee. “Investors are exploring new opportunities, leading to a redistribution of capital within the space.”

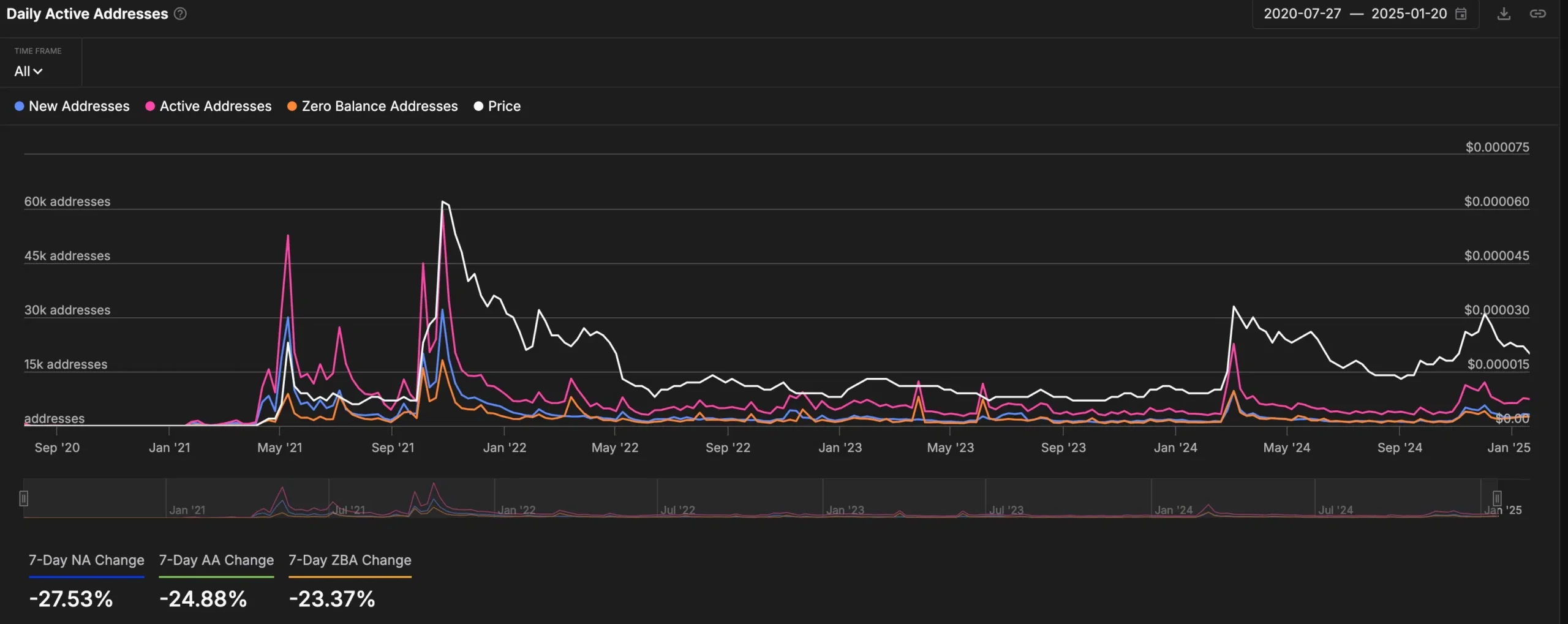

Declining Network Activity Raises Concerns

Beyond price movements, SHIB’s network activity has shown signs of decline. According to IntoTheBlock, new and active addresses have decreased by 27.5% and 25% in the past week, respectively. Furthermore, the daily SHIB burn rate has dropped by nearly 94%, with only 656,468 tokens burned recently.

“A decrease in network engagement can be a red flag,” warns blockchain researcher Emily Clark. “Sustained growth relies on active participation from the community and continuous development efforts.”

Conclusion

Shiba Inu finds itself at a critical juncture. While efforts to reduce token supply through increased burn rates are evident, the immediate impact on price remains uncertain. Technical indicators suggest potential bearish trends, and the emergence of new meme coins is intensifying competition. For SHIB to regain momentum, a renewed focus on community engagement, technological development, and strategic initiatives will be essential.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What is a ‘death cross’ in cryptocurrency trading?

A ‘death cross’ occurs when a short-term moving average, typically the 50-day, crosses below a long-term moving average, such as the 200-day. This pattern is often interpreted as a bearish signal, indicating the potential for further price declines.

How does token burning affect a cryptocurrency’s value?

Token burning reduces the circulating supply of a cryptocurrency by permanently removing tokens from circulation. While this can create scarcity and potentially increase value, other factors like demand, market sentiment, and overall utility also play significant roles.

Why is SHIB’s declining network activity concerning?

Decreased network activity, such as fewer active addresses and lower transaction volumes, can indicate waning interest or engagement from the community. Sustained growth and stability often depend on active participation and ongoing development within the network.

What steps can the Shiba Inu community take to enhance SHIB’s prospects?

To bolster SHIB’s future, the community can focus on increasing engagement through initiatives like educational campaigns, fostering technological advancements such as developing new features or applications, and exploring strategic partnerships to enhance the token’s utility and appeal.