DeFi yield farming and decentralized lending are changing the way people generate passive income and engage with financial institutions, eliminating the need for banks and intermediaries.

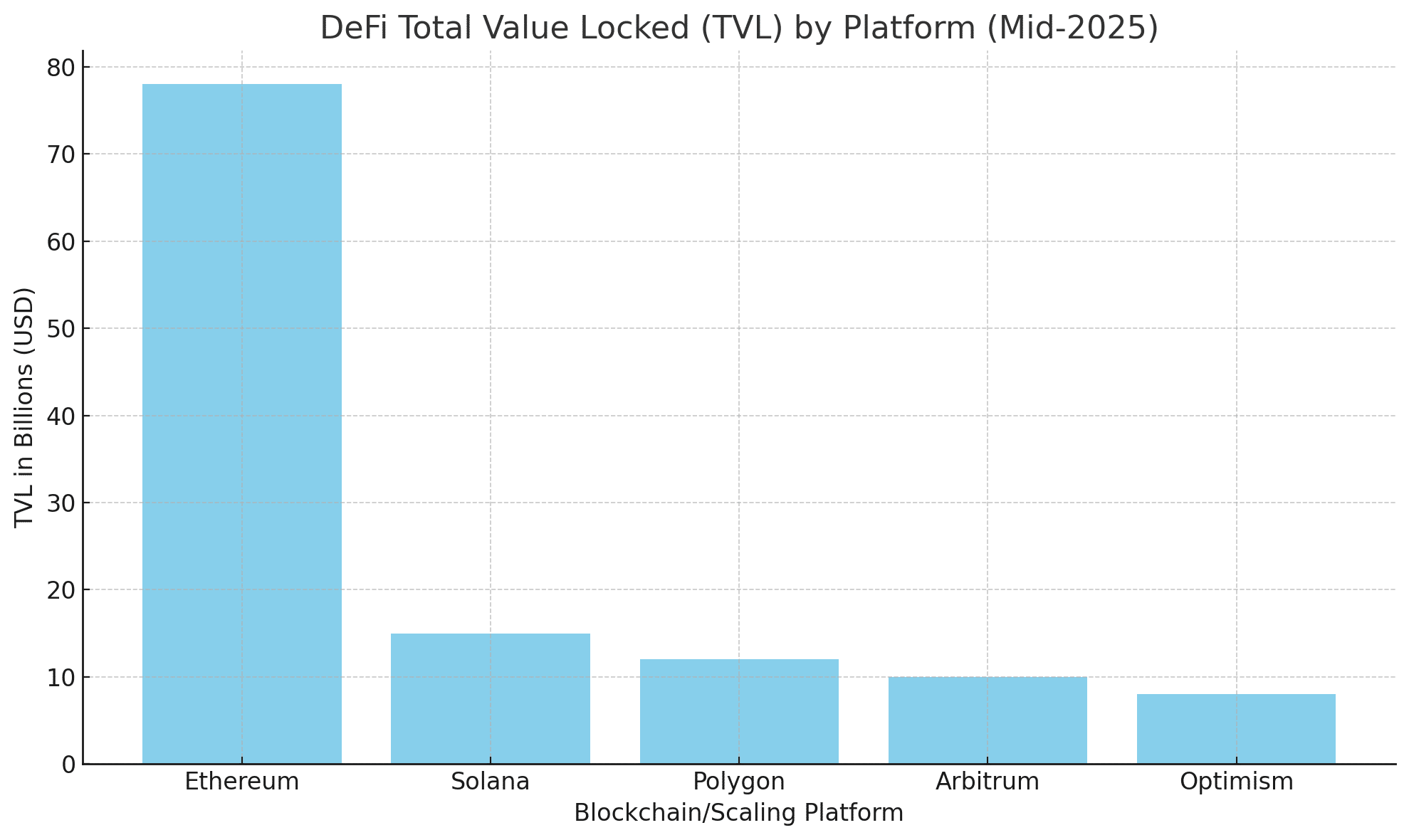

At the core of this revolution are strong blockchain scaling technologies like rollups and sidechains, which make these systems efficient, quick, and cost-effective. From Ethereum to Solana, to rollups like Optimism and Arbitrum, the infrastructure that powers DeFi is just as crucial as the financial instruments themselves.

DeFi Lending: Borrowing Without Banks

DeFi lending is a decentralized method of lending or borrowing digital assets using blockchain-based smart contracts. Aave, Compound, and JustLend are examples of platforms that enable users to deposit tokens into liquidity pools. These pools make loans to others while the lenders collect interest.

Unlike traditional loans, DeFi loans are overcollateralized. For example, someone might deposit $1,000 in ETH and borrow $500 in USDC. Smart contracts automate the process, eliminating credit checks and intermediaries.

According to DefiLlama, DeFi lending procedures had over $17.9 billion in total value locked (TVL) by mid-2025. As liquidity increases, borrowing rates become more competitive, making DeFi lending a credible alternative to centralized finance.

What Is DeFi Yield Farming?

DeFi yield farming refers to obtaining passive revenue by staking or locking crypto into liquidity pools. It enables users to act as decentralized market makers while earning trading fees or governance tokens such as COMP, UNI, and CRV.

Yield farming isn’t confined to just one procedure. A frequent method is to deposit stablecoins into Curve for rewards, stake LP tokens on Convex for extra incentives, or transfer assets to other chains like as Optimism and Arbitrum for better APYs.

“DeFi is essentially the financial layer of the internet,” explains Uniswap founder Hayden Adams. “But without scalable infrastructure, the costs make it inaccessible.”

Scaling DeFi: The Need for Speed and Low Fees

High gas prices and network congestion on Ethereum previously rendered DeFi unavailable to typical users. That changed with blockchain scaling solutions, which are frameworks designed to execute transactions quickly and cheaply while retaining security.

Scaling DeFi entails enabling common users to harvest produce, borrow, or lend without spending $30 on petrol for each transaction. These improvements have boosted activity on Optimism, Arbitrum, and Polygon, as well as high-throughput base layers such as Solana.

Rollups: Optimism and Arbitrum Lead the Charge

Rollups are Ethereum scaling solutions that combine thousands of transactions and send them to Ethereum in a compressed format. Optimism and Arbitrum are the most popular optimistic rollups.

On Arbitrum, DeFi protocols like as GMX and Radiant Capital provide leveraged yield farming and lending for transaction costs as low as $0.10. Optimism supports Synthetix and Velodrome, and incentives encourage adoption.

“Rollups bring Ethereum’s security without its cost,” stated Steven Goldfeder, CEO of Offchain Labs. This makes DeFi yield farming more viable and accessible to regular investors.

Sidechains: Polygon Scales Ethereum in Parallel

Polygon is a sidechain that operates alongside Ethereum but has its own consensus method. Polygon became a DeFi activity hotspot in 2023-2024 because of its very cheap fees and quick conclusion.

Polygon is used by projects like as Aave, Quickswap, and Balancer, which provide almost negligible transaction costs. Polygon’s roadmap now includes zkEVM scaling technology, which enhances Ethereum compatibility while retaining user experience.

Polygon has played an important role in introducing consumers to DeFi yield farming, especially in poorer regions where fees of $0.50 might be prohibitively expensive.

Base Layers: Ethereum and Solana Power the Core

While scaling solutions are useful, everything still links to a base layer blockchain. Ethereum is the primary platform for most DeFi, protecting the protocols and assets that operate on rollups and sidechains. Its shift to proof-of-stake and network enhancements via EIP-4844 are intended to further cut costs and increase scalability.

Meanwhile, Solana has developed as a high-speed, low-cost foundation layer that does not rely on rollups or sidechains. Marinade Finance, Jito, and Jupiter are among the DeFi giants that use Solana, which has 65,000 transactions per second and block finality in seconds.

Though Solana’s architecture varies from Ethereum’s, it provides a unique platform for DeFi yield farming with low costs and near-instant settlement, enticing both developers and consumers.

Conclusion: The Scalable Future of DeFi Yield Farming

DeFi lending and DeFi yield farming have emerged as strong instruments for those seeking financial sovereignty. However, the advancement of blockchain scaling—via rollups like Optimism and Arbitrum, sidechains like Polygon, and fast base layers like Solana—is enabling truly global access.

As the infrastructure evolves, transaction costs fall and adoption increases. This convergence of financial innovation and technological scalability is paving the way for the next wave of global, decentralized finance. The revolution is not just in the yields, but also in the system’s design and scaling.

Read also Layer 1 vs Layer 2 blockchains.

Summary

DeFi lending and yield farming, as well as how blockchain scaling technologies such as Optimism, Arbitrum, Polygon, Ethereum, and Solana enable them. Learn how these technologies make decentralized finance more accessible, efficient, and lucrative.

FAQs

What is DeFi yield farming?

It’s a way to earn passive income by locking crypto into DeFi platforms and receiving rewards like fees or tokens.

Which blockchain is best for DeFi?

Ethereum is the most trusted, while Solana, Arbitrum, and Polygon offer faster and cheaper alternatives.

Are DeFi lending platforms safe?

Mostly yes, if they’re audited and well-known, but smart contract risks and market volatility still apply.

What are rollups in DeFi?

Rollups are Ethereum scaling solutions that reduce costs and speed up DeFi transactions by bundling them off-chain.

Glossary of Key Terms

DeFi (Decentralized Finance): Peer-to-peer financial systems built on public blockchains.

DeFi Yield Farming: Earning rewards by providing liquidity or staking in decentralized protocols.

Rollups: Ethereum scaling solutions that batch transactions to cut fees.

Sidechain: A blockchain that runs parallel to another (e.g., Polygon with Ethereum).

Base Layer: The main blockchain protocol like Ethereum or Solana.

Smart Contract: Self-executing code that enforces terms of a financial agreement.