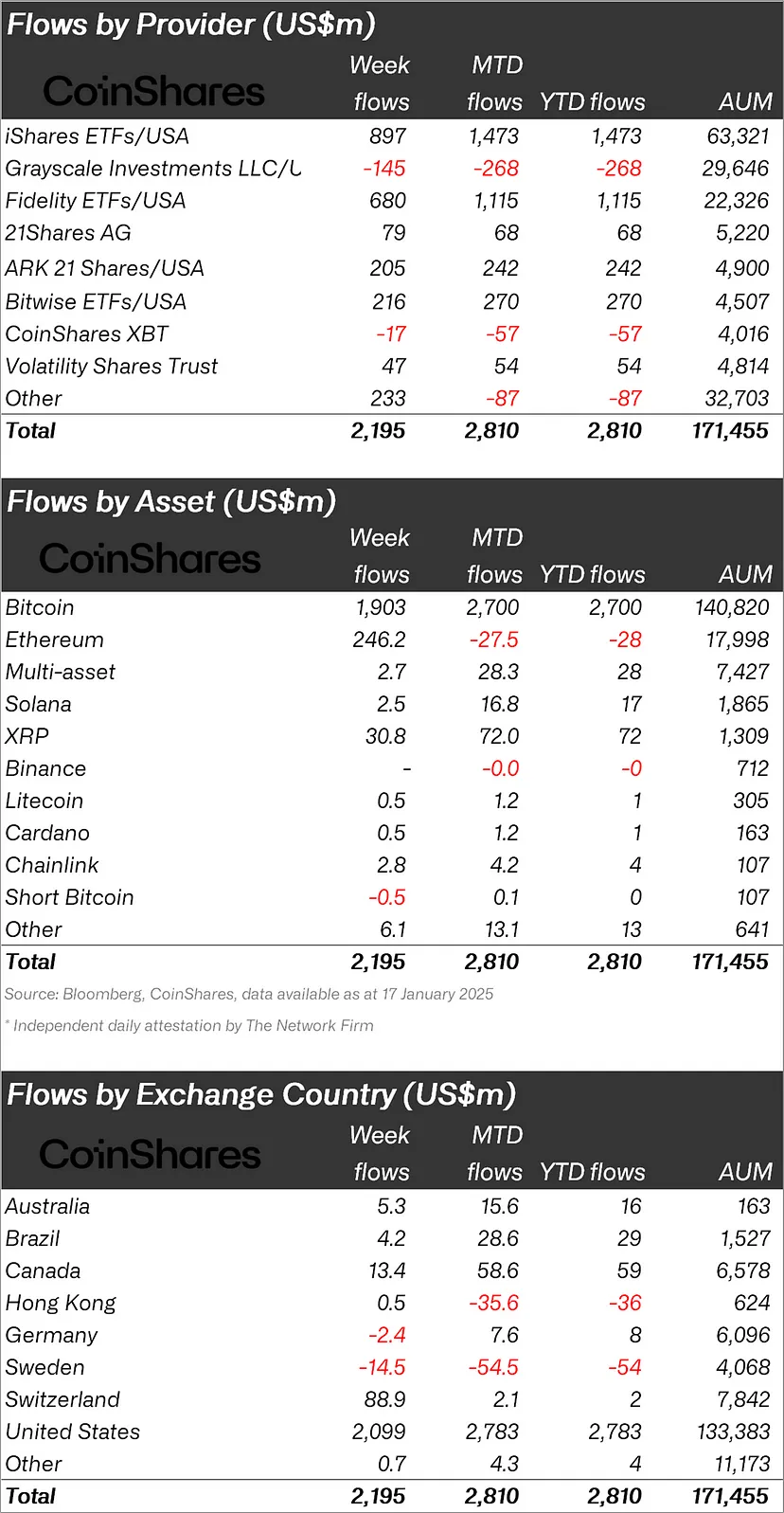

The latest report from CoinShares reveals a surge in institutional interest, with crypto asset investment products witnessing a record-breaking $2.2 billion in weekly inflows—the highest this year. This impressive performance pushed year-to-date (YTD) inflows to $2.8 billion and brought total assets under management (AuM) to an all-time high of $171 billion. Global ETP trading volumes reached $21 billion, accounting for 34% of the total Bitcoin trading volume on trusted exchanges.

Regional Breakdown and Top Assets

The United States led the charge, contributing $2 billion to last week’s inflows. Switzerland and Canada also reported robust figures, with $89 million and $13 million, respectively. Bitcoin saw a staggering $1.9 billion in inflows, bringing its YTD total to $2.7 billion. Despite positive price movements, short Bitcoin positions recorded minor outflows of $0.5 million, diverging from the typical trend of inflows following price hikes.

Ethereum recovered from earlier outflows with $246 million in new investments. While its YTD performance remains underwhelming compared to Bitcoin, Ethereum’s weekly inflows dwarfed those of Solana, which secured $2.5 million. Meanwhile, XRP continued its impressive streak, attracting $31 million last week and reaching a cumulative inflow of $484 million since November 2024.

Altcoins and Market Movements

Altcoins also saw notable activity. Stellar reported $2.1 million in weekly inflows, while other altcoins experienced varying levels of investor interest. The record-breaking inflows coincided with heightened market enthusiasm surrounding Donald Trump’s inauguration and speculation about potential crypto-friendly policies.

Key Figures at a Glance

- Bitcoin: $1.9 billion in weekly inflows, $2.7 billion YTD.

- Ethereum: $246 million in weekly inflows.

- XRP: $31 million in weekly inflows, $484 million total since November 2024.

- Global ETP volumes: $21 billion, 34% of total Bitcoin trading volume on trusted exchanges.

Outlook and Analysis

The crypto market’s resilience and institutional interest underscore its growing mainstream adoption. As global inflows reach unprecedented levels, investors and analysts are closely watching how developments in policy and technology will shape the future of digital assets.

For more insights and updates, follow The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!