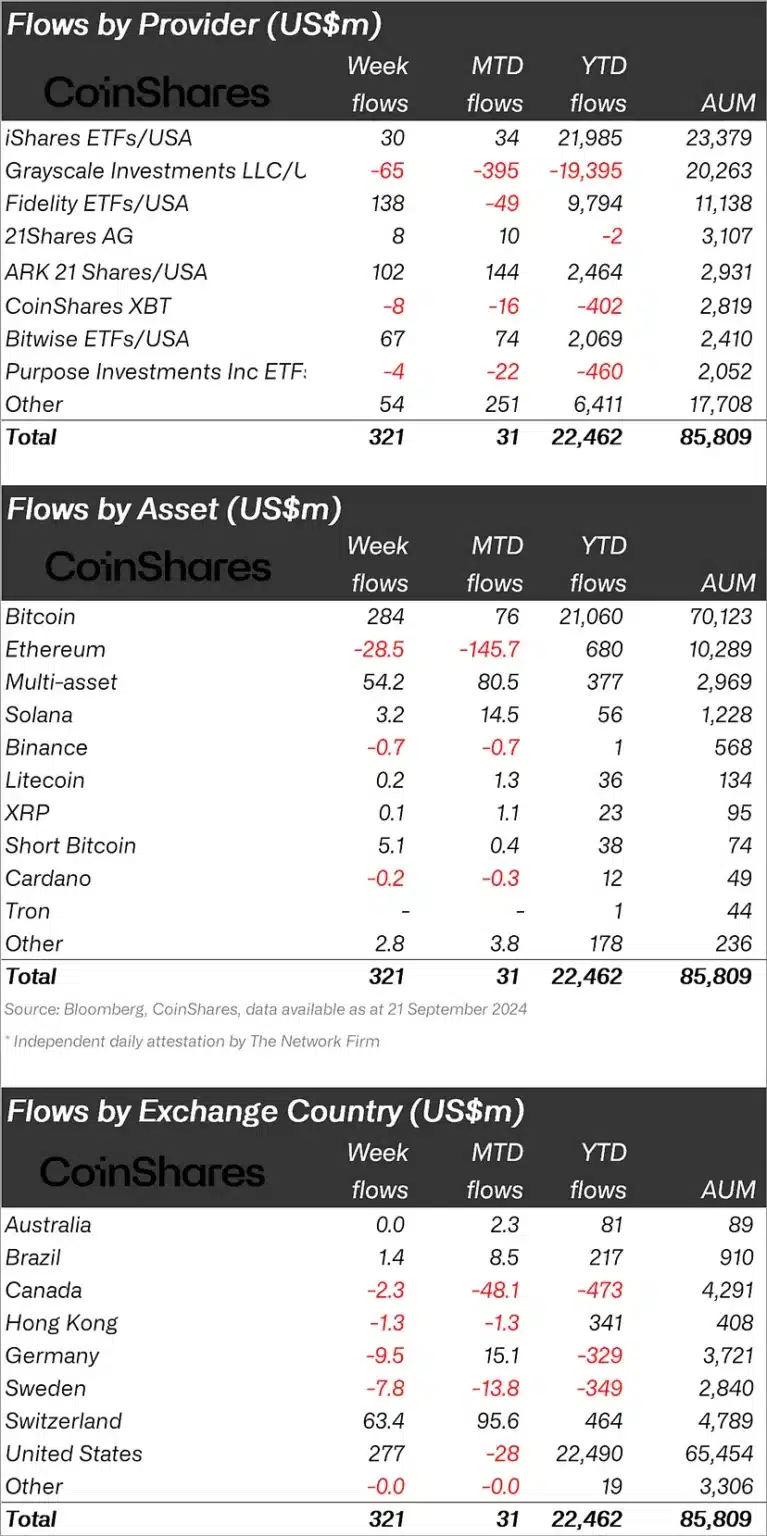

Interest in crypto asset investment products continues to rise as capital flows into the market, especially following the recent Federal Reserve rate cut. According to the weekly crypto asset flows report by CoinShares, a total of $321 million was invested in Bitcoin and altcoin products this week. The U.S. Federal Reserve’s decision to cut interest rates by 50 basis points was a key factor behind this significant increase.

Bitcoin and Short Bitcoin Lead the Way

Bitcoin led the pack, attracting $284 million in new investments, making it the most favored crypto asset among institutional investors. Recent price volatility has also driven investors towards short Bitcoin positions, with $5.1 million flowing into short BTC products. The interest in these products reflects a cautious approach by investors looking to hedge against market fluctuations and minimize risks in an uncertain environment.

Ethereum Sees Five Straight Weeks of Outflows

In contrast to Bitcoin’s inflows, Ethereum has seen continued outflows for five consecutive weeks. Last week alone, Ethereum products experienced $29 million in outflows. This is largely attributed to ongoing withdrawals from the Grayscale Trust and weak demand for newly launched exchange-traded funds (ETFs). The declining interest in Ethereum raises questions about its long-term future. However, Solana has seen a steady inflow of $3.2 million, highlighting growing interest in alternative cryptocurrencies and Solana’s potential as an investment.

Regional Differences in Fund Flows

Fund flows into crypto asset products varied by region. The United States attracted the most capital, with $277 million in inflows, followed by Switzerland, which recorded its second-largest weekly inflow of the year at $63 million. However, Germany, Sweden, and Canada all saw outflows, with $9.5 million, $7.8 million, and $2.3 million leaving their respective markets.

These regional differences reflect how local market conditions and investor sentiment can vary significantly. While the U.S. and Switzerland continue to attract investors, other European regions are taking a more cautious stance.

As noted by The Bit Journal, these fund flows demonstrate both the growing interest in the crypto market and the shifting dynamics between various regions and investment products.