Trump’s inner circle hints at a leadership pivot in U.S. monetary policy

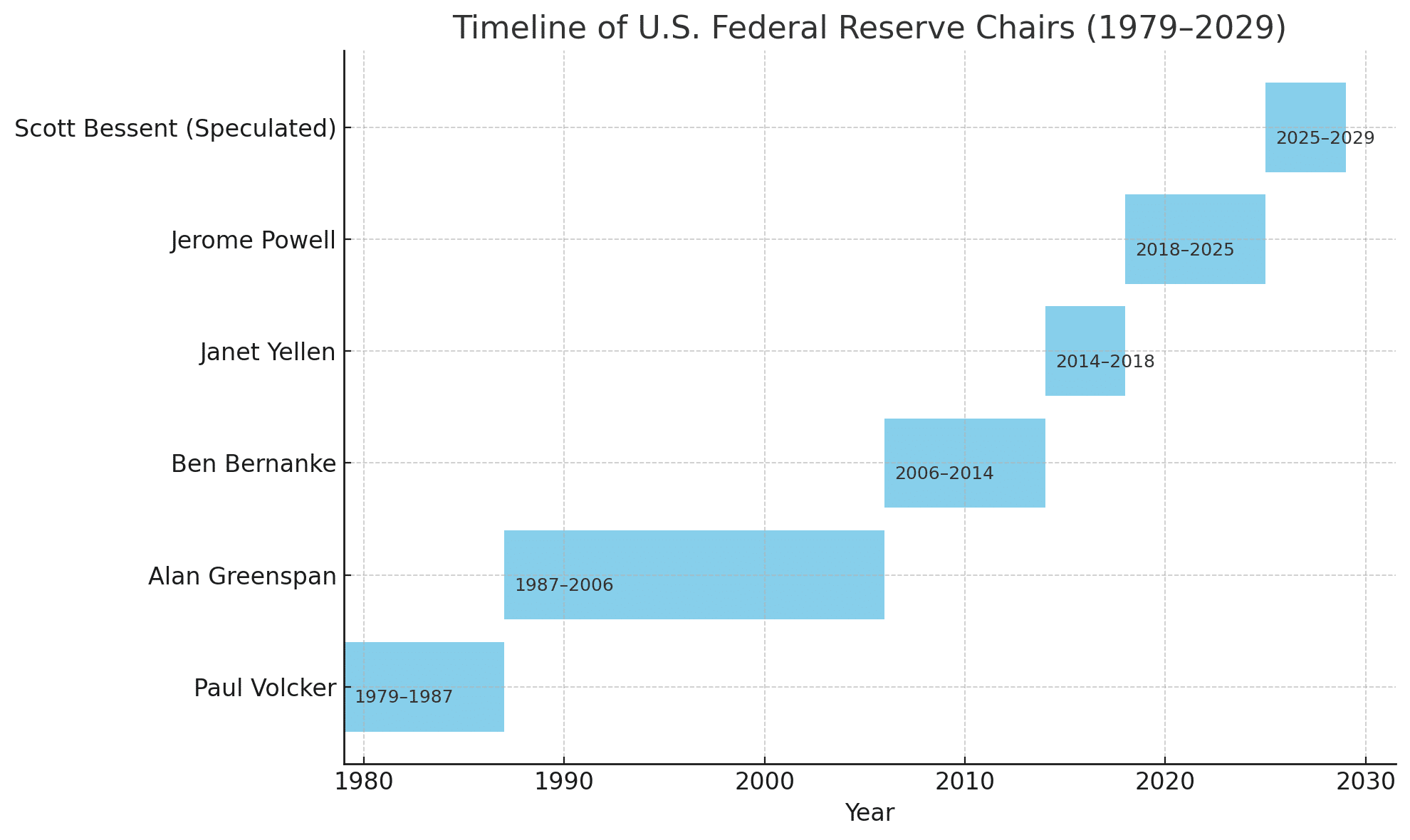

The future of the U.S. Federal Reserve may soon rest in the hands of Scott Bessent, the current Treasury Secretary and a trusted economic voice in Donald Trump’s administration. According to multiple high-level sources, Bessent is now a leading contender to replace Jerome Powell as Chair of the Federal Reserve, a move that could shake both traditional markets and the digital asset landscape.

Although Powell’s term doesn’t officially end until May 2026, former President Trump, currently eyeing a return to office, has indicated a desire to preemptively name a successor. Trump said in recent remarks that a decision would come “very soon,” suggesting urgency and political momentum behind the scenes.

“I have the best job in Washington,” Bessent told reporters, neither confirming nor denying the rumors, but acknowledging that “the president will do what is right for the economy and the American people.”

Who Is Scott Bessent?

Before taking up the Treasury role in early 2025, Bessent built his reputation in global finance as a hedge fund executive and economic strategist. He served as chief investment officer at Soros Fund Management and has held advisory roles in U.S.–China negotiations and trade policy formulation.

Bessent’s deep market experience and reputation for pragmatism have earned him a bipartisan following. These traits could serve him well in steering U.S. monetary policy during an era of rising geopolitical tensions, inflation pressures, and digital asset adoption.

Implications for Markets and Crypto

The potential shift in Fed leadership has already stirred a reaction across Wall Street and the crypto community. A more dovish approach from Bessent, which analysts say is likely, could lead to:

Lower interest rates,

A weaker dollar,

And increased appetite for risk assets like Bitcoin and Ethereum.

On the flip side, Bessent’s ties to traditional finance and regulatory clarity could also accelerate stablecoin oversight and encourage institutional adoption of compliant digital assets.

“Markets are already responding to this possibility,” noted crypto analyst Benjamin Hayes. “A Fed chair like Bessent would likely coordinate more smoothly with fiscal policy, which is bullish for crypto long-term.”

Political Optics and the Powell Factor

Jerome Powell, first appointed by Trump in 2017 and reappointed by President Biden, remains publicly focused on taming inflation and maintaining Fed independence. However, Trump has long criticized Powell’s policy decisions, especially during the post-pandemic recovery period.

A Powell exit, especially one driven by political timing, would send a powerful signal about the future of U.S. monetary strategy, likely favoring looser policy frameworks more in tune with Trump-era economic goals.

Crypto Community Responds

The crypto market has been quick to price in the possibility of a new Fed chair. Bitcoin showed modest strength on the day the rumors broke, while Ethereum posted a 3.2% rise, driven by speculation of a more accommodative stance on inflation and liquidity.

Meanwhile, some crypto policy advocates see an opportunity. If Bessent takes the helm, experts believe a friendlier regulatory tone toward stablecoins and digital currencies may emerge—though this would depend heavily on Congressional cooperation.

Conclusion

The rise of Scott Bessent as a potential Fed Chair signals more than a personnel change—it’s a shift in economic direction. For crypto investors, the stakes couldn’t be higher. With regulatory frameworks, inflation control, and digital asset strategy on the line, the Federal Reserve’s next leader could define the tone of the next financial era.

As markets await confirmation, one thing is certain: the crypto world is watching closely, and preparing for what may be the most consequential Fed leadership change in over a decade.

FAQs

Is Scott Bessent confirmed as the next Fed Chair?

No. While he is currently the frontrunner according to multiple reports, there has been no official nomination. Trump is expected to announce a decision “very soon.”

What does a Fed leadership change mean for crypto?

Fed policy shapes liquidity, interest rates, and the economic environment. A more dovish chair could be bullish for Bitcoin, altcoins, and stablecoins.

Will Jerome Powell finish his term?

That remains unclear. Trump may opt to replace Powell early if re-elected, using political leverage and Senate approval to fast-track the transition.

Glossary of Key Terms

Federal Reserve Chair – The head of the central bank in the United States, guiding economic policy and interest rates.

Dovish Policy – A monetary approach that favors low interest rates and economic stimulus.

Stablecoin – A cryptocurrency pegged to a stable asset like the U.S. dollar, used for payments and trading.

Liquidity – The availability of capital or cash in financial markets, affecting asset prices.

Monetary Policy – Central bank strategy to manage inflation, employment, and economic stability.