According to market reports, Mantra OM token dropped over 90% in late hours of Sunday through Monday, an implosion the team blames on centralized exchanges not the project itself. The crash in low liquidity hours has the crypto community in an uproar with industry leaders demanding transparency and accountability.

From Vertical Gains to Vertical Collapse

Just days ago Mantra OM token was one of 2024’s hottest tokens, up over 7,000% and getting attention for its low social media footprint despite strong price action. Mantra, a protocol that tokenizes real-world assets (RWAs) like real estate and commodities, had built momentum with partnerships with major regional players like the UAE’s DAMAC Group. The deal announced in January 2025 aimed to tokenize $1 billion in real estate, hospitality, and data center assets.

Unfortunately, that momentum imploded. OM’s price went from over $6 to 40 cents in less than 6 hours, causing over $50 million in long liquidations on OM-tracked futures. reports have it that Open interest went from $345 million to $130 million according to derivatives data providers, suggesting mass forced exits and evaporating speculation.

Team: “It Wasn’t Us”

In a post on X (formerly Twitter), the Mantra team said the project is fine, and it wasn’t them:

“We want to assure you that MANTRA is strong. Today’s activity was triggered by reckless liquidations, not the project. One thing we want to be clear on: this was not our team.”

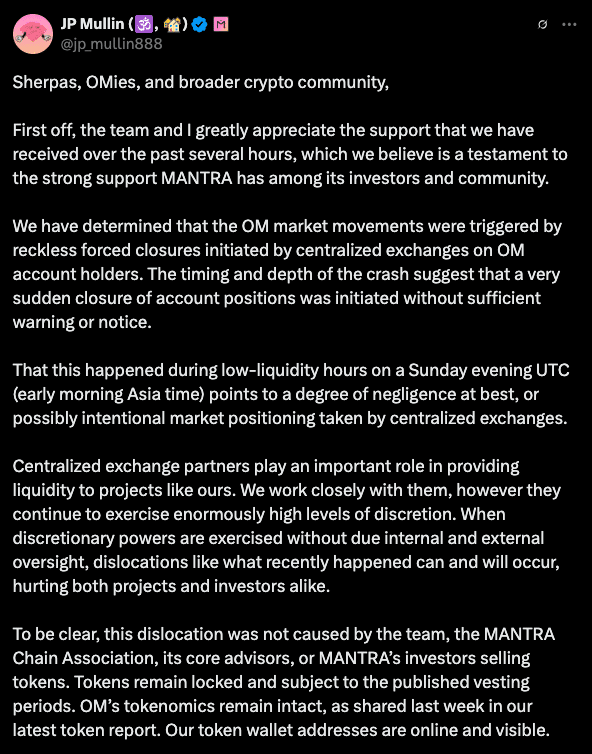

Co-founder John Patrick Mullin doubled down on that message and pointed the finger at centralized exchanges. In a public thread, he said:

“We have determined that the OM market movements were triggered by reckless forced closures initiated by centralized exchanges on OM account holders. The timing and depth of the crash suggest a very sudden closure of account positions was initiated without sufficient warning or notice.”

Mullin also implied bad faith on the part of exchanges, talking about “intentional market positioning,” and said Mantra OM token holders were blindsided by forced liquidations with no warning.

Community Divided as Data Surfaces

Despite the team’s quick response, not everyone in the crypto space is buying it. Under Mullin’s thread, comments ranged from supportive to dismissive. Some asked for on-chain evidence; others accused the project of misdirection. The sentiment gained more momentum when blockchain analysts pointed out over $220 million in Mantra OM token deposits to centralized exchanges in the hours leading up to the crash, and the timing and intent behind it.

OKX founder Star Xu chimed in publicly saying it’s “a big scandal” and will provide transparency:

“It’s a big scandal to the whole crypto industry. All of the onchain unlock and deposit data is public, all major exchanges’ collateral and liquidation data can be investigated. OKX will make all of the reports ready!”

His comments are telling. While the Mantra team claims to have been caught off guard, the fact that there were big unlocks and transfers before the crash has gingered rumors of internal coordination or at least institutional negligence.

Broader Implications for RWA Tokenization

The collapse comes at a bad time for the crypto industry’s push into real-world asset (RWA) tokenization. Mantra has been one of the most vocal projects in that space, promising compliant exposure to tangible assets via blockchain rails. Mantra OM token has been the central token to that pitch, acting as both governance and utility token across the ecosystem.

Now critics are saying that if Mantra OM token, despite its partnerships and on-paper traction can crash so hard, it exposes the structural risks in how these tokens are collateralized and how centralized platforms handle risk exposure. The event has prompted calls for more robust safeguards, especially around margin trading of thinly traded RWA tokens.

Where This Leaves Mantra

Despite the chaos, the Mantra team has committed to publishing a post-mortem and hinted at “corrective steps” to restore confidence in the token.

For now, it’s a wake-up call for both retail and institutional players watching the RWA space. Price gains alone don’t mean market maturity, especially when large positions can get wiped out overnight under opaque exchange policies. The Mantra OM token crash has started a broader conversation about liquidity, custodial accountability and public proof of solvency during times of volatility.

FAQs

What caused the Mantra OM token crash?

The Mantra team says it was forced liquidations by centralized exchanges. Co-founder John Patrick Mullin said positions were closed suddenly and without warning.

How much did OM lose?

OM fell over 90% in a few hours, from over $6 to just above $0.40 in late-night trading.

What is Mantra’s business model?

Mantra tokenizes real-world assets (RWAs) like real estate and commodities, allowing users to invest in these assets via blockchain.

Did any major exchanges comment on the crash?

OKX founder Star Xu called it a “big scandal” and said he will release transparent liquidation and collateral data, putting pressure on centralized platforms.

Glossary

Forced Liquidation: When an asset is sold automatically because the account holder can’t meet margin requirements. Common in leveraged trading.

Open Interest: The total number of outstanding derivatives, like futures, that haven’t been settled.

Real-World Assets (RWAs): Physical or traditional financial assets that are tokenized and traded on the blockchain.

Centralized Exchange (CEX): A digital asset exchange run by a central entity where custody, order books and execution are controlled by the platform.

On-chain Data: Data recorded directly on the blockchain, including transactions, token unlocks and wallet activity.