Ripple (XRP)’s path toward a spot ETF may be the next major catalyst for altcoin investors. In a high assertion, pro-XRP attorney John Deaton recently declared that “XRP ETFs are coming,” reinforcing growing speculation that institutional doors are creaking open for Ripple’s token. As crypto markets flirt with stability, the ETF drumbeat is growing louder, and XRP is once again in the spotlight.

Attorney John Deaton Signals ETF Greenlight for XRP

John Deaton, well-known for his tireless legal advocacy on behalf of XRP holders during the SEC v. Ripple case, recently took to social media and interviews to share his confidence that XRP ETFs are on the way. According to Deaton,

“Once Bitcoin and Ethereum ETFs are approved, the floodgates are open. There is no legal justification left to block XRP.”

His comments follow a broader trend of altcoin ETF filings and increasing institutional demand.

This isn’t just lawyer talk, it’s a forecast grounded in precedent. With Bitcoin spot ETFs already trading in the U.S. and Ethereum ETFs likely to follow, Deaton argues that denying XRP would not stand up to legal scrutiny, especially considering Ripple’s recent partial legal victory against the SEC.

Corporate Adoption Deepens: $100 Million XRP Treasury Buy

Institutional confidence in XRP isn’t just rhetorical, it’s financial. This week, BitGo and publicly listed firm VivoPower announced a $100 million XRP treasury acquisition, positioning the token as a serious contender alongside Bitcoin for corporate reserves. The move echoes the early days of Bitcoin’s institutional adoption when companies like MicroStrategy and Tesla added BTC to their balance sheets.

“Adding XRP to treasury strategy sends a strong message that institutions are not just watching, they’re acting,”

said a senior analyst at CoinShares. It’s the kind of domino that, when tipped, can reshape the entire altcoin landscape.

Ripple XRP Leveraged ETF Breaks Records

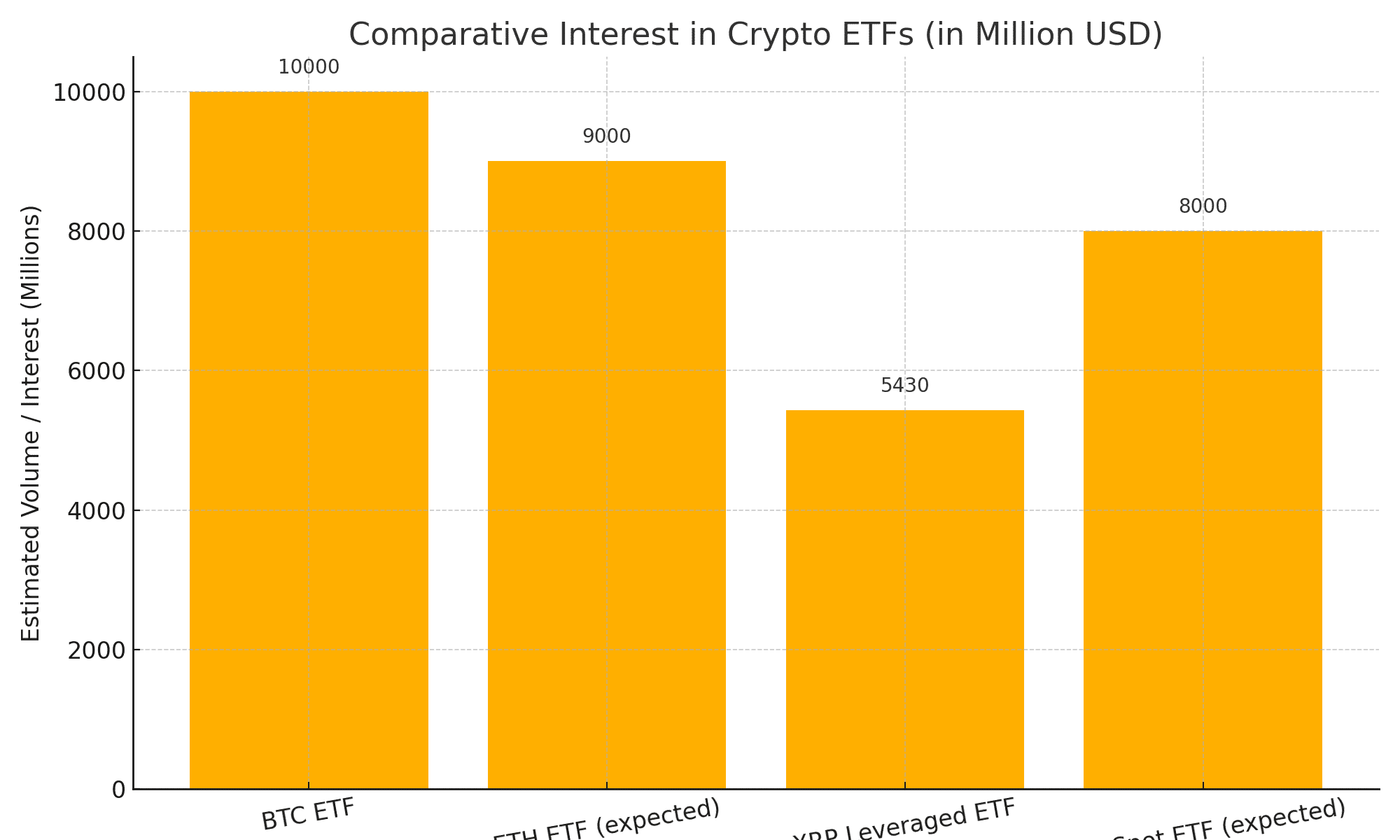

Backing Deaton’s optimism is the success of XRP-based ETFs already trading in select jurisdictions. Most notably, Teucrium’s XRP 2x leveraged ETF recorded a whopping $5.43 million in volume on its first day, beating out Solana’s equivalent ETF launch by a wide margin.

This early success reveals a critical insight: there is already substantial retail and institutional appetite for exposure to XRP in derivative form. With regulatory frameworks beginning to solidify and XRP’s legal headwinds diminishing, the market is preparing for what could be a transformative shift.

Can XRP Flip Ethereum?

In an unexpected twist, Deaton also floated the possibility of XRP surpassing Ethereum in market capitalization by the end of 2025. While this prediction may raise eyebrows in traditional circles, some data points give it weight.

Ethereum has faced growing criticism for high gas fees, delays in implementing scaling upgrades, and regulatory ambiguity around its transition to proof-of-stake. Meanwhile, XRP remains one of the most actively used assets for cross-border payments and has strong ties to institutional fintech partnerships across the globe.

“If Ethereum stumbles and XRP rides the ETF and adoption wave, flipping ETH isn’t out of the question,” Deaton stated in an X (formerly Twitter) thread.

ETF Filings and SEC Watch

XRP ETF discussions are not just theoretical. Industry giants, including 21Shares, Bitwise, Grayscale, WisdomTree, and Franklin Templeton, have either hinted or confirmed interest in launching XRP-based exchange-traded products. The filings are waiting on the SEC’s green light, but optimism is high following Ethereum ETF approvals.

Another key milestone looms: June 16 marks the deadline for Ripple and the SEC to submit a status update on their potential settlement. A favorable resolution could remove the final barrier standing between XRP and a U.S.-based ETF.

Market Implications

The XRP price has been steady above $2.10 recently, reflecting strong investor confidence. If an XRP spot ETF were approved, analysts expect a significant capital inflow, similar to Bitcoin’s post-ETF rally. A major asset management firm told FXEmpire:

“XRP ETFs would not just attract crypto-native capital, but also fresh inflows from retirement portfolios and institutional funds.”

In the broader context, XRP’s potential ETF approval isn’t just a win for Ripple or XRP holders, it’s a bellwether for the maturity of the altcoin market.

Final Thoughts

Ripple (XRP) has weathered regulatory storms, market cycles, and community skepticism. Now, with the scent of ETF approval in the air, it may finally be positioned to reap the rewards of resilience. From treasury buys to leveraged products and mounting legal clarity, the stars appear to be aligning for XRP.

As John Deaton puts it, “It’s no longer a matter of if, but when.”

Frequently Asked Questions (FAQs)

What did John Deaton say about XRP ETFs?

John Deaton, a pro-XRP attorney, stated that XRP ETFs are inevitable following the approval of Bitcoin and Ethereum ETFs. He believes there’s no legal basis to exclude XRP from ETF offerings.

Why is the $100 million XRP treasury buy important?

The $100 million acquisition of XRP by BitGo and VivoPower marks one of the largest institutional purchases of the token. It signals growing corporate confidence in XRP as a treasury reserve asset, similar to early Bitcoin adoption.

What is the significance of the XRP 2x leveraged ETF?

Teucrium’s XRP 2x leveraged ETF recorded $5.43 million in volume on its first day, highlighting strong market interest and reinforcing the case for a fully regulated XRP spot ETF in the U.S.

Could XRP really flip Ethereum?

According to Deaton, if Ethereum continues to face technical and regulatory challenges while XRP gains adoption through ETFs and institutional use, it’s plausible that XRP could surpass ETH in market capitalization by 2025.

When is the next key date for Ripple and the SEC?

June 16, 2025, is the next critical deadline when Ripple and the SEC must file a status report, which could influence ongoing XRP ETF applications and overall investor sentiment.

Glossary of Key Terms

XRP

A cryptocurrency developed by Ripple Labs, primarily used for fast and low-cost international money transfers.

ETF (Exchange-Traded Fund)

A type of investment fund traded on stock exchanges, designed to track the price of an asset or basket of assets, such as cryptocurrencies like Bitcoin, Ethereum, or XRP.

Leveraged ETF

An ETF that uses financial derivatives and debt to amplify the returns of an underlying asset. For example, a 2x leveraged ETF aims to return twice the daily movement of the asset it tracks.

Treasury Reserve Asset

An asset held by a corporation or institution as part of its financial reserves. Cryptocurrencies like Bitcoin—and now XRP—are increasingly being adopted for this role.

John Deaton

A prominent crypto lawyer and advocate for XRP holders, known for his role in challenging the SEC’s lawsuit against Ripple.

SEC (U.S. Securities and Exchange Commission)

The federal agency responsible for enforcing securities laws and regulating the U.S. financial markets, including decisions on ETF approvals and cryptocurrency regulations.

Spot ETF

An ETF that directly holds the underlying asset—in this case, XRP—rather than derivatives or futures contracts, offering pure exposure to the asset’s price movements.

Ripple

The fintech company behind XRP, focused on enabling real-time, cross-border payment solutions for financial institutions.