The cryptocurrency industry faced uncertain circumstances, and SEC Commissioner Hester Peirce unveiled a future-oriented plan. Known affectionately as “Crypto Mom,” her comprehensive regulatory reform proposals emerged as a pivotal vision for the incoming Trump administration.

Her roadmap aimed to foster accommodating transparency for digital assets through a paradigm shift toward rules that welcome progression instead of impeding it. Though regulations carry risks without reform, her balanced approach balanced oversight with openness to innovation opportunities. If actualized, it could prove transformative for businesses at the frontier of financial technology seeking fair, sensible guidelines.

Hester Peirce, “Crypto Mom” Advocates for Clearer Guidelines

In a recent televised dialogue with the business channel, Hester Peirce delineated three pivotal readjustments intended to imbue desperately needed lucidity and invigorate progress within the cryptocurrency sector. She underscored the necessity for rulebook renovation to retain tempo with technological advances, declaring, “We necessitate to furnish transparent instructions that permit invention to thrive while guaranteeing shareholder defence.” This method underscores her dedication to stabilizing regulatory monitoring with the fluid essence of the crypto industry.

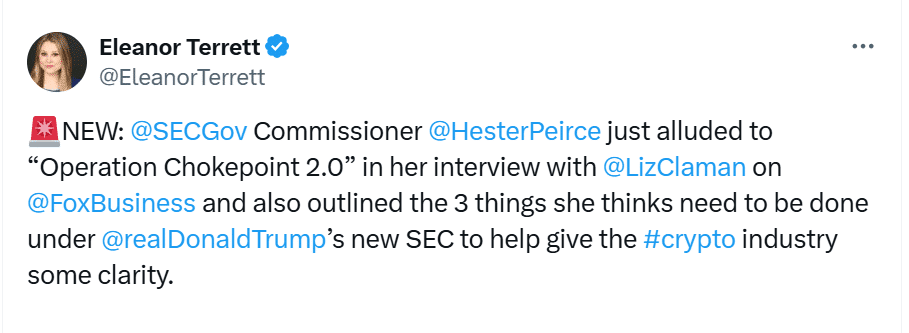

Operation Chokehold 2.0: A Call for Change

Hester Peirce additionally addressed anxieties regarding the alleged “Initiative to Stranglehold 2.0,” a supposed undertaking aimed at limiting crypto-associated banking services—an allegation the SEC has formerly rejected. She advocated for halting any governmental strangleholds that deny crypto holders access to essential utilities, like custodial answers.

“The administration ought not hamper admittance to monetary services for crypto holders,” Peirce asserted, highlighting the importance of incorporating digital assets into the broader financial system.

Defining Jurisdiction: SEC’s Role in Crypto Oversight

A significant aspect of Hester Peirce’s reform agenda involves delineating the nuanced boundaries of the SEC’s regulatory authority over the burgeoning sphere of crypto assets. She stressed the necessity of distinguishing which digital assets should fall under existing securities laws and which require novel frameworks, in order to ensure the appropriate level of oversight is applied to encourage innovation without compromising consumer protections.

“Providing clarity around our jurisdiction allows for improved adherence to regulations and spurs technological progress,” Peirce noted, advocating for a more discerning method of crypto governance.

Public Engagement: A Collaborative Approach to Regulation

Hester Peirce underscored the primacy of inclusive participation in shaping sensible rules, promoting an environment that cultivates open exchange between all invested parties. She expressed concerns that under the SEC’s current leadership, insufficient time has been dedicated to public discussions on regulatory changes. “Soliciting perspectives from those in the industry and community is pivotal in crafting regulations that serve both present needs and safeguard the interests of users,” she remarked, emphasizing the worth of collaborative policy crafting.

Leadership Changes: A New Direction for the SEC

The impending departure of SEC Chair Gary Gensler, scheduled for January 2025, opens the door for new leadership at the top. President Donald Trump has tapped Paul Atkins, a vocal proponent of lighter touch regulation, as Gensler’s successor. Atkins’ confirmation would usher in a crypto-friendlier era of oversight, mirroring the administration’s broader supportive stance. Furthermore, the creation of a new “Crypto Czar” role, assigned to tech investor David Sacks, signifies a targeted dedication to digital currency governance and artificial intelligence.

Industry Reactions: A Spectrum of Perspectives

Within the cryptocurrency community, reactions have varied significantly. While some advocates call for defunding or dissolution of the SEC altogether, others maintain a cautiously optimistic view regarding Hester Peirce’s past reform plans. Critics argue that Peirce has failed to deliver on substantive reforms when it mattered most, such as during the pivotal 2020 lawsuit against Ripple. Alternatively, supporters believe her continued drive could ultimately yield meaningful changes to rules and enforcement.

A Unified Regulatory Framework: SEC and CFTC Collaboration

Former Commodity Futures Trading Commission (CFTC) Chair Christopher Giancarlo has recommended that the CFTC take on a more prominent role in the regulation of cryptocurrencies. Reflecting this perspective, lawmakers on both sides of the aisle recently introduced bipartisan legislation aimed at fostering collaboration between the SEC and CFTC to establish a unified oversight framework leveraging each agency’s comparative advantages to govern the booming crypto markets effectively.

Final Words

In closing, Acting SEC Chair Hester Peirce’s vision for ushering in a more transparent, inclusive, and innovation-friendly regulatory approach under the incoming administration of President Donald Trump represents a pivotal juncture for the cryptocurrency sector. With new leadership at the SEC and the appointment of a dedicated “Crypto Czar” to guide the transition, the potential for meaningful change is substantial.

By promoting clarity, cooperation, and public involvement, these initiatives could balance protecting investors while enabling the crypto industry’s growth. As regulations continue to take shape, actively engaging all stakeholders will be critical to developing a future where innovation and protection exist in harmony.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!