The crypto world never sleeps, and neither do the whales making jaw-dropping transactions. Over the last 24 hours, more than $1 billion in massive whale moves in Bitcoin and Ethereum were reported, which had the crypto community buzzing, The BIT Journal reported on Tuesday. Whether it’s a calculated reshuffle or a sign of something bigger brewing, these transactions paint a vivid picture of the market’s undercurrents. Let’s dive into the highlights and decode what might be behind these mind-blowing transfers.

Bitcoin Whales Make Waves with Multi-Million Transfers

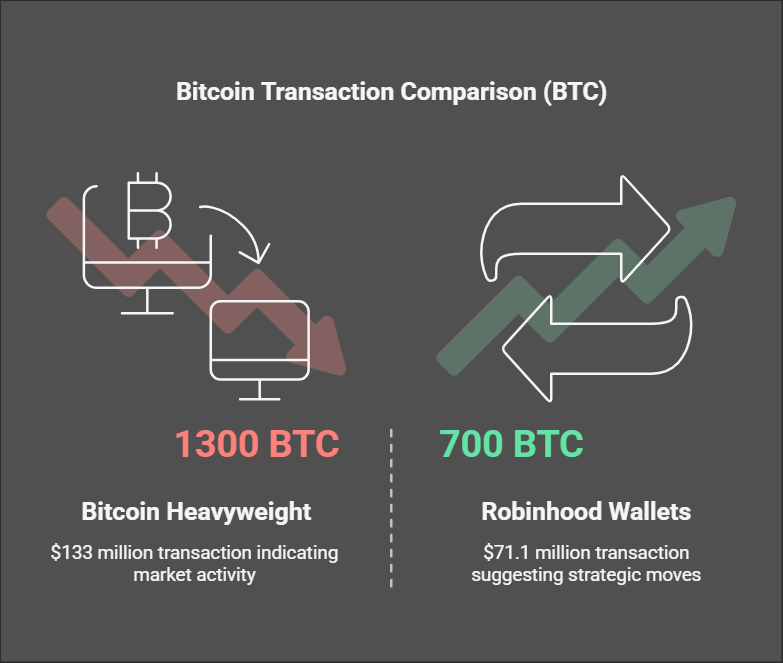

Bitcoin (BTC) once again proves it’s the heavyweight champion of crypto as whales move hundreds of BTC across wallets and exchanges. The largest transaction, 1,300 BTC worth over $133 million, was sent from a private wallet to another address labeled “A.” While the intent remains unclear, such transfers often hint at potential market activity—possibly a major purchase or even a strategic reallocation.

Another noteworthy transaction came from Robinhood wallets, which shuffled 700 BTC worth $71.1 million to another address. These institutional-level moves are no accident. Whether it’s rebalancing funds or preparing for market entry, this type of activity rarely happens without a plan.

Key Observations from Bitcoin Transactions:

- Whales like Robinhood and Coinbase Institutional are leading the charge.

- Transactions involving private wallets suggest potential off-market trades.

- Fees remain relatively low for such high-value transfers, showcasing Bitcoin’s scalability.

Could these whale moves signal a major Bitcoin price movement? History tells us when whales start moving, markets often follow suit.

Ethereum Sees Multi-Million Transfers—and Burns

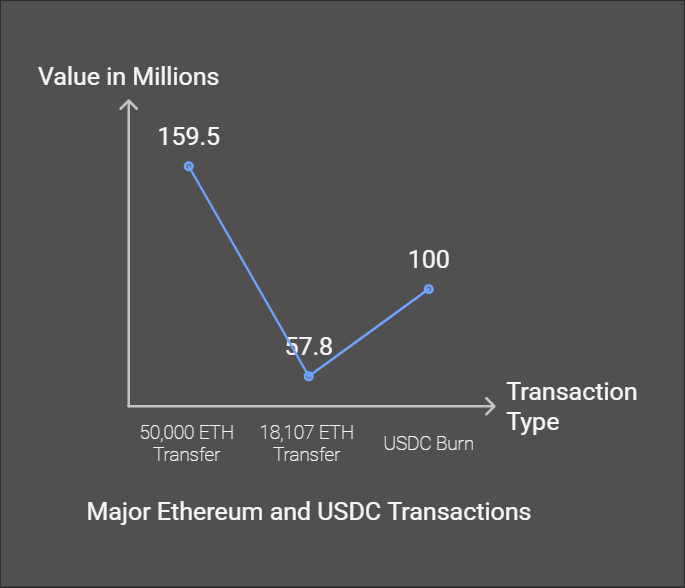

The action isn’t limited to Bitcoin. Ethereum (ETH) whales are making equally eye-catching moves. Two standout transfers include 50,000 ETH (valued at $159.5 million) and 18,107 ETH ($57.8 million), both pointing to major exchange wallets like Binance. Such large-scale movements often indicate preparation for significant trades, possibly to capitalize on upcoming market trends.

But Ethereum’s story doesn’t end there. The USDC Treasury burned 100 million USDC, worth over $100 million, in two separate transactions. Burning stablecoins reduces their supply, potentially signaling a strategic market maneuver. It’s a move that makes you wonder—are these burns laying the groundwork for something big?

Ethereum Highlights:

- Binance continues to dominate as a destination for whale ETH transfers.

- The USDC Treasury burn underscores stablecoins’ critical role in market stability.

- Ethereum remains the network of choice for institutional-grade transactions.

What These Whale Moves Mean for the Market

Whale activity isn’t just about numbers—it’s a barometer for market sentiment. High-value transfers often precede price movements, whether it’s Bitcoin breaking past resistance levels or Ethereum gearing up for a rally.

These transactions also highlight the increasing role of institutions. Wallets like Robinhood, Coinbase, and Binance are central players, pointing to greater adoption and trust in crypto from traditional finance. But it’s not just about big names. The burn of 100 million USDC reflects strategic thinking, potentially aimed at stabilizing or preparing the market for increased activity.

Key Numbers from the Whale Moves

| Blockchain | Largest Transfer | Amount (USD) | Total Volume | Notable Participants |

| Bitcoin | 1,300 BTC | $133.7 million | $458.2 million | Robinhood, Coinbase Institutional |

| Ethereum | 50,000 ETH | $159.5 million | $367 million | Binance, USDC Treasury |

Why Whale Activity Deserves Your Attention

It’s easy to overlook these whale moves as just numbers on a screen, but they often tell a much bigger story. For instance, the timing of these transactions—right as Bitcoin and Ethereum hover near key price levels—might hint at upcoming volatility.

Plus, the sheer scale of these transactions shows just how far crypto has come. We’re not talking about small-scale trades anymore. These are institutional-sized bets, signaling confidence in crypto as a long-term asset class.

Frequently Asked Questions

- What is whale activity in crypto?

Whale moves refer to large-scale transactions made by individuals or institutions holding significant amounts of cryptocurrency. - Why are whales moving to Bitcoin and Ethereum now?

While motives vary, such moves often precede significant market events like price rallies, portfolio rebalancing, or institutional investments. - What does the USDC Treasury burn mean?

Burning stablecoins reduces their circulating supply, potentially affecting their value and signaling strategic market adjustments. - How do large transactions impact the market?

Whale movements can trigger market reactions, influencing price trends and investor sentiment, especially during periods of low liquidity. - Why do institutions like Coinbase play a significant role in whale activity?

Institutions manage large amounts of crypto for clients, making them key players in high-value transactions and market stabilization. - Should retail investors worry about whale activity?

Not necessarily. While whale moves can impact prices, they also reflect confidence in crypto, which can benefit long-term investors. - How can I track whale moves and transactions?

Platforms like Whale Alert and Blockchain Explorers provide real-time data on large cryptocurrency transfers.