The cryptocurrency market is bracing for significant movement today as a massive $2.639 billion in options contracts are set to expire. Of this total, Bitcoin (BTC) accounts for $1.9 billion, while Ethereum (ETH) options worth $712 million will also expire. Will this event fuel market volatility or set a steady course for the rest of 2025?

The First Options Expiry of the Year

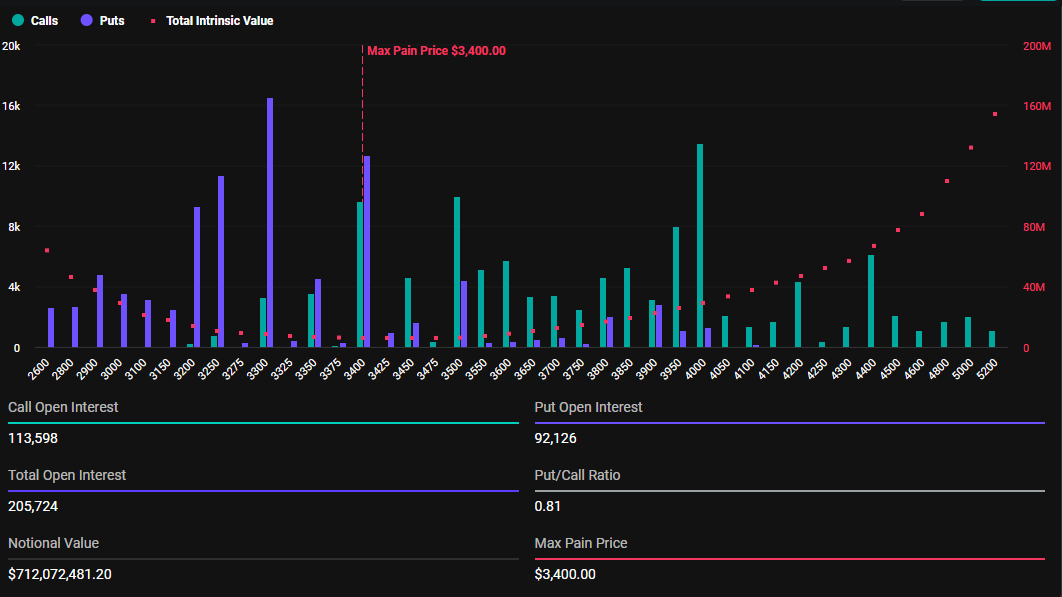

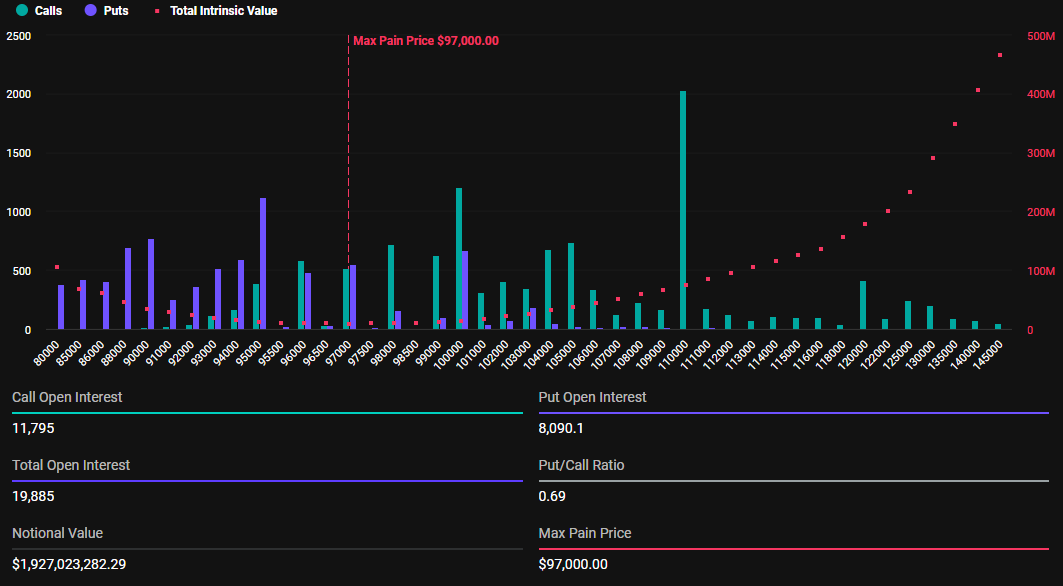

As covered by The Bit Journal, the market is striving to gain momentum despite lingering uncertainty. According to Deribit data, today’s Bitcoin options expiry involves 19,885 contracts, a sharp drop from the 88,537 contracts that expired last week. Similarly, Ethereum options contracts set to expire have decreased to 205,724 from 796,021 in the previous week, reflecting the year-end nature of last week’s expiry.

For Bitcoin, the maximum pain price (strike price where most contracts lose value) is $97,000, with a put/call ratio of 0.69. This indicates a generally bullish sentiment despite Bitcoin’s ongoing struggle to reclaim the critical $100,000 milestone. Ethereum’s maximum pain price stands at $3,400, with a put/call ratio of 0.81, reflecting a similarly optimistic market outlook. A put/call ratio below 1 suggests that traders are betting more heavily on price increases.

Prepare for Volatility

In options trading, the strike price plays a crucial role in shaping market behavior. It often represents the level where most contracts expire worthless, causing maximum financial “pain” for traders. These expiries typically introduce short-term price fluctuations, amplifying market uncertainty. Smart money, often represented by institutional options sellers, tends to steer asset prices toward levels that optimize their profits.

Potential Impact on BTC and ETH Prices

At the time of writing, BTC is trading at $96,494, while ETH is priced at $3,437. These prices suggest a modest increase for Bitcoin and a slight decrease for Ethereum as they approach their respective strike prices, signaling potential market turbulence.

Deribit offered insights on the current market dynamics:

“Volatility levels remained consistent throughout the post-holiday period. While December’s significant open interest in options at year-end did not result in the expected fireworks, ETH volatility is trading over five points lower, and BTC continues its slightly steeper trend since Christmas.”

Key Takeaways for Investors

The expiry of these significant options contracts introduces both opportunities and risks for investors. Traders should prepare for potential price swings and closely monitor maximum pain prices as the market aligns with institutional strategies. Whether Bitcoin and Ethereum will stabilize or experience heightened volatility remains to be seen, but the outcome of today’s options expiry will provide valuable insights into market direction.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!