Bitcoin (BTC) recently attempted to spark a so-called “Santa Rally,” aiming for the $100,000 milestone, but the effort fell short. The cryptocurrency’s failure to surpass this psychological level has left short-term investors increasingly concerned. With optimism fading, Bitcoin’s journey toward six-figure prices remains uncertain.

Negative Sentiment Among Bitcoin Holders

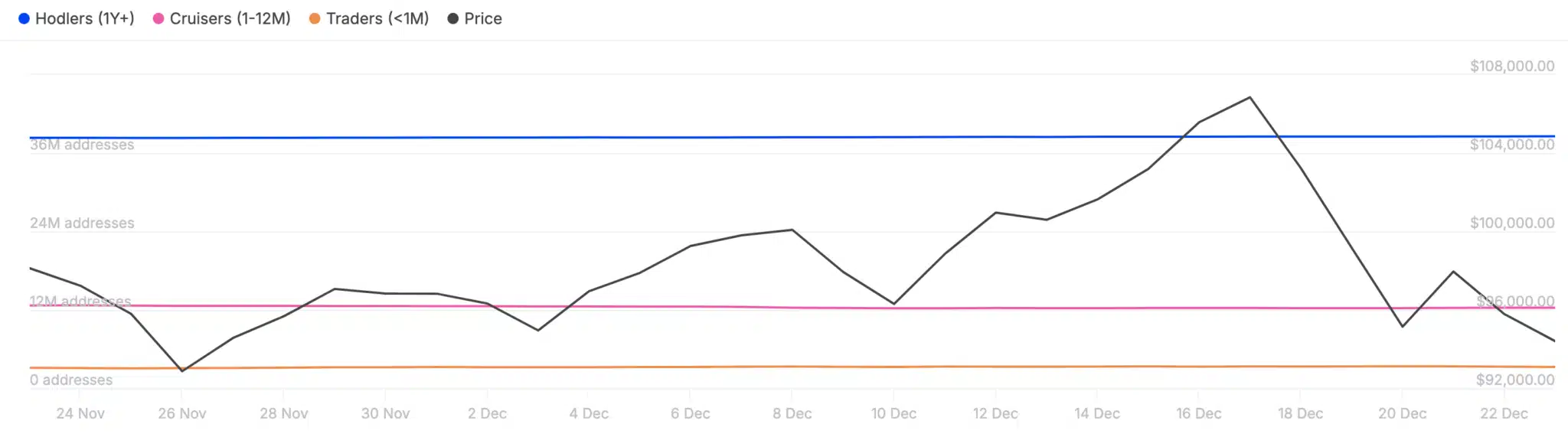

Bitcoin’s inability to break through the $100,000 resistance has pulled its price below $97,000, triggering a broader bearish mood in the cryptocurrency market. According to the IntoTheBlock “Addresses by Time Held” metric, activity among holders who keep Bitcoin for 30 to 365 days has declined.

This group, often seen as a barometer for market sentiment, has shown reduced activity in recent weeks. When these mid-term holders grow in number, it typically indicates growing confidence in the market. Conversely, their decline suggests waning trust. If this trend persists, Bitcoin’s price may face additional downward pressure.

Short-Term Holders Losing Faith

The Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL), a key indicator tracked by Glassnode, has dropped into the “hope or fear” zone. This suggests that short-term Bitcoin investors are increasingly pessimistic about a meaningful recovery.

If this trend continues, the likelihood of sustained demand and a price rebound diminishes. Coupled with market uncertainty, these dynamics could further complicate Bitcoin’s path to recovery. However, a significant catalyst, such as breaking news or a surge in buying activity, could reverse the situation.

Will Bitcoin Fall Below $90,000?

On the daily chart, Bitcoin is struggling to overcome the $99,332 resistance level. This critical zone has been a significant barrier to recovery. Additionally, the Relative Strength Index (RSI) has dipped below the neutral 50.00 mark, indicating weakening momentum. Should this trend persist, Bitcoin’s price could decline to as low as $85,851 in the near term.

Conversely, a successful breach of the $99,332 resistance could shift the narrative entirely, opening the door for a rally toward $110,000. Investors should closely monitor key support and resistance levels, as well as market trends.

A Pivotal Moment for Bitcoin

Bitcoin’s inability to reach $100,000 has created a sense of uncertainty in the market. However, technical indicators and broader market conditions suggest that a rebound is still possible. As reported by The Bit Journal, adopting a careful strategy and staying informed about market movements are crucial for investors. Bitcoin’s trajectory will heavily depend on how the market evolves in the coming days.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!