Algorand, ranking 18th among the Top “Made in USA” Coins, has again captured investor attention by demonstrating resilience in recent market fluctuations. With ALGO hovering at a key $0.38 level, investors are asking whether it could surge toward $0.60 or slip into a downturn.

A Pivotal Price Point

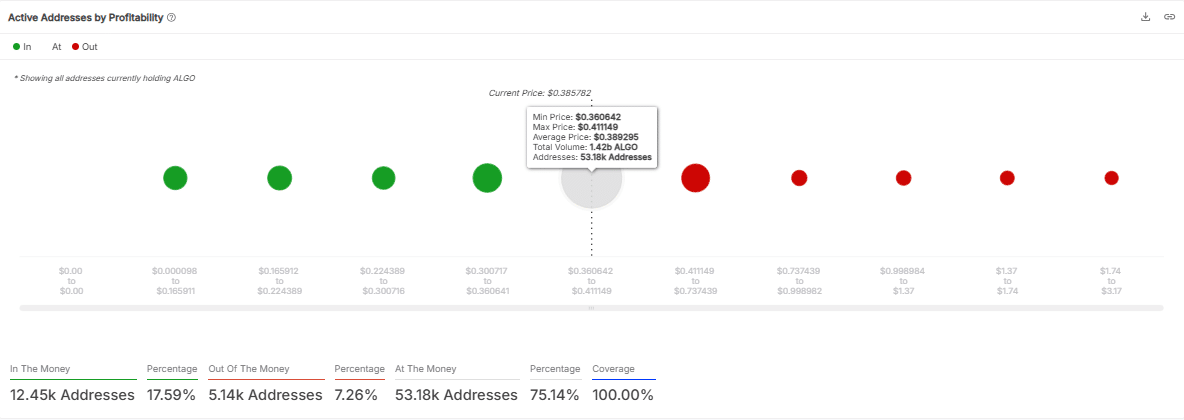

Recent data indicates that 75.14% of these altcoin addresses are “At The Money,” suggesting $0.38 is where most holders break even on their positions. This cluster of investors has great potential to influence short-term price movements. Meanwhile, 17.59% of addresses are “In The Money,” profiting at current levels, and 7.26% are “Out of The Money,” seeing losses.

This distribution highlights the significance of $0.38 as a key support or resistance. If ALGO holds above it, a buying momentum surge could occur. Conversely, failing to maintain this mark might rattle investor confidence, leading to a sell-off.

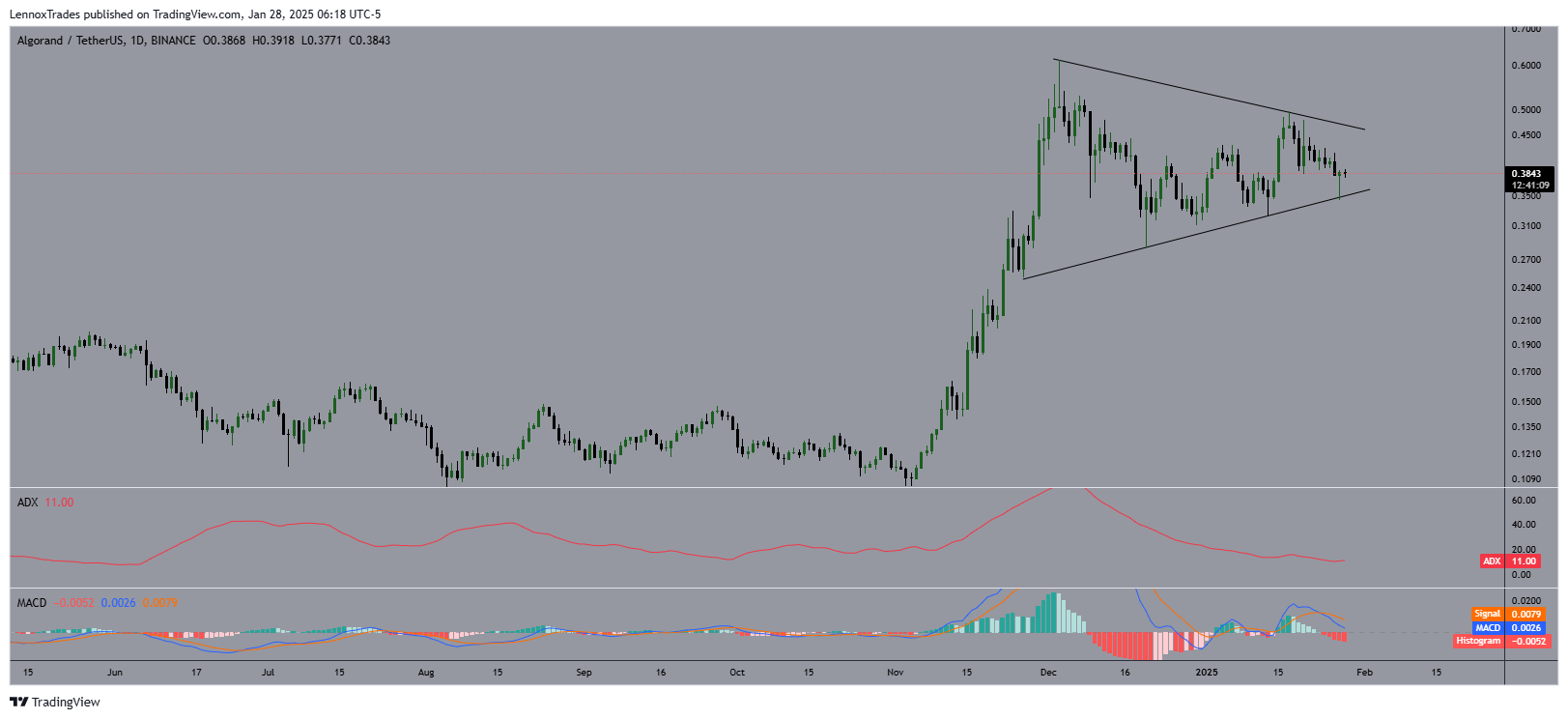

Eyeing the Bullish Pennant

Algorand’s price recently touched $0.3808—a 10% daily gain—though it still reflects a 9.17% drop on the weekly chart, according to CoinMarketCap. The token is currently testing the $0.38 mark, a vital juncture that could set the tone for the days ahead.

Technical analysis points to a bullish pennant formation. If it breaks out convincingly, traders are watching a possible climb toward $0.60. However, indicators like the MACD show only a slight convergence near the zero line, suggesting momentum is not definitively bullish yet. In addition, the ADX reading at around 11 implies a weak trend, which may mean any significant rally or decline isn’t locked in.

Traders should keep an eye on $0.31 as the next possible support zone if ALGO drops below $0.38. Historically, $0.31 has provided stability in times of volatility, though testing this lower range could further unsettle market sentiment.

Holding the Line or Breaking Away?

The high percentage of addresses at $0.38 indicates that volatility could escalate in the near term. Should this altcoin successfully defend this level, it might pave the way for a stronger recovery, potentially inching closer to the much-anticipated $0.60 target. This scenario would likely invite more buyers, buoyed by renewed confidence in ALGO’s upward trajectory.

On the flip side, a dip below $0.38 could open the door to a cascade of sell orders. In that event, traders could see a retracement to $0.31 or lower, prolonging its consolidation phase. Investors should look for a breakout above the current range or a drop below support before taking any significant positions.

Algorand’s Roadmap Developments and Security Concerns

Beyond price action, this altcoin’s roadmap offers insight into the project’s future. The network aims to bolster decentralization through a shift to a Peer-to-Peer (P2P) Gossip Network, tackling previous concerns about centralized architecture. Additionally, the team is working on post-quantum security measures, anticipating a time when quantum computing could pose a threat to conventional cryptography.

Another key initiative is the upcoming AlgoKit 3.0, designed to expand programming language support and attract a wider pool of developers. While these efforts underscore the altcoin’s commitment to innovation, questions linger about whether these enhancements can effectively future-proof the blockchain against rapid technological evolution.

Conclusion:

Algorand’s showdown at $0.38 marks a critical juncture for traders and long-term holders alike. A sustained push above this pivotal level could energize a rally toward $0.60, feeding optimism around the project’s roadmap and decentralization efforts. However, the possibility of slipping below $0.38 looms large, potentially sparking further drops and testing the community’s resolve.

As ALGO walks this tightrope, investors should monitor technical indicators and overall market sentiment. The altcoin’s focus on security and decentralization may boost its appeal, yet maintaining a position above $0.38 remains crucial for confirming higher valuations.

Stay tuned to The BIT Journal and watch Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Frequently Asked Questions (FAQs)

1. Will Algorand’s security upgrades lift it to $0.60?

They could spur momentum, but holding above $0.38 is critical.

2. Why is $0.38 so crucial for this altcoin?

It’s the break-even point for 75.14% of holders, making it a potential pivot for price moves.

3. What if it fails to maintain $0.38?

A drop below could trigger sell-offs and a possible slide toward $0.31.

4. Is a bullish pennant forming for ALGO?

Technicals hint at one, suggesting a run toward $0.60 if the breakout is strong.

5. Are momentum indicators confirming a rally?

The MACD is near zero and the ADX is weak at 11, implying no definitive trend yet.