In recent developments, the cryptocurrency market is abuzz with discussions surrounding the potential approval of exchange-traded funds (ETFs) for various digital assets. Prediction markets, notably Polymarket, have become focal points for gauging investor sentiment regarding the U.S. Securities and Exchange Commission’s (SEC) stance on ETFs for cryptocurrencies such as XRP, Solana (SOL), and Litecoin (LTC).

Polymarket Predictions: Assessing ETF Approval Probabilities

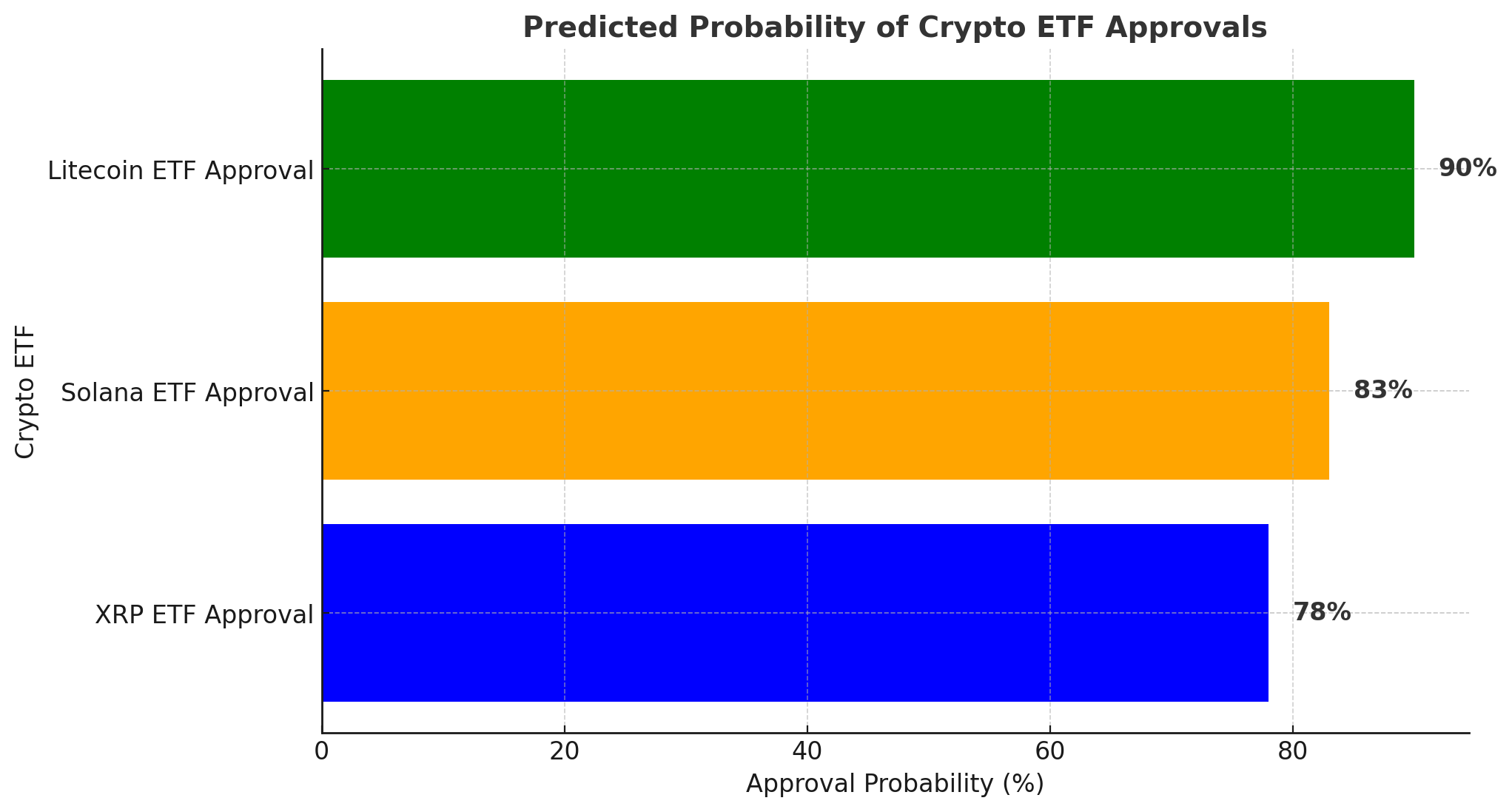

Polymarket, a decentralized prediction platform, offers insights into the perceived likelihood of SEC approvals for cryptocurrency ETFs. As of mid-February 2025, the platform indicates a 78% probability that the SEC will approve an XRP ETF by the end of the year. This figure reflects a significant increase from earlier in the year, suggesting growing confidence among market participants.

Similarly, Polymarket data shows an 83% chance for a Solana ETF and a 90% chance for a Litecoin ETF receiving SEC approval within the same timeframe. These elevated probabilities underscore a broader market optimism regarding the expansion of regulated investment vehicles beyond the well-established Bitcoin and Ethereum ETFs.

Market Implications of Potential ETF Approvals

The approval of ETFs for XRP, Solana, and Litecoin could have profound implications for the cryptocurrency landscape:

Increased Accessibility: ETFs provide a regulated avenue for both institutional and retail investors to gain exposure to digital assets without the complexities of direct ownership.

Enhanced Liquidity: The introduction of ETFs is likely to boost trading volumes, thereby improving market liquidity and potentially stabilizing prices.

Mainstream Validation: SEC approval would serve as a significant endorsement, potentially attracting a wave of new investors and fostering greater acceptance of these digital assets.

Historically, the approval of Bitcoin ETFs in early 2024 led to substantial capital inflows, propelling Bitcoin’s price to record highs. Upon ETF approval, XRP, Solana, and Litecoin could anticipate a similar trajectory.

Current Market Performance

As of February 18, 2025, the cryptocurrency market reflects cautious optimism:

XRP (XRP): Trading at $2.59, experiencing a slight decrease of 0.037% from the previous close.

Solana (SOL): Priced at $169.26, down by 8.52% from the previous close.

Litecoin (LTC): Valued at $123.82, reflecting a 1.66% decline from the previous session.

These price movements may be influenced by speculative trading and the anticipation of regulatory decisions.

Regulatory Landscape and Future Outlook

The potential approval of these ETFs is occurring against a backdrop of significant regulatory shifts. The recent inauguration of President Donald Trump has introduced a more crypto-friendly administration, with expectations of favorable regulatory changes. The anticipated appointment of Paul Atkins as the new SEC Chair further bolsters optimism for the approval of a broader range of cryptocurrency ETFs.

While prediction markets like Polymarket provide valuable insights into investor sentiment, it’s essential to recognize that these are speculative assessments. The SEC’s final decisions will ultimately shape the investment landscape. Investors are advised to stay informed and exercise due diligence as these developments unfold.

Conclusion

The cryptocurrency sector stands on the cusp of potential transformation with the anticipated approval of ETFs for assets like XRP, Solana, and Litecoin. Such developments could enhance market accessibility, liquidity, and legitimacy. However, the inherent volatility of the crypto market necessitates cautious optimism. Stakeholders should monitor regulatory updates closely and consider the broader market dynamics when making investment decisions.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs on Ripple, XRP, and ETF Approvals

1. What are the chances of an XRP ETF being approved?

Prediction markets like Polymarket estimate a 78% probability that the SEC will approve an XRP ETF in 2025.

2. How does an XRP ETF benefit investors?

An ETF allows investors to gain exposure to XRP without directly holding the asset, making it easier for institutional and retail investors to participate in the market.

3. What are the odds for Solana and Litecoin ETFs?

Polymarket data suggests an 83% chance for a Solana ETF and 90% for a Litecoin ETF, reflecting growing market confidence.

4. How will a Ripple XRP ETF impact the crypto market?

A regulated XRP ETF could boost liquidity, attract institutional investors, and increase mainstream adoption of XRP and other altcoins.

Note: Cryptocurrency investments carry inherent risks due to market volatility. It is essential to conduct thorough research and consult with financial advisors before making investment decisions.